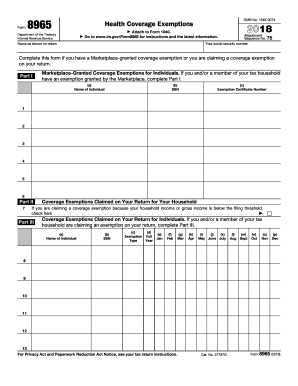

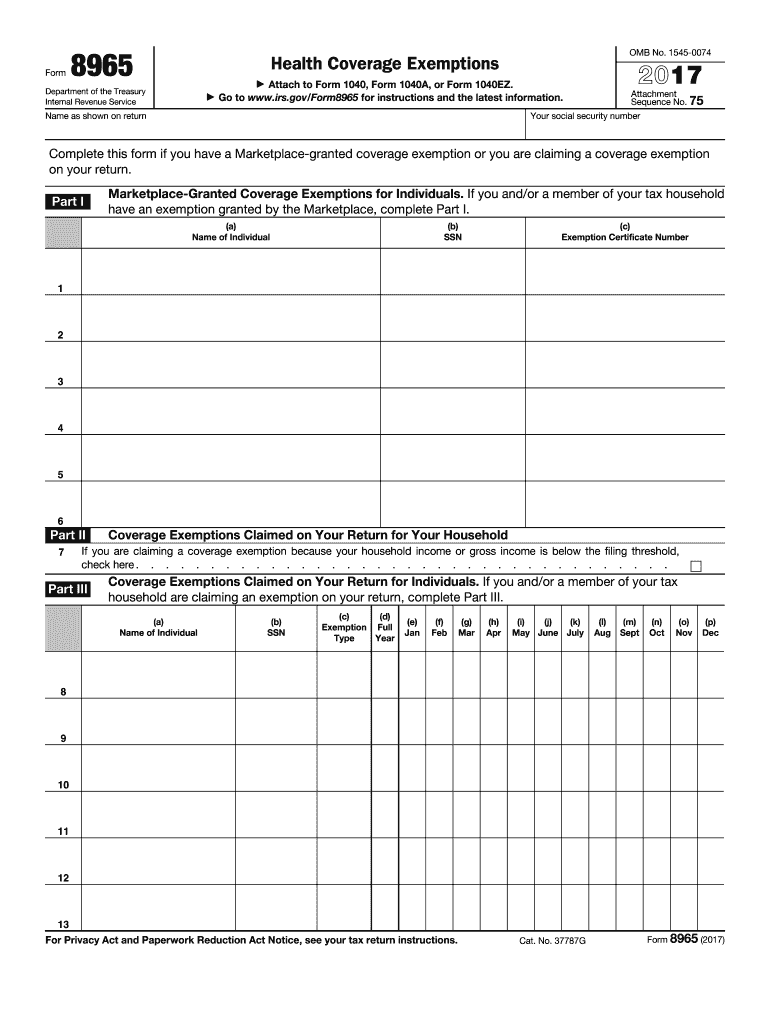

IRS 8965 2014 free printable template

Instructions and Help about IRS 8965

How to edit IRS 8965

How to fill out IRS 8965

About IRS 8 previous version

What is IRS 8965?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8965

What should I do if I discover an error in my submitted IRS 8965?

If you find an error after filing your IRS 8965, you should prepare an amended return. This involves filing a corrected version of the form and clearly indicating the changes made. It’s essential to retain records of both the original and amended versions for your files.

How can I verify that my IRS 8965 has been received and is being processed?

To verify the status of your IRS 8965, you can check the IRS e-file status tool online. If you filed by mail, you might consider contacting the IRS directly, as they can provide the latest information on processing times and confirm receipt of your form.

Are there specific privacy concerns I should be aware of when filing IRS 8965?

Yes, when filing IRS 8965, it's crucial to protect your personal information. Ensure that you use secure methods while submitting your form, especially when e-filing. Moreover, understand the IRS’s guidelines on data retention and privacy to safeguard your sensitive information.

What common mistakes should I avoid when completing my IRS 8965?

Common mistakes include failing to check for the latest updates regarding income guidelines and eligibility for exemptions. Additionally, ensure that all provided information is accurate and consistent, as discrepancies can lead to processing delays or rejection of your application.