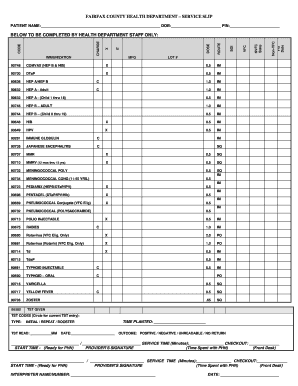

Get the free Huntington Home Savers Borrower Request for Assistance

Show details

This document serves as a checklist for homeowners seeking assistance to avoid foreclosure. It outlines the steps required to complete the Borrower Request for Assistance Form and provides guidance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign huntington home savers borrower

Edit your huntington home savers borrower form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your huntington home savers borrower form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit huntington home savers borrower online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit huntington home savers borrower. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out huntington home savers borrower

How to fill out Huntington Home Savers Borrower Request for Assistance

01

Obtain the Huntington Home Savers Borrower Request for Assistance form from the Huntington website or a local branch.

02

Fill in your personal information at the top, including your name, contact information, and account number.

03

Detail your financial situation, including income, expenses, and any hardships you are facing that necessitate assistance.

04

Provide supporting documentation, such as pay stubs, bank statements, or proof of unemployment.

05

Review the form to ensure all information is accurate and complete.

06

Sign and date the form to certify the information is true, and send it back to Huntington via the specified method (mail, email, or online submission).

07

Follow up with Huntington after submission to confirm receipt and discuss next steps.

Who needs Huntington Home Savers Borrower Request for Assistance?

01

Homeowners facing financial difficulties who are struggling to make their mortgage payments.

02

Individuals who have experienced a change in income, such as job loss or reduced hours, that impacts their ability to pay their mortgage.

03

Borrowers who are at risk of foreclosure and need assistance in finding a solution or modifying their mortgage.

Fill

form

: Try Risk Free

People Also Ask about

What number is 1 800 480 2265?

If you prefer to open your account in person, just stop by your local Huntington branch to meet with a personal banker. Find your nearest Branch. If you have questions at any time, we're always here to help. Just call us at 1-800-480-BANK (2265).

How do I talk to a Huntington representative?

We Are Here to Help Call us at (800) 480-2265; daily 7:00 a.m. to 8:00 p.m. ET. We're looking forward to hearing from you! To contact us from outside the U.S. call +1 (616) 355-8828; daily 7:00 a.m. to 8:00 p.m. ET.

Will Huntington Bank let you skip a mortgage payment?

Answer: Under a payment forbearance plan, the lender agrees to accept reduced payments or no payments at all for an extended period of time. At the end of the forbearance period, the borrower has several options including the ability to defer the missed payments to the end of the loan.

How to get $400 dollars from Huntington Bank?

Huntington Bank Perks Checking - $400 If opening an account online, you must open it through the checking account promotion page; otherwise, the bonus will not be applied. Deposit $500 within 90 days: You must make a qualifying direct deposit of $500 or more within 90 days of account opening.

How do I talk to a person at Huntington Bank?

If you have questions at any time, we're always here to help. Just call us at 1-800-480-BANK (2265).

How much do Huntington Bank client advisors make?

As of Jan 16, 2025, the average annual pay for a Huntington National Bank Finance Advisor in the United States is $80,625 a year. Just in case you need a simple salary calculator, that works out to be approximately $38.76 an hour. This is the equivalent of $1,550/week or $6,718/month.

How do I file a complaint against Huntington Bank?

Whether your card is stolen, lost, damaged, or you want to file a dispute, it's important to contact us as soon as possible. For ATM or debit cards, call (800) 480-2265. For Consumer or Small Business credit cards, call (800) 340-4165. For Commercial credit cards, call (888) 766-0436. For ACH, call (800) 480-2265.

What loan services does Huntington provide?

At Huntington, we offer both unsecured and secured personal loans. Unsecured personal loans allow you to obtain a loan primarily based on your credit report, and secured personal loans are based partially on the value of your personal assets, so you can choose the type of loan that best fits your financial needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Huntington Home Savers Borrower Request for Assistance?

The Huntington Home Savers Borrower Request for Assistance is a form used by borrowers seeking help with their mortgage payments or loan modifications due to financial difficulties.

Who is required to file Huntington Home Savers Borrower Request for Assistance?

Borrowers who are struggling to make their mortgage payments or need assistance with loan modifications are required to file the Huntington Home Savers Borrower Request for Assistance.

How to fill out Huntington Home Savers Borrower Request for Assistance?

To fill out the Huntington Home Savers Borrower Request for Assistance, borrowers must provide personal information, details about their mortgage, financial hardship explanation, and submit any required documentation.

What is the purpose of Huntington Home Savers Borrower Request for Assistance?

The purpose of the Huntington Home Savers Borrower Request for Assistance is to evaluate a borrower's situation and provide them with options for mortgage assistance or modification to avoid foreclosure.

What information must be reported on Huntington Home Savers Borrower Request for Assistance?

Borrowers must report personal identification details, mortgage information, income sources, monthly expenses, and any circumstances affecting their financial situation on the Huntington Home Savers Borrower Request for Assistance.

Fill out your huntington home savers borrower online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Huntington Home Savers Borrower is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.