Get the free rental of tangible personal property, property under sec - revenue wi

Show details

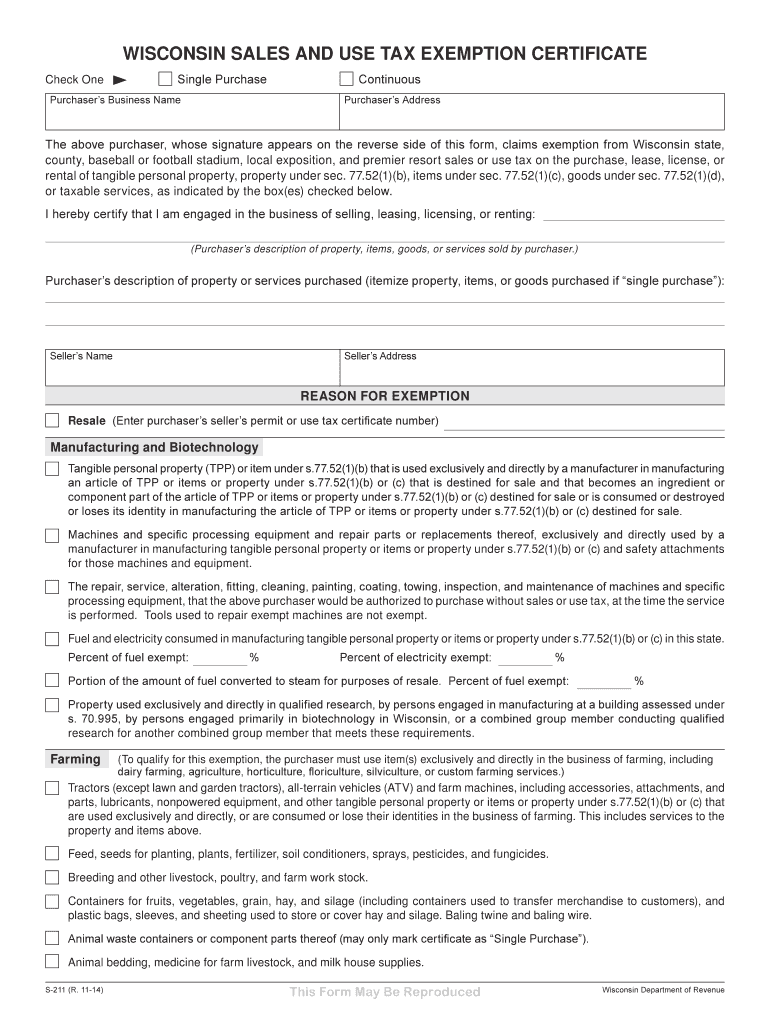

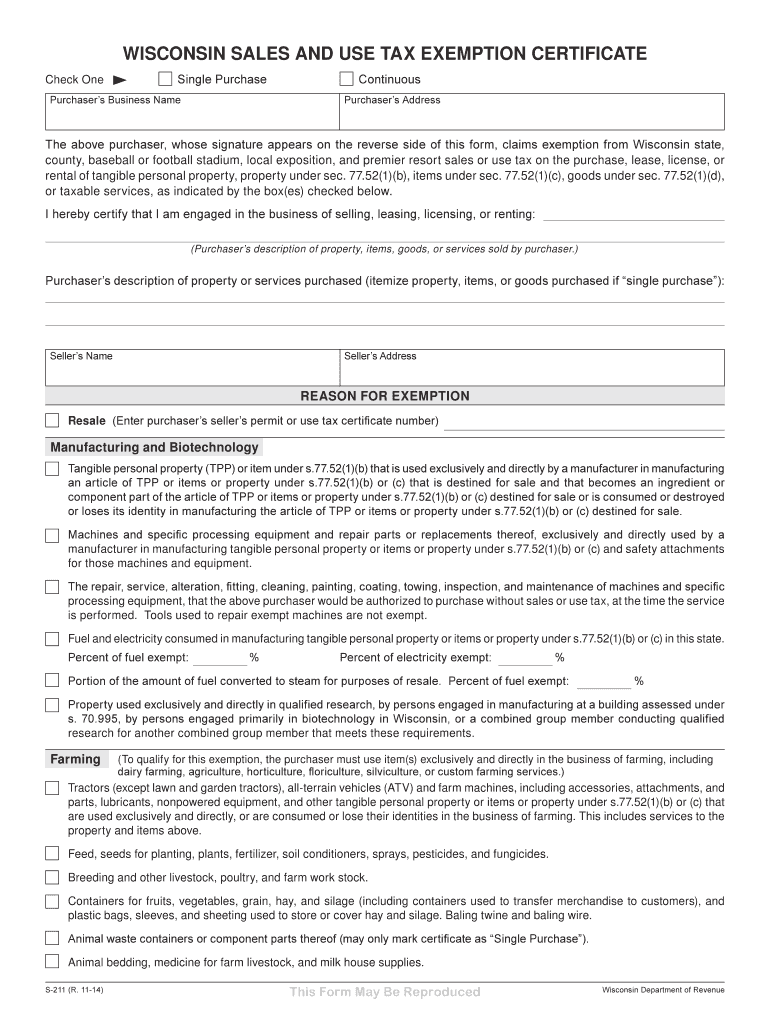

Component part of the article of TPP or items or property under s.77.52(1)(b) or (c) destined for sale or is consumed or destroyed or loses its ... WISCONSIN SALES AND USE TAX EXEMPTION CERTIFICATE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rental of tangible personal

Edit your rental of tangible personal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental of tangible personal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rental of tangible personal online

Follow the steps below to benefit from the PDF editor's expertise:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit rental of tangible personal. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rental of tangible personal

How to Fill Out Rental of Tangible Personal:

01

Begin by gathering all the necessary information for the rental agreement, including the name and contact information of both the lessor (the person or company providing the rented item) and the lessee (the person or company renting the item).

02

Clearly state the description of the tangible personal property being rented. This includes providing details such as brand, model, serial number, and any additional specific features or conditions related to the item.

03

Specify the rental period, indicating the exact start and end dates or duration of the agreement. This ensures both parties are aware of the rental timeframe and can make proper arrangements.

04

Determine the rental fee or payment terms. Clearly outline the amount to be paid, whether it is a fixed sum or a periodic payment, and the frequency of the payments (e.g., weekly, monthly). Include any additional charges or fees that may apply, such as a security deposit or damage waiver.

05

Address the issue of liability and insurance. Clarify who bears the responsibility for any damages or losses that may occur during the rental period. It is often advised to have the lessee provide proof of insurance to protect both parties in case of unforeseen circumstances.

06

Include any special terms or conditions that are relevant to the rental agreement. This may cover topics such as maintenance responsibilities, restrictions on use or alterations to the rented item, and any penalties for late returns or breaches of the agreement.

07

Both the lessor and the lessee should carefully read and understand the rental agreement before signing it. It is recommended to have a copy for each party involved for future reference.

Who needs rental of tangible personal:

01

