MA OCAJ-1 TRC IV 1995-2025 free printable template

Show details

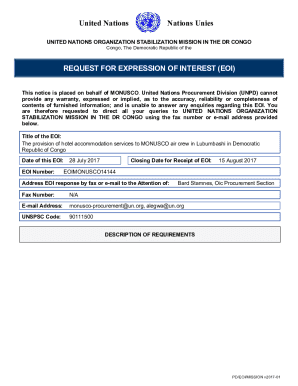

AFFIDAVIT DISCLOSING CARE OR CUSTODY PROCEEDING Pursuant to Trial Court Rule IV DOCKET NUMBER TRIAL COURT OF MASSACHUSETTS Name of Case BMC District Court Juvenile Court Prob & Family Court Superior

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA OCAJ-1 TRC IV

Edit your MA OCAJ-1 TRC IV form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA OCAJ-1 TRC IV form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MA OCAJ-1 TRC IV online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MA OCAJ-1 TRC IV. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out MA OCAJ-1 TRC IV

How to fill out MA OCAJ-1 TRC IV

01

Gather all necessary personal information, including your name, address, and contact details.

02

Ensure you have documentation that verifies your eligibility for the MA OCAJ-1 TRC IV.

03

Start filling out the form by entering personal details in the designated sections.

04

Provide any required financial information or proof as outlined in the form instructions.

05

Carefully read the instructions for each section to ensure accurate completion.

06

Review your filled-out form for any errors or missing information.

07

Sign and date the form as required.

08

Submit the form as per the indicated submission method (online, mail, etc.).

Who needs MA OCAJ-1 TRC IV?

01

Individuals seeking access to the resources or benefits offered under the MA OCAJ-1 TRC IV program.

02

Those who meet the eligibility criteria outlined by the Massachusetts Office of Community Affairs and Job Development.

Fill

form

: Try Risk Free

People Also Ask about

Is Massachusetts a mandatory withholding state?

As an employer, you must withhold Massachusetts personal income taxes from all Massachusetts residents' wages for services performed either in or outside Massachusetts and from nonresidents' wages for services performed in Massachusetts.

What is the MA M 4 form?

Massachusetts Employee's Withholding Allowance Certificate. The M-4 form tells Harvard how much to withhold for state income taxes. Massachusetts Employee's Withholding Exemption Certificate.

What is the Massachusetts withholding tax rate?

For tax year 2022, Massachusetts has a 5.0% tax on both earned (salaries, wages, tips, commissions) and unearned (interest, dividends, and capital gains) income. Certain capital gains are taxed at 12%.

Should I claim exemption from withholding?

Who Should Be Filing Exempt on Taxes? As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax liability and had no tax liability in the previous tax year.

What is MA withholding tax?

Massachusetts has a 5.00 percent flat income tax rate and a 6.25 percent flat statewide sales tax rate.

How do I fill out a w4 in MA?

0:32 2:14 How to fill out the updated W-4 tax form - YouTube YouTube Start of suggested clip End of suggested clip 4. Step three dependents you've always been able to claim dependents. But now it's in terms ofMore4. Step three dependents you've always been able to claim dependents. But now it's in terms of dollars not the number of dependents. In most cases a dependent is considered anyone under the age of 17.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit MA OCAJ-1 TRC IV from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your MA OCAJ-1 TRC IV into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the MA OCAJ-1 TRC IV electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your MA OCAJ-1 TRC IV in seconds.

How do I edit MA OCAJ-1 TRC IV on an Android device?

You can make any changes to PDF files, such as MA OCAJ-1 TRC IV, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is MA OCAJ-1 TRC IV?

MA OCAJ-1 TRC IV is a form used by businesses in Massachusetts to report certain tax information related to their operations or specific transactions.

Who is required to file MA OCAJ-1 TRC IV?

Businesses operating in Massachusetts that meet specific criteria regarding their tax obligations are required to file MA OCAJ-1 TRC IV.

How to fill out MA OCAJ-1 TRC IV?

To fill out MA OCAJ-1 TRC IV, businesses must provide their identifying information, detail relevant transactions, and ensure all required fields are completed accurately before submission.

What is the purpose of MA OCAJ-1 TRC IV?

The purpose of MA OCAJ-1 TRC IV is to gather necessary tax-related information from businesses for compliance and regulatory purposes.

What information must be reported on MA OCAJ-1 TRC IV?

The information that must be reported on MA OCAJ-1 TRC IV includes the business's tax identification number, transaction details, and any other required financial information relevant to the tax report.

Fill out your MA OCAJ-1 TRC IV online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA OCAJ-1 TRC IV is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.