Get the free Personnel and Payroll Forms - smith

Show details

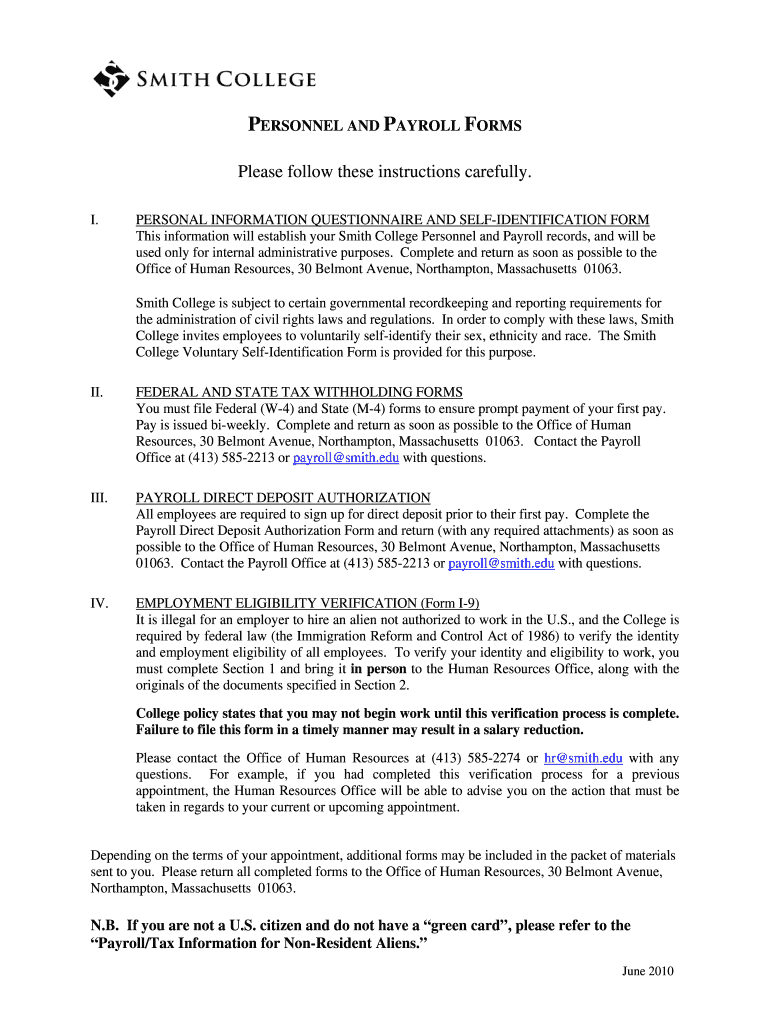

Este documento contiene formularios necesarios para establecer los registros de personal y nómina en Smith College, incluyendo un cuestionario de información personal, formularios de retención

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personnel and payroll forms

Edit your personnel and payroll forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personnel and payroll forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personnel and payroll forms online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit personnel and payroll forms. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personnel and payroll forms

How to fill out Personnel and Payroll Forms

01

Gather all necessary personal information, including name, address, and contact details.

02

Provide your social security number and tax information as required.

03

Fill out employment details, including position, department, and employee ID.

04

Complete sections related to payment details, such as bank account information for direct deposits.

05

Review the forms for accuracy before submission.

06

Submit the forms to the HR or payroll department as instructed.

Who needs Personnel and Payroll Forms?

01

New employees starting a job.

02

Existing employees updating their information.

03

HR personnel and payroll administrators for maintaining records.

04

Contractors or temporary staff who require payroll processing.

Fill

form

: Try Risk Free

People Also Ask about

What are W4 and I9 forms?

Form W-2 is provided to all employees and the IRS. W-2s report an employee's annual wages, as well as federal income tax, state and local income tax (if applicable), Social Security, and Medicare taxes withheld. Employers must also file W-2s with the Social Security Administration using Form W-3 (see below).

Do I need to file 941 if I have no payroll?

As an employer, you are required to file Form 941 even if you have no employees or payroll taxes. Even if your tax amount is zero, the IRS expects you to file Form 941.

How do I fill out my W-4 correctly?

New employees need to fill out a Form I-9 to verify employment eligibility as well as a W-4 for income tax.

What are W4 and I9 forms?

The main difference between the W-2 and W-4 is their purpose: the W-2 is issued by employers annually to report wages and taxes withheld for tax filing, while the W-4 is completed by employees to determine how much federal income tax should be withheld from their paycheck.

Do I claim 0 or 1 on my W4?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

What form to fill out for payroll?

How to fill out a W-4 form Step 1: Enter your personal information. Fill in your name, address, Social Security number and tax filing status. Step 2: Account for all jobs or spousal income. Step 3: Claim dependents, including children. Step 4: Refine your withholdings. Step 5: Sign and date your W-4.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Personnel and Payroll Forms?

Personnel and Payroll Forms are documents used by organizations to collect, manage, and report employee-related information, including hiring, payroll, benefits, and employment status.

Who is required to file Personnel and Payroll Forms?

Employers are required to file Personnel and Payroll Forms for all employees, including full-time, part-time, and temporary staff, to comply with labor laws and tax regulations.

How to fill out Personnel and Payroll Forms?

To fill out Personnel and Payroll Forms, gather necessary employee information such as name, social security number, tax withholding, and benefits selections. Complete the forms accurately, sign as required, and submit them to the HR or payroll department.

What is the purpose of Personnel and Payroll Forms?

The purpose of Personnel and Payroll Forms is to ensure proper record-keeping of employee data, facilitate payroll processing, comply with legal requirements, and enable effective human resource management.

What information must be reported on Personnel and Payroll Forms?

Personnel and Payroll Forms must report information such as employee personal details, tax information, job title, salary, benefits information, and employment status.

Fill out your personnel and payroll forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personnel And Payroll Forms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.