Get the free alabama vehicle gift affidavit

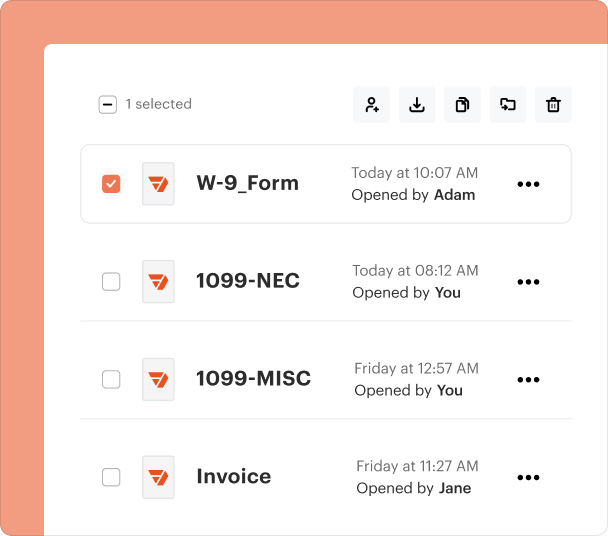

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

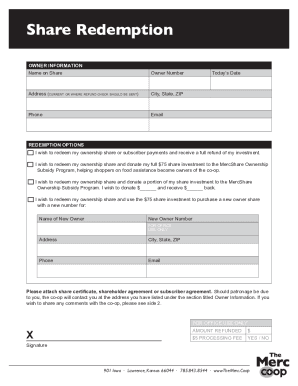

Understanding the Affidavit of Motor Vehicle Form

What is the affidavit of motor vehicle form

The affidavit of motor vehicle form is a legal document used to record the transfer of ownership of a vehicle. This form serves as proof that the transfer has occurred, often being essential for tax exemption purposes when the vehicle is given as a gift. By signing this document, both the donor and recipient affirm that the vehicle transfer is without consideration, meaning no payment is involved.

When to Use the affidavit of motor vehicle form

This form is typically utilized when a vehicle is gifted between individuals, such as family members or friends. If a vehicle is transferred with no monetary compensation, the affidavit is required to establish that the transaction is a gift, thus qualifying for potential tax exemptions. It is vital to complete the affidavit in cases of estate transfers, where the vehicle ownership changes following the death of the owner.

Required Documents and Information

To complete the affidavit of motor vehicle form, you will need several key details. This includes the vehicle's year, make, model, and Vehicle Identification Number (VIN). Additionally, both the donor's and recipient's names, addresses, and contact information must be provided. It is important to include the relationship between the donor and recipient, along with a declaration that the transfer is made without consideration, confirming that no debts are being assumed by the recipient.

How to Fill the affidavit of motor vehicle form

Filling out the affidavit requires careful attention to detail. Start by entering the vehicle's information accurately. Clearly list the names and contact information for both the donor and recipient. Under the relationship section, check the appropriate box that best describes the connection between the two parties. Once completed, both parties should sign the affidavit in front of a notary public to ensure its legal validity. Remember, any incorrect information could lead to issues later on.

Best Practices for Accurate Completion

To avoid any complications, double-check all entries for accuracy before submission. It is advisable to use printed forms to ensure legibility. Both parties should review the entire document together to confirm correctness. Additionally, retain copies of the signed affidavit for personal records, as this can be beneficial for verifying ownership and for future reference when dealing with vehicle registration or tax matters.

Common Errors and Troubleshooting

Common mistakes when completing the affidavit include incorrect vehicle information, missing signatures, or not notarizing the document. It is crucial to ensure that the VIN matches the vehicle's registration documents. Inaccurate relationship designations can also lead to complications. If you notice any errors after submission, it may be necessary to file an amended affidavit to correct the records with the relevant authorities.

Frequently Asked Questions about pdffiller form

Do I need a notary for the affidavit of motor vehicle form?

Yes, the affidavit must be signed in front of a notary public to verify its authenticity.

Can I use the affidavit for multiple vehicles?

Each vehicle transfer should be documented with a separate affidavit of motor vehicle form.

pdfFiller scores top ratings on review platforms