Get the free Surety Bond for Erosion and Sediment Control

Show details

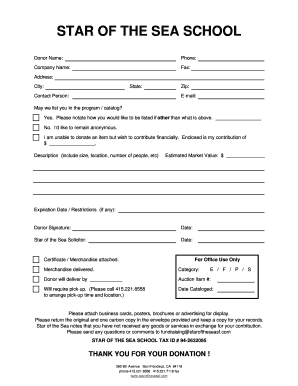

This document serves as a binding agreement for a surety bond pertaining to erosion and sediment control in Caroline County, Virginia. It outlines the obligations of the Principal and Surety to pay

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign surety bond for erosion

Edit your surety bond for erosion form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your surety bond for erosion form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing surety bond for erosion online

Follow the steps down below to use a professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit surety bond for erosion. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out surety bond for erosion

How to fill out Surety Bond for Erosion and Sediment Control

01

Gather necessary information: Ensure you have your project details, contractor information, and any legal requirements for your locality.

02

Obtain a Surety Bond form: Get the correct form for Surety Bonds specific to Erosion and Sediment Control from your local government or a surety company.

03

Fill out the bond form: Enter your personal and business information, project details, and the specific amount of the bond required.

04

Include necessary attachments: This may include project plans, proof of insurance, and any other documents required by the surety company or local authorities.

05

Sign and date the bond form: Ensure all parties involved in the bond are included, and sign where necessary.

06

Submit the bond: Provide the completed bond form and any required attachments to the appropriate local agency or authority overseeing erosion and sediment control.

07

Pay the premium: Prepare to pay the bond premium to the surety company, which is typically a percentage of the bond amount.

Who needs Surety Bond for Erosion and Sediment Control?

01

Contractors and developers involved in construction projects that may impact land and cause erosion.

02

Landowners who are undertaking significant earth-moving activities.

03

Municipalities or other entities that are required by local regulations to manage erosion and sediment control during construction.

Fill

form

: Try Risk Free

People Also Ask about

Why would someone need a surety bond?

Surety bonds help small businesses win contracts by providing the customer with a guarantee that the work will be completed. Many public and private contracts require surety bonds, which are offered by surety companies.

Who prepares the erosion and sediment control plan?

All builders/developers are required to prepare an Erosion Prevention and Sediment Control Plan (EP&SCP) showing how they will minimise soil erosion and trap sediment that may be eroded from the site during the construction.

What are the three common types of bonds?

The Bottom Line Different bond types—government, corporate, or municipal—have unique characteristics influencing their risk and return profile.

What are the different types of surety bonds?

There are numerous types of surety bonds, and there is no official or legal way to divide them into categories. However, it may be helpful to break them down into four categories: contract bonds, judicial bonds, probate court bonds, and commercial bonds.

What are the three types of surety bonds?

There are many types of surety bonds, and each state has its own bonding requirements for different industries. However, there are four major types of surety bonds that you should know: license and permit bonds, contract bonds, court bonds, and fidelity bonds.

What are the three parties to a surety bond?

Surety bonds are entered into by three parties: The Principal: This party is responsible for obtaining the bond and fulfilling the obligation. The Obligee: This party is the one who needs the guarantee by the principal. This can be a company, a government agency, or an individual. The Surety: The guarantor of the bond.

What are the 3 C's of surety?

A number of these factors fall under what the Surety industry calls “The Three C's”; Character, Capacity, and Capital. All three of these are important to the underwriting process. The principal needs to exhibit the Character, Capacity, and Capital to qualify for surety credit.

How do you write a surety bond?

How to Fill Out a Surety Bond Form Bond Number. The bond number is the unique identification number assigned to your bond. Bond Premium. This is the cost of your bond, typically calculated as a percentage of your bond coverage. Principal Name. Surety Name. State of Incorporation. Obligee Name. Bond Amount. Bond Obligation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Surety Bond for Erosion and Sediment Control?

A Surety Bond for Erosion and Sediment Control is a financial guarantee that ensures compliance with environmental regulations related to erosion and sediment management during construction activities.

Who is required to file Surety Bond for Erosion and Sediment Control?

Typically, developers, contractors, or property owners who are undertaking land-disturbing activities that could impact erosion and sedimentation are required to file a Surety Bond for Erosion and Sediment Control.

How to fill out Surety Bond for Erosion and Sediment Control?

To fill out a Surety Bond for Erosion and Sediment Control, one must provide information such as the principal's details, the surety's information, the amount of the bond, and any specific requirements outlined by the local or state regulatory authority.

What is the purpose of Surety Bond for Erosion and Sediment Control?

The purpose of a Surety Bond for Erosion and Sediment Control is to ensure that the responsible party will perform necessary erosion and sediment control measures and comply with regulations, thus protecting the environment.

What information must be reported on Surety Bond for Erosion and Sediment Control?

The information that must be reported on a Surety Bond for Erosion and Sediment Control includes the bond number, parties involved, bond amount, project description, and specific conditions or requirements imposed by the regulatory authority.

Fill out your surety bond for erosion online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Surety Bond For Erosion is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.