Individuals or businesses in need of temporary use of equipment, machinery, or other tangible assets can benefit from rental services. This includes construction companies, event planners, photographers, filmmakers, and individuals who require specialized equipment for personal projects.

02

Rental services are also commonly utilized by those who prefer a cost-effective approach rather than purchasing the item outright. Renting can be a more practical solution for short-term or occasional needs, avoiding the upfront costs associated with buying and maintaining the property.

03

Businesses or individuals who want to test or evaluate a specific product or equipment before committing to a purchase may opt for a rental service. This allows them to assess the item's suitability and performance without a long-term commitment.

In conclusion, filling out a rental agreement for tangible personal property involves providing detailed information about the item, specifying the rental period and payment terms, addressing liability and insurance, and including any relevant special conditions. This service can be beneficial for individuals or businesses requiring temporary use of assets, those seeking a cost-effective option, and those interested in evaluating products before purchase.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my rental of tangible personal directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your rental of tangible personal and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit rental of tangible personal from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your rental of tangible personal into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit rental of tangible personal in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing rental of tangible personal and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is rental of tangible personal?

Rental of tangible personal property is the leasing or renting of physical items such as equipment, vehicles, or tools.

Who is required to file rental of tangible personal?

Businesses or individuals who lease or rent out tangible personal property are required to file rental of tangible personal.

How to fill out rental of tangible personal?

To fill out rental of tangible personal, you need to provide information about the rented items, duration of rental, rental income, and any expenses related to the rental.

What is the purpose of rental of tangible personal?

The purpose of rental of tangible personal is to report rental income and expenses for taxation purposes.

What information must be reported on rental of tangible personal?

Information such as rental income, expenses, depreciation, and any other related financial details must be reported on rental of tangible personal.

Fill out your rental of tangible personal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rental Of Tangible Personal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.