PH SSS Retirement Claim Application 2012-2025 free printable template

Show details

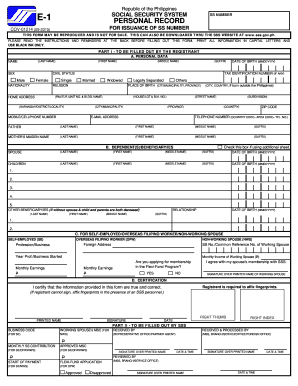

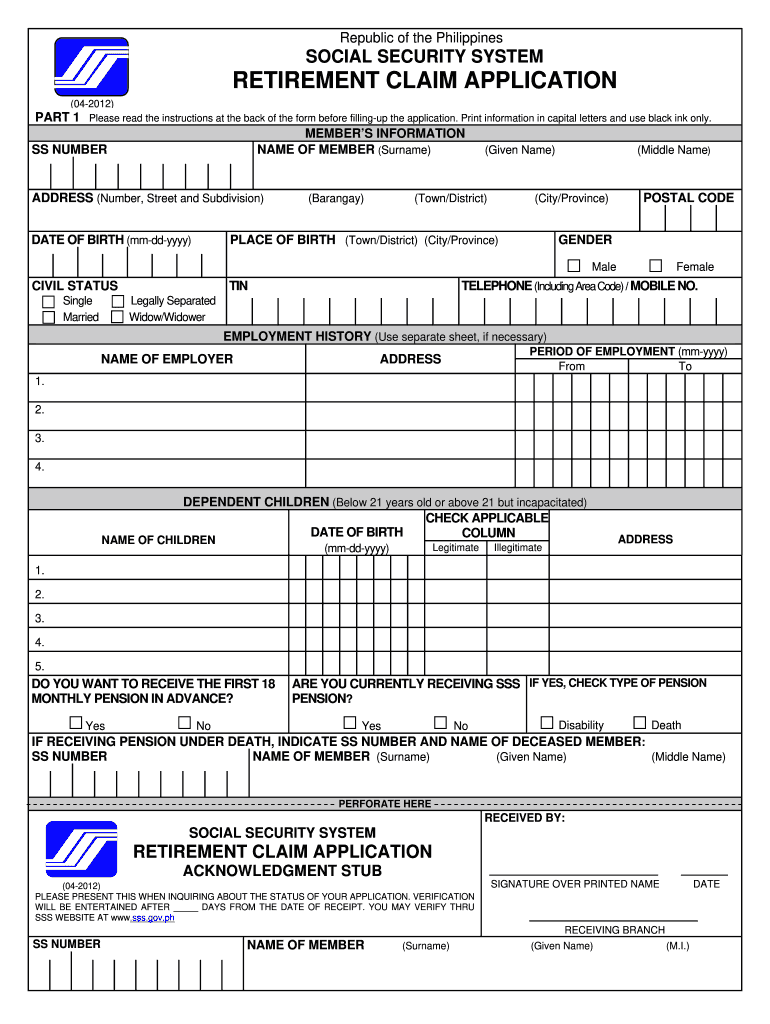

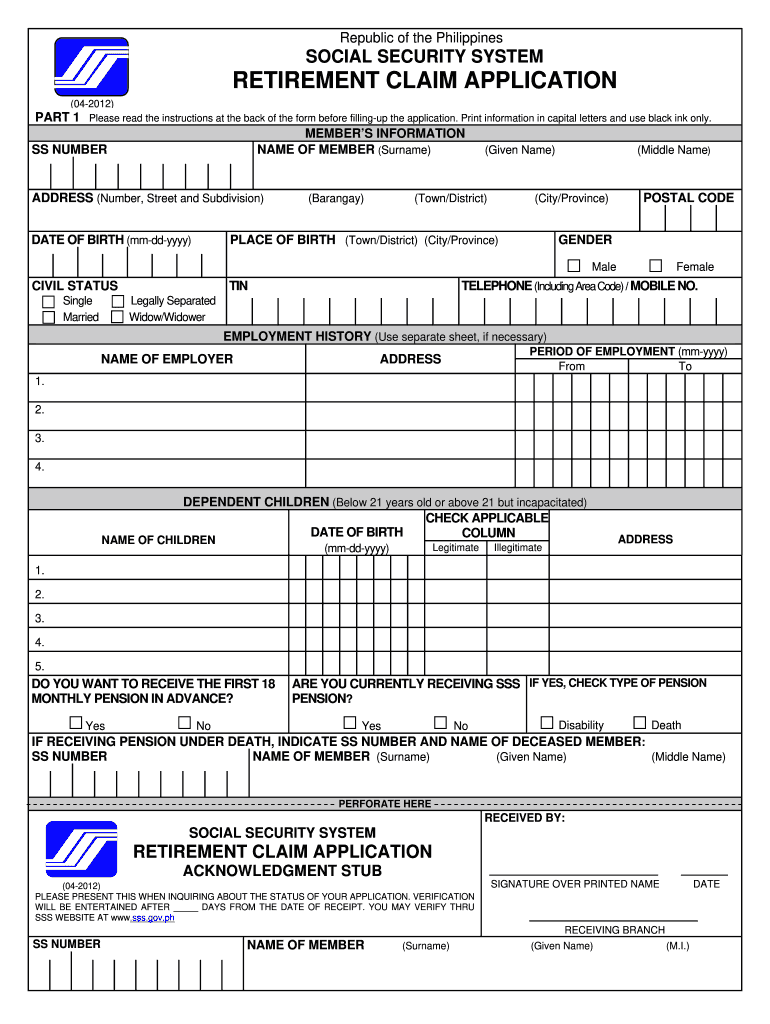

Republic of the Philippines SOCIAL SECURITY SYSTEM RETIREMENT CLAIM APPLICATION 04-2012 PART 1 Please read the instructions at the back of the form before filling-up the application. Print information in capital letters and use black ink only. MEMBER S INFORMATION NAME OF MEMBER Surname SS NUMBER ADDRESS Number Street and Subdivision DATE OF BIRTH mm-dd-yyyy Barangay Given Name Town/District Middle Name City/Province PLACE OF BIRTH Town/District City/Province POSTAL CODE GENDER Male CIVIL...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign requirements for filing sss pension form

Edit your file retirement online sss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sss senior citizen pension requirements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to Edit Your SSS Retirement Requirements Documents

1

Log in to your pdfFiller account. If you do not have an account, create one to access the editing features.

2

Upload your SSS retirement requirements documents. You can do this directly from your device, from a cloud storage service, or through integrated platforms.

3

Use the text-editing tools to fill out SSS retirement requirements documents. You can rearrange pages, insert your logo, or add your signature as needed.

4

Save your edited form in various formats. You can choose to download it directly, print it, or send it via email or stored in cloud services.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sss form for retirement

How to fill out sss retirement requirements documents

01

Gather the necessary information, such as your revenue, expenses, and any other pertinent financial data.

02

Carefully enter your data into each section of the form. Be sure to input accurate figures to avoid discrepancies.

03

Review your entries thoroughly. Check for any missing information or errors that may have occurred during data entry.

04

Utilize pdfFiller's tools for auto-calculation and field validation to ensure your form meets all requirements before submission.

05

Save your completed form securely and share it as needed, whether you choose to download it or print a copy.

Who needs sss retirement requirements documents?

01

