Get the free TAX-DEDUCTIBLE CONTRIBUTION FORM 2012

Show details

Este formulario permite realizar donaciones deducibles de impuestos para apoyar la preservación y mejora del Parque Tarrywile, un tesoro comunitario que incluye una mansión victoriana y más de

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax-deductible contribution form 2012

Edit your tax-deductible contribution form 2012 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax-deductible contribution form 2012 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax-deductible contribution form 2012 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax-deductible contribution form 2012. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

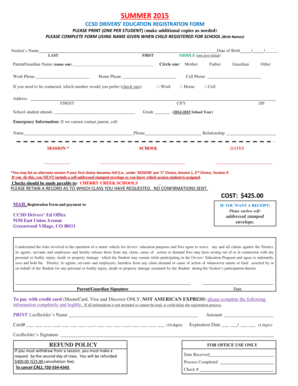

How to fill out tax-deductible contribution form 2012

How to fill out TAX-DEDUCTIBLE CONTRIBUTION FORM 2012

01

Obtain the TAX-DEDUCTIBLE CONTRIBUTION FORM 2012 from the appropriate source.

02

Fill in your personal information, including name, address, and Social Security number.

03

Specify the tax year for which you are making the contribution.

04

Indicate the organization to which you are making the contribution, including their tax ID number.

05

Enter the amount of the contribution you are claiming as tax-deductible.

06

Provide documentation of the contribution, such as receipts or acknowledgment letters from the organization.

07

Review all information for accuracy and completeness.

08

Sign and date the form before submitting it with your tax return.

Who needs TAX-DEDUCTIBLE CONTRIBUTION FORM 2012?

01

Individuals who make charitable contributions to qualified organizations and want to claim those contributions as tax deductions.

02

Taxpayers who itemize deductions on their federal tax return and need to report their charitable contributions.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax-deductible donation form?

Donors that give in-kind or non-cash gifts can also deduct their contributions from their taxes. Donors donating a non-cash item or group of non-cash items valued over $500 must file Form 8283 with their taxes. When sending tax receipts for these contributions, nonprofits must remember not to assign a value.

Who fills out form 8283?

Form 8283 is filed by individuals, partnerships, and corporations. C corporations. C corporations, other than personal service corporations and closely held corporations, must file Form 8283 only if the amount claimed as a deduction is more than $5,000 per item or group of similar items.

What is a tax-deductible contribution?

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases.

What documentation do I need to deduct charitable donations?

When Do I Need Proof of Charitable Contributions? A canceled check. A bank or credit union statement. A credit card statement. An electronic fund transfer receipt. A scanned image of both sides of a canceled check obtained from a bank or credit union website.

What is an example of a tax-deductible?

Home mortgage interest. Income, sales, real estate and personal property taxes. Losses from disasters and theft. Medical and dental expenses over 7.5% of your adjusted gross income.

What is an example of a tax-deductible donation?

For example, Laura has an AGI of $100,000 for 2025. If she gives cash, she could deduct donations up to 60% of her AGI, so $60,000. If she wants to give stock that has gained value, the most she could give and deduct is $30,000. If you give more than the annual limit, that charitable donation tax deduction isn't lost.

What qualifies as a deductible charitable contribution?

Qualified organizations include nonprofit groups that are religious, charitable, educational, scientific, or literary in purpose, or that work to prevent cruelty to children or animals. You will find descriptions of these organizations under Organizations That Qualify To Receive Deductible Contributions.

What does it mean when contributions are deductible?

A deductible IRA can lower your tax bill by allowing you to deduct your contributions on your tax return - you essentially get a refund on the taxes you paid earlier in the year. You fund a nondeductible IRA with after-tax dollars. You cannot deduct contributions on your tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TAX-DEDUCTIBLE CONTRIBUTION FORM 2012?

The TAX-DEDUCTIBLE CONTRIBUTION FORM 2012 is a document used by taxpayers to report contributions made to qualified charitable organizations, which may be deductible from their taxable income.

Who is required to file TAX-DEDUCTIBLE CONTRIBUTION FORM 2012?

Taxpayers who make charitable contributions and wish to claim those contributions as tax deductions on their federal tax returns are required to file the TAX-DEDUCTIBLE CONTRIBUTION FORM 2012.

How to fill out TAX-DEDUCTIBLE CONTRIBUTION FORM 2012?

To fill out the form, taxpayers must provide their personal information, details of the charity receiving the contribution, the date and amount of the contribution, and any relevant documentation to substantiate the claim.

What is the purpose of TAX-DEDUCTIBLE CONTRIBUTION FORM 2012?

The purpose of the TAX-DEDUCTIBLE CONTRIBUTION FORM 2012 is to allow taxpayers to report their charitable contributions for the year, enabling them to potentially reduce their taxable income and tax liability.

What information must be reported on TAX-DEDUCTIBLE CONTRIBUTION FORM 2012?

The form requires information such as the taxpayer's name and Social Security number, the charity's name and tax identification number, the amount of the contribution, the date of the contribution, and the type of contribution (cash, property, etc.).

Fill out your tax-deductible contribution form 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax-Deductible Contribution Form 2012 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.