Get the free (a) Income item(s) description - ftb ca

Show details

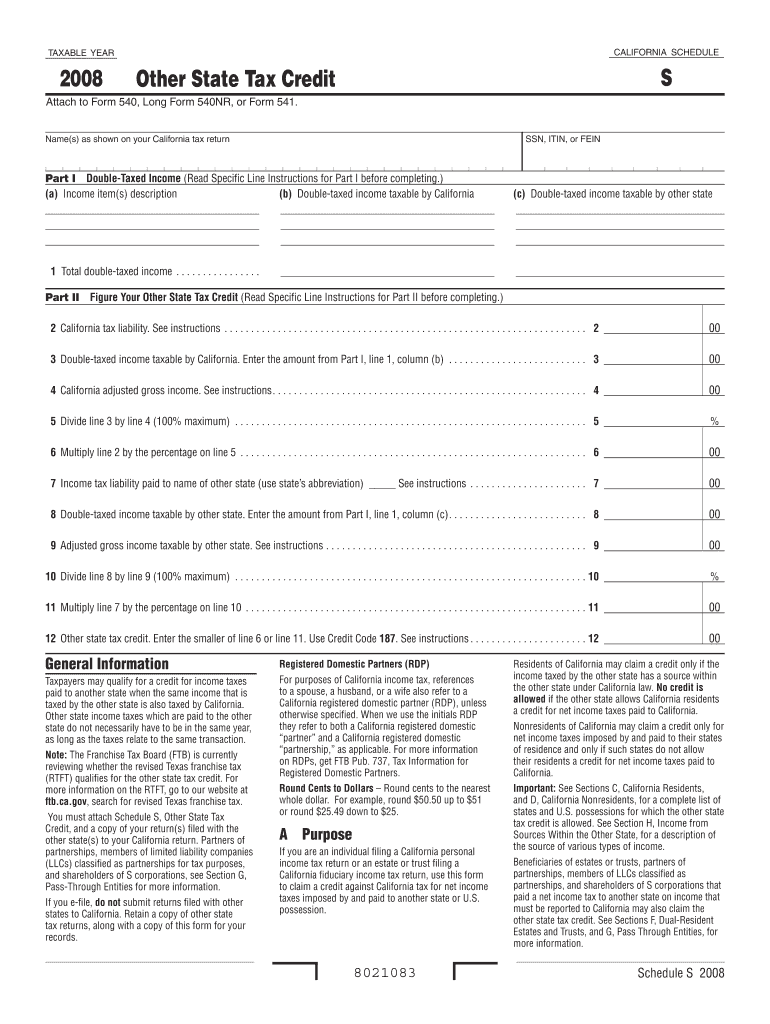

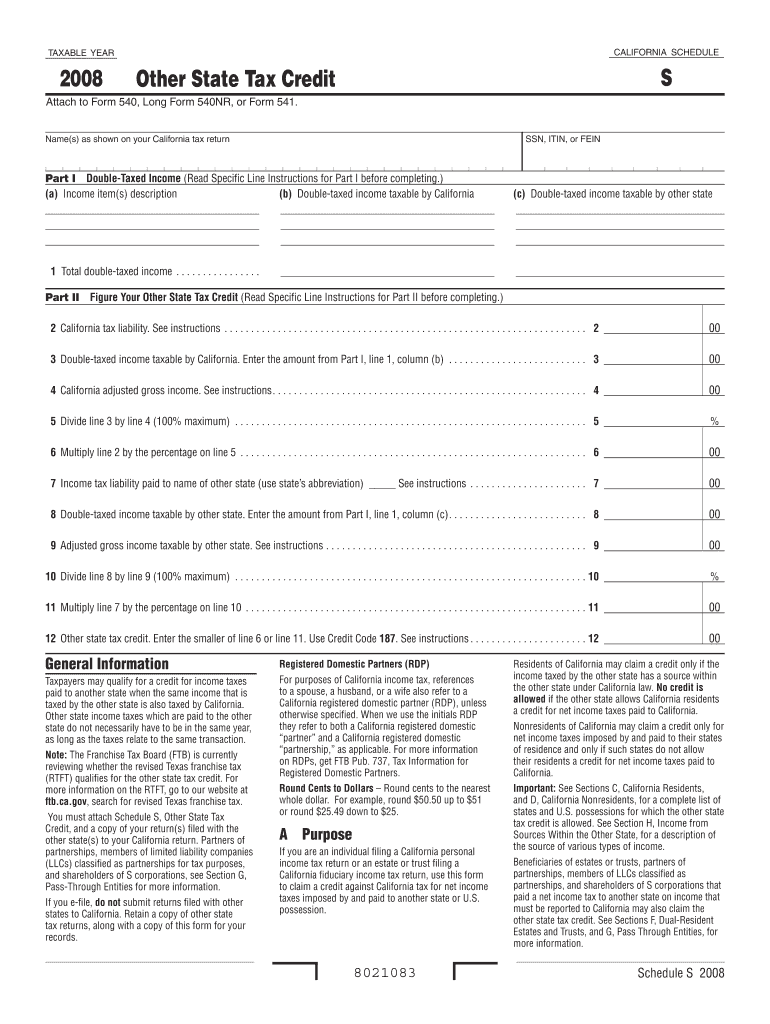

Schedule S 2008 ... Attach to Form 540, Long Form 540NR, or Form 541. General Information ... ft.ca.gov, search for revised Texas franchise tax. You must ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a income items description

Edit your a income items description form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a income items description form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing a income items description online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit a income items description. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a income items description

How to fill out an income items description:

01

Start by accurately identifying and listing all sources of income. This can include wages, salaries, bonuses, tips, commissions, rental income, investments, and more.

02

Each income item should have a clear description. For example, instead of listing "Salary," specify the employer and the position held. If it's rental income, provide details about the property location and type of rental.

03

Include the specific amounts for each income item. Be precise and include any necessary calculations or breakdowns. If applicable, note whether the amount is pre-tax or post-tax.

04

Keep in mind that some income items may require additional information or documentation. For instance, self-employment income might require providing a Schedule C form or invoices.

05

Review and double-check your income items description for accuracy and completeness. Ensure that all relevant income sources are included and clearly described.

Who needs an income items description?

01

Individuals filing income tax returns: When filing annual tax returns, individuals must provide an income items description to accurately report their income and ensure compliance with tax laws.

02

Freelancers and self-employed individuals: For those who work independently or have their own businesses, maintaining a detailed income items description is crucial for calculating and reporting their income accurately.

03

Landlords and property owners: Rental income is considered an income item and should be included in the description for tax purposes. Accurate reporting is necessary to calculate rental income and any associated deductions.

04

Investors and traders: Individuals who earn income from investments, such as dividends or capital gains, need to include these income items in their description to report them accurately for tax purposes.

05

Loan applicants: When applying for loans or mortgages, lenders often require a detailed income items description to evaluate the borrower's financial stability and repayment capacity.

Remember, accurately filling out an income items description is essential for various financial and legal purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the a income items description in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I edit a income items description on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share a income items description from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete a income items description on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your a income items description. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is a income items description?

An income items description is a detailed explanation of all sources of income received by an individual or entity.

Who is required to file a income items description?

Any individual or entity that receives income from various sources is required to file an income items description.

How to fill out a income items description?

To fill out an income items description, one must list all sources of income received, provide detailed descriptions of each source, and report the corresponding amounts.

What is the purpose of a income items description?

The purpose of an income items description is to provide a clear and transparent overview of all sources of income, ensuring compliance with tax regulations and laws.

What information must be reported on a income items description?

On an income items description, one must report all sources of income, including wages, investments, rental income, royalties, and any other sources of earnings.

Fill out your a income items description online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A Income Items Description is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.