Get the free AR1000TD ARKANSAS INDIVIDUAL INCOME TAX

Instructions and Help about ar1000td arkansas individual income

How to edit ar1000td arkansas individual income

How to fill out ar1000td arkansas individual income

Latest updates to ar1000td arkansas individual income

All You Need to Know About ar1000td arkansas individual income

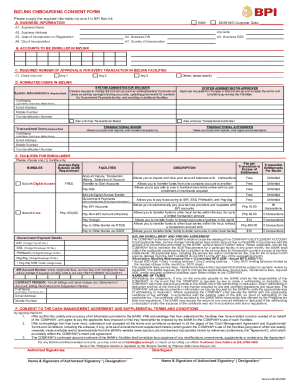

What is ar1000td arkansas individual income?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about ar1000td arkansas individual income

What should I do if I realize I've made an error on my ar1000td arkansas individual income after submission?

If you find an error after filing the ar1000td arkansas individual income, you can submit an amended return. This involves completing a new form with the corrected information and marking it as an amendment. Ensure to include any necessary documentation that supports the changes you made.

How can I track the status of my ar1000td arkansas individual income submission?

To track the status of your ar1000td arkansas individual income filing, visit the Arkansas Department of Finance and Administration's website. They provide a portal where you can check the processing status by entering your details, which helps you confirm if your submission has been received and is being processed.

What should I do if my e-file submission of the ar1000td arkansas individual income is rejected?

If your e-file submission of the ar1000td arkansas individual income is rejected, review the rejection codes provided in the notice you receive. Common issues include missing information or mismatched data. Follow the outlined steps to correct the errors and resubmit your form promptly to avoid delays.

What are the implications of filing the ar1000td arkansas individual income on someone else's behalf?

Filing the ar1000td arkansas individual income on someone else's behalf requires you to be their authorized representative or hold a power of attorney. Ensure you have the necessary documentation to prove your authority. This will help in handling any inquiries or notices from the Department of Finance and Administration effectively.