Get the free Anti-Money Laundering Compliance Guide

Show details

Este guía contiene información importante sobre las leyes y regulaciones federales que afectan a su negocio y a sus empleados, específicamente en relación con la Ley de Secreto Bancario (BSA),

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign anti-money laundering compliance guide

Edit your anti-money laundering compliance guide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your anti-money laundering compliance guide form via URL. You can also download, print, or export forms to your preferred cloud storage service.

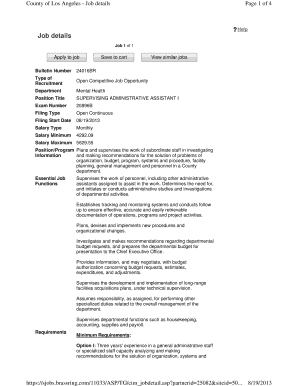

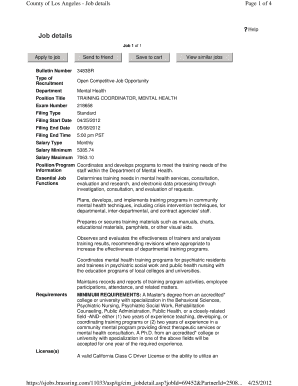

How to edit anti-money laundering compliance guide online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit anti-money laundering compliance guide. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out anti-money laundering compliance guide

How to fill out Anti-Money Laundering Compliance Guide

01

Begin by gathering all necessary documents and information required for the Anti-Money Laundering Compliance Guide.

02

Identify the key components of the guide, such as risk assessment, policies, and procedures.

03

Fill out the risk assessment section by evaluating potential money laundering risks specific to your business.

04

Outline your company's policies related to customer due diligence (CDD) and ongoing monitoring.

05

Include procedures for reporting suspicious activities and adhering to regulatory requirements.

06

Review and include training programs for employees on AML regulations and compliance.

07

Ensure that there is a designated compliance officer responsible for overseeing AML efforts.

08

Periodically review and update the compliance guide to reflect any regulatory changes or internal updates.

Who needs Anti-Money Laundering Compliance Guide?

01

Financial institutions such as banks and credit unions.

02

Real estate professionals involved in property transactions.

03

Insurance companies offering certain financial products.

04

Casinos and gaming operators.

05

Cryptocurrency exchanges and related businesses.

06

Lawyers and accountants dealing with large transactions or client funds.

07

Any business or industry that handles large sums of money and is at risk of being used for money laundering.

Fill

form

: Try Risk Free

People Also Ask about

What are the 5 main indicators of money laundering?

Trust and company formation secretive or suspicious behaviour by the client. formation of a shell company in an offshore jurisdiction without a legitimate commercial purpose. interposition of an entity in a transaction without any clear need. unnecessarily complex corporate structures.

What is an example of AML compliance?

AML compliance programs must implement customer due diligence (CDD) rules to identify and assess each customer's risk of criminal activity. For example, FinCEN's CDD Rule requires financial institutions to: Identify and verify customer identities. Identify and verify beneficial owners' identities.

What are four main ingredients for AML compliance?

The Four (4) Pillars Of BSA/AML Compliance PILLAR #1. DESIGNATION OF A COMPLIANCE OFFICER. PILLAR #2. DEVELOPMENT OF INTERNAL POLICIES, PROCEDURES AND CONTROLS. PILLAR #3. ONGOING, RELEVANT TRAINING OF EMPLOYEES. PILLAR #4. INDEPENDENT TESTING AND REVIEW. CONCLUSION.

What are the 5 pillars of an AML policy?

The five pillars of AML compliance offer a holistic approach, emphasizing internal controls, assigned roles, training and awareness, independent testing, and a risk-based strategy for ongoing Customer Due Diligence (CDD).

What is an example of AML?

For example, a large deposit of cash into an account could prompt a bank to ask the depositor to verify the source of the money. While this may annoy customers who aren't doing anything wrong, the process is necessary to identify those who are up to mischief. KYC is a cornerstone of any AML compliance program.

What is the AML compliance?

Anti-money laundering (or AML) compliance entails a careful adherence to rules and regulations aimed at combating illicit financial activities. In the US, AML compliance is upheld by the US Treasury's Financial Crimes Enforcement Network (FinCen) and governed by the Bank Secrecy Act (or BSA).

What are the AML compliance processes?

What are the 6 components of an AML compliance program? Appointing a compliance officer, Employee training, Risk assessment, Detection and reporting of suspicious activity, Internal practices, Internal audits.

How to learn AML compliance?

AML Foundations course structure: Four-week, online anti-money laundering training course. Available on desktop or mobile (and most other devices) Complete the four hours of coursework at your own pace. Pass a short, 20-question final assessment to receive your AML certificate. Results available immediately.

What are the 3 stages of AML with examples?

Placement: where the illicit funds enter the legitimate financial system. Layering: where the funds are moved around to create confusion and distance them from their criminal origin. Integration: where the money is reintroduced into the economy in a way that makes it appear to have come from legitimate sources.

What are the five pertinent AML laws and regulations?

The BSA outlines five essential pillars that financial institutions can rely on to establish AML programs in ance with regulations, which include: appointing a designated compliance officer (1), establishing an internal AML policy (2), conducting employee training (3), conducting testing and auditing (4), and

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Anti-Money Laundering Compliance Guide?

The Anti-Money Laundering Compliance Guide is a set of guidelines and regulations that help institutions prevent, detect, and report money laundering activities. It outlines practices and procedures to ensure compliance with anti-money laundering laws.

Who is required to file Anti-Money Laundering Compliance Guide?

Financial institutions, such as banks, credit unions, and brokerage firms, as well as certain non-financial businesses, are required to file the Anti-Money Laundering Compliance Guide to demonstrate adherence to AML laws.

How to fill out Anti-Money Laundering Compliance Guide?

To fill out the Anti-Money Laundering Compliance Guide, institutions must collect and provide accurate information about their AML policies, procedures, and internal controls, as well as document training and reporting mechanisms.

What is the purpose of Anti-Money Laundering Compliance Guide?

The purpose of the Anti-Money Laundering Compliance Guide is to establish a framework for detecting and preventing money laundering activities, protect financial systems from illicit activities, and ensure adherence to legal and regulatory requirements.

What information must be reported on Anti-Money Laundering Compliance Guide?

The information reported in the Anti-Money Laundering Compliance Guide typically includes policies and procedures regarding customer identification, transaction monitoring, and risk assessment, as well as records of training provided to staff.

Fill out your anti-money laundering compliance guide online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Anti-Money Laundering Compliance Guide is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.