Get the free Credit & Homeownership Empowerment Services, Inc. - CHES, Inc.

Show details

This document details the initial action plan for homeowners working with CHES, Inc. It outlines the necessary documents to bring for the first meeting with a Homeownership Advisor, the roles and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit amp homeownership empowerment

Edit your credit amp homeownership empowerment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit amp homeownership empowerment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit amp homeownership empowerment online

Follow the guidelines below to benefit from the PDF editor's expertise:

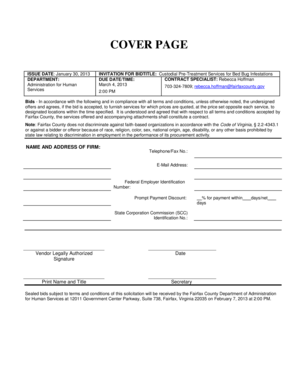

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit amp homeownership empowerment. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit amp homeownership empowerment

Point by point guide for filling out credit & homeownership empowerment:

01

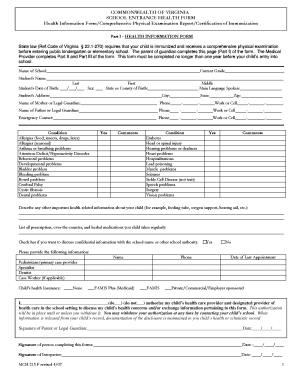

Start by researching and gathering all the necessary information and documents required to fill out the credit and homeownership empowerment form. This may include personal identification documents, financial statements, and any other relevant paperwork.

02

Carefully read and understand the instructions provided with the form. Make sure you are aware of all the required fields and sections that need to be completed.

03

Begin filling out the form by entering your personal information accurately. This may include your full name, residential address, contact details, social security number, and other relevant personal data.

04

Provide detailed information about your current financial situation. This may include your employment status, income sources, monthly expenses, existing debts, and any assets you own.

05

Fill out the sections related to homeownership. If you already own a home, provide the necessary details such as the property address, mortgage information, and any additional properties you may own. If you are a first-time homebuyer, provide the required information regarding your plans and goals for homeownership.

06

Complete the credit-related sections of the form. This may involve providing details about your credit history, outstanding loans or debts, and any previous bankruptcies or foreclosures.

07

Double-check all the information you have entered to ensure its accuracy and completeness. Take your time to review the form thoroughly and make any necessary corrections.

08

Once you are satisfied with the completed form, sign and date it as required. Also, check if any supporting documents need to be attached to the form before submission.

09

Determine the appropriate method of submission for the form. This may involve mailing it to a specific address, submitting it online through a designated portal, or delivering it in person to the relevant institution.

Who needs credit & homeownership empowerment?

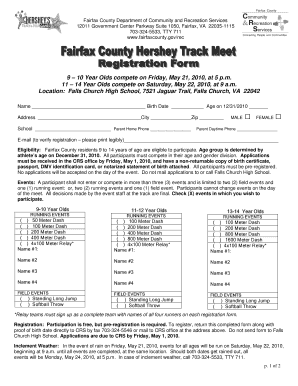

01

Anyone who wishes to improve their understanding of credit and homeownership-related matters can benefit from credit & homeownership empowerment programs. These programs are particularly valuable for individuals who are planning to purchase a home or who are interested in improving their financial well-being.

02

First-time homebuyers can greatly benefit from credit & homeownership empowerment. These programs help educate them about the homebuying process, provide guidance on obtaining favorable mortgage terms, and offer insights into budgeting and managing homeownership costs.

03

Individuals with limited credit history or those struggling with poor credit scores can also benefit from credit & homeownership empowerment. These programs offer assistance in understanding credit reports, improving credit scores, and guiding individuals towards better financial practices.

Overall, credit & homeownership empowerment is beneficial for anyone seeking to enhance their understanding of credit, homeownership, and financial management.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit amp homeownership empowerment from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your credit amp homeownership empowerment into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an electronic signature for signing my credit amp homeownership empowerment in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your credit amp homeownership empowerment and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I edit credit amp homeownership empowerment on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing credit amp homeownership empowerment.

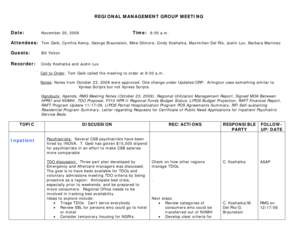

What is credit & homeownership empowerment?

Credit & homeownership empowerment refers to programs and initiatives aimed at educating individuals about credit management, homeownership opportunities, and financial empowerment.

Who is required to file credit & homeownership empowerment?

Individuals seeking to improve their credit scores, understand homeownership options, or gain knowledge about financial empowerment are encouraged to participate in credit & homeownership empowerment programs.

How to fill out credit & homeownership empowerment?

To fill out credit & homeownership empowerment, individuals can attend workshops, webinars, or counseling sessions provided by financial institutions, housing agencies, or nonprofit organizations.

What is the purpose of credit & homeownership empowerment?

The purpose of credit & homeownership empowerment is to help individuals make informed financial decisions, improve their creditworthiness, explore homeownership opportunities, and achieve financial stability.

What information must be reported on credit & homeownership empowerment?

Information reported on credit & homeownership empowerment may include credit scores, debt levels, homeownership goals, financial literacy knowledge, and action plans for improving credit and achieving homeownership.

Fill out your credit amp homeownership empowerment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Amp Homeownership Empowerment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.