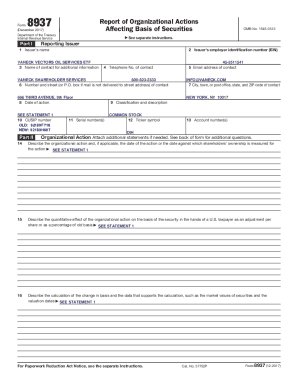

KY CA-2 2020-2025 free printable template

Show details

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit . Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY CA-2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out

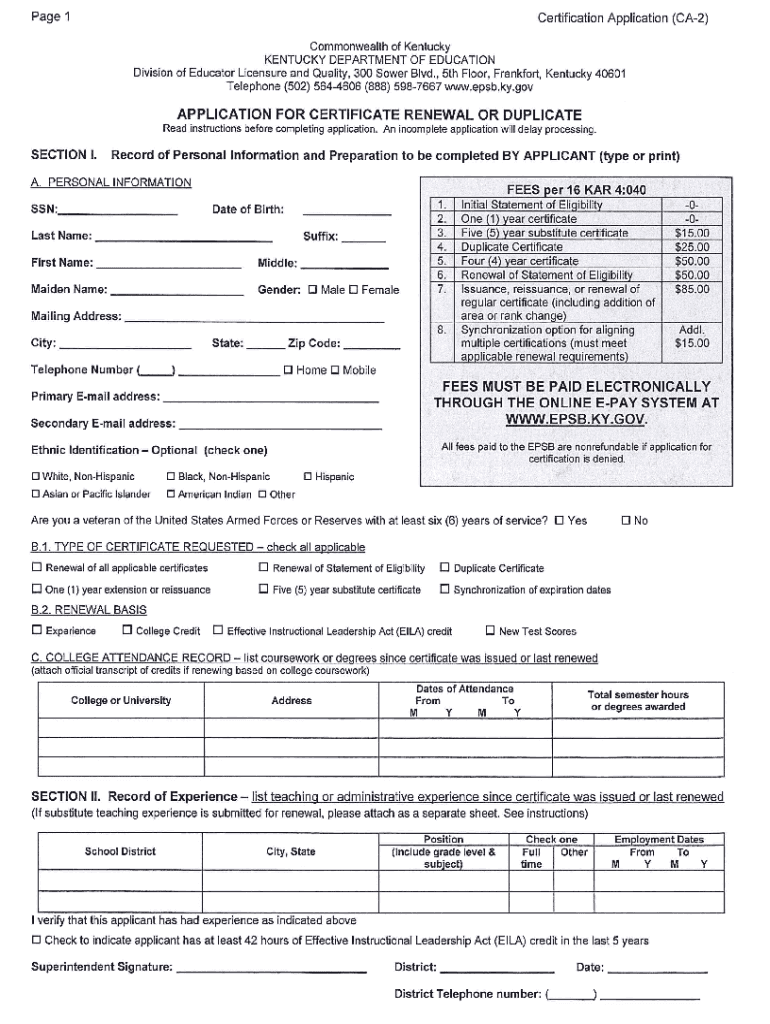

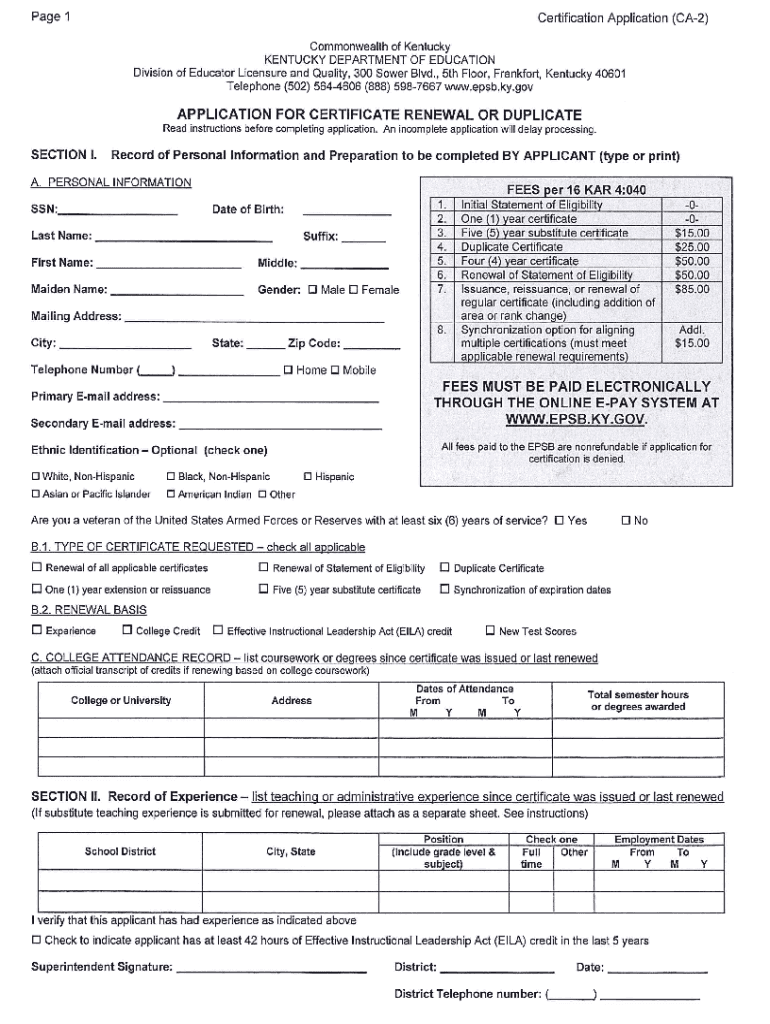

How to fill out KY CA-2

01

Obtain the KY CA-2 form from the official Kentucky Department of Revenue website or your local tax office.

02

Begin by filling out the taxpayer’s name and address at the top of the form.

03

Enter your Social Security Number or Federal Employer Identification Number in the designated field.

04

Specify the type of tax return or the specific tax issue for which you are filing the KY CA-2.

05

Provide a clear explanation of the reason for the request or the type of adjustment you are requesting.

06

Include any relevant documentation that supports your request.

07

Review the form for accuracy and completeness.

08

Sign and date the form.

09

Submit the completed form according to the instructions provided on the form, either by mail or electronically.

Who needs KY CA-2?

01

Individuals or businesses in Kentucky who need to request a correction or adjustment to their tax filings.

02

Taxpayers who are seeking to amend their previous tax returns.

03

Those who have received a notice from the Kentucky Department of Revenue requiring further information or clarification.

Fill

form

: Try Risk Free

People Also Ask about

How do I file a complaint against a teacher in Kentucky?

OEA requires that complainants submit their concerns in writing (file a complaint online). If you have a concern or comment pertaining to a local school district, please contact OEA toll-free at 800-242-0520 or at 502-564-8167. Complaints may also be faxed directly to OEA at 502-564-8322.

How long does a Kentucky teaching certificate last?

Five-year renewal requires: Appropriate payment through the KECS system via the ePay online payment service for certification fees.

What happens if my teaching license expires Kentucky?

Reinstatement of Certification If your teaching certificate expires and you do not renew it before the expiration date, you may still use the Application for Certificate Renewal/Duplicate form and simply pay the extra fee indicated on the form.

Can you teach in Kentucky without certification?

To serve as a teacher