Retiring Employees: Individuals preparing for retirement who need to complete required documentation to access SSS benefits.

02

HR Professionals: Human resources personnel assisting employees with the retirement process and ensuring compliance with requirements.

03

Financial Advisors: Advisors helping clients navigate the retirement process, ensuring that they complete all necessary forms accurately.

Fill

how to apply sss retirement online form

: Try Risk Free

People Also Ask about sss pension requirements form

Can I withdraw my SSS contribution after 10 years?

However, once you become a covered SSS member, you become a member for life. The contributions that you remit become savings for the future that will serve as basis for the granting of social security benefits in times of contingencies. Membership cannot be withdrawn and contributions paid cannot refunded.

How does SSS retirement work?

Types of Benefit There are two types of retirement benefit: Monthly pension - a lifetime cash benefit paid to a retiree who has paid at least 120 monthly contributions to the SSS prior to the semester of retirement. Lump sum amount - granted to a retiree who has not paid the required 120 monthly contributions.

How do I process my SSS retirement?

SSS account, click Apply for Retirement Benefit under the Benefits section of the E-Services tab, fill out the required information, and submit the required supporting documents,” Regino said. With the unclaimed benefit of a deceased member.

What are the documents needed for SSS retirement?

Documents Required When Applying SSS Retirement Claim Application form. 1 x 1 photo. Your Social Security Card or SSS Form E-6 Acknowledgment Stub. UMID or SSS biometrics ID card or two (2) other valid IDs, both with signature and at least one (1) with a photo and date of birth. DDR Signature Card.

How much pension will I get from SSS after 10 years?

the sum of P300 plus 20 percent (20%) of the average monthly salary credit plus two percent (2%) of the average monthly salary credit for each CYS in excess of 10 years; or 2. 40 percent (40%) of the average monthly salary credit; or 3. P1,200, if with at least 10 CYS; P2,400, if with at least 20 CYS.

How much Social Security will I get at 65?

For those who are collecting Social Security at age 65, the average payment in 2022 is about $2,484 a month, ing to the Social Security Administration.

How much is SSS retirement benefit?

40 percent (40%) of the average monthly salary credit; or 3. P1,200, if with at least 10 CYS; P2,400, if with at least 20 CYS. A retiree has the option to receive the first 18 months pension in lump sum, discounted at a preferential rate of interest to be determined by the SSS.

When can I apply for Social Security retirement benefits?

You can start receiving your Social Security retirement benefits as early as age 62. However, you are entitled to full benefits when you reach your full retirement age. If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase.

How much is SSS retirement claim?

the sum of P300 plus 20 percent (20%) of the average monthly salary credit plus two percent (2%) of the average monthly salary credit for each CYS in excess of 10 years; or 2. 40 percent (40%) of the average monthly salary credit; or 3. P1,200, if with at least 10 CYS; P2,400, if with at least 20 CYS.

Is it better to apply for Social Security online or in person?

Overall, most people feel that applying for social security benefits online is a much more convenient option than applying in person. The process is straightforward and easy to follow, and you can complete it at any time that is convenient for you.

How can I apply for SSS retirement?

You can apply: Online; or. By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office. Call ahead to make an appointment.

What are the requirements to claim SSS pension?

Member must have paid at least 120 monthly contributions prior to the semester of retirement and is any of the following, whichever is applicable: at least 60 years old and separated from employment or has ceased to be an SE/OFW/Household Helper (optional retirement);

How much do I get from SSS when I retire?

The minimum monthly Retirement Pension is P1,200 if the member has 120 months contribution or at least ten (10) CYS; or P2,400 if with at least 20 CYS. A cash benefit granted - either as a monthly pension or a lump sum amount - to the beneficiaries of a deceased member.

How can I apply for SSS retirement online in the Philippines?

All they need to do is to access their My. SSS account, click Apply for Retirement Benefit under the Benefits section of the E-Services tab, fill out the required information, and submit the required supporting documents,” Regino said.

Can I file SSS retirement online in the Philippines?

Can I file my SSS pension online? THE Social Security System (SSS) announced on Friday that self-employed members who belong to the 60 to 64 age bracket are required to submit their retirement benefit claims online through the My. SSS Portal starting July 1.

What is the minimum SSS pension in USA?

As of 2022, the average Social Security monthly benefit for retired workers is $1,657, while the full special minimum benefit for a worker with 30 years of service is $950. The number of low-income earners receiving the special minimum benefit has declined from 200,000 in the 1990s to 32,000 as of 2019.

How does Social Security retirement work?

Social Security replaces a percentage of a worker's pre-retirement income based on your lifetime earnings. The amount of your average wages that Social Security retirement benefits replaces depends on your earnings and when you choose to start benefits.

What are the requirements for SSS retirement?

Member must have paid at least 120 monthly contributions prior to the semester of retirement and is any of the following, whichever is applicable: at least 60 years old and separated from employment or has ceased to be an SE/OFW/Household Helper (optional retirement);

How are retirement benefits calculated?

Social Security benefits are based on your lifetime earnings. Your actual earnings are adjusted or “indexed” to account for changes in average wages since the year the earnings were received. Then Social Security calculates your average indexed monthly earnings during the 35 years in which you earned the most.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What are the fillable SSS retirement requirements documents?

The fillable SSS retirement requirements documents are forms you can edit and complete online, ensuring a smooth process.

How can I fill out SSS retirement requirements documents?

You can fill out SSS retirement requirements documents using our online platform, allowing you to enter your details with ease.

Is there a PDF version of the SSS retirement requirements documents?

Yes, you can access the SSS retirement requirements documents PDF for offline use and printing.

Can I find SSS retirement requirements documents online?

Absolutely. You can find and complete SSS retirement requirements documents online on our website.

How do I download SSS retirement requirements documents?

You can download the SSS retirement requirements documents directly from our website in PDF format.

Are there printable versions of the SSS retirement requirements documents?

Yes, we offer printable SSS retirement requirements documents that you can easily print after completing them.

How do I access the SSS retirement requirements documents form?

You can access the SSS retirement requirements documents form through our website and start filling it out right away.

Is my data secure when using these forms?

Yes, your data is secure. We implement strong encryption and use secure servers to ensure your information is protected.

Can I collaborate with others on these forms?

Yes, you can collaborate with others by sharing links to the documents, allowing multiple users to work simultaneously.

What should I do if I encounter a problem with the form?

If you face any issues, you can refer to our troubleshooting guide or contact our support team for assistance.

Fill out your PH SSS Retirement Claim Application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Requirements For Retirement In Sss is not the form you're looking for?Search for another form here.

Keywords relevant to sss retirement claim application

Related to sss retirement requirements

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.