Get the free DISPOSAL OF ASSET FORM

Show details

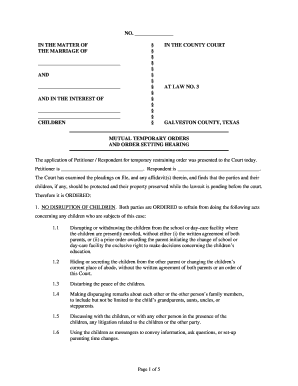

This form is required for the disposal of assets valued over $500. It includes sections for asset details, disposal approval, disposal detail, and communication details. Proper signatures and justification

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign disposal of asset form

Edit your disposal of asset form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your disposal of asset form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing disposal of asset form online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit disposal of asset form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out disposal of asset form

How to fill out DISPOSAL OF ASSET FORM

01

Obtain the DISPOSAL OF ASSET FORM from the relevant department or online portal.

02

Fill in the date of submission at the top of the form.

03

Provide details of the asset to be disposed of, including asset number and description.

04

Specify the reason for disposal, such as obsolescence or damage.

05

Indicate the proposed method of disposal, whether by sale, donation, or recycling.

06

Include any supporting documentation, such as asset appraisal or internal memos.

07

Review the completed form for accuracy.

08

Submit the form to the appropriate authority for approval.

Who needs DISPOSAL OF ASSET FORM?

01

Departments and teams managing physical or digital assets.

02

Employees responsible for asset management.

03

Financial officers overseeing asset disposal processes.

Fill

form

: Try Risk Free

People Also Ask about

How do you calculate the disposal of an asset?

The Profit on disposal of an asset is calculated as: Sale amount less Net value of asset less Disposal cost. The Net value of the asset is the Cost of the asset less the Accumulated depreciation. The Disposal cost could be zero.

What is the journal entry for disposing of an asset?

Asset Disposal Journal Entry The journal entry typically involves: Removing the asset's cost from the books. Removing the accumulated depreciation associated with the asset. Recording any proceeds from the sale of the asset.

What is the process of disposal of assets?

Asset disposal is the elimination of an asset from a company's records, typically by selling or scrapping it. These are often long-term assets that contributed to generating profits, such as machinery, technology or company vehicles.

How to dispose of an asset?

The Fixed Asset Disposal Form Template is used to document the disposal of old or faulty equipment. Include information such as the name of the person who authorized the disposal, the method of disposal as well as details about costs in case the asset was sold.

How do you get rid of an asset?

You can dispose of a fixed asset by selling it on a sales order or invoice for a value; that'll reverse the acquisition cost and cumulative deprecation and take the gain/loss to the account you've set up in the posting set up.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DISPOSAL OF ASSET FORM?

The Disposal of Asset Form is a document used to formally record the disposal of assets from an organization, detailing the reasons for disposal and assessing any financial implications.

Who is required to file DISPOSAL OF ASSET FORM?

Typically, any department or individual within an organization that disposes of assets, either through sale, donation, or write-off, is required to file the Disposal of Asset Form.

How to fill out DISPOSAL OF ASSET FORM?

To fill out the Disposal of Asset Form, one must provide details such as the asset description, asset ID, the reason for disposal, method of disposal, and signature of the responsible person.

What is the purpose of DISPOSAL OF ASSET FORM?

The purpose of the Disposal of Asset Form is to ensure transparency, accountability, and proper documentation of asset management within an organization.

What information must be reported on DISPOSAL OF ASSET FORM?

The information that must be reported includes the asset's description, identification number, acquisition date, cost, reason for disposal, method of disposal, and approval signatures.

Fill out your disposal of asset form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Disposal Of Asset Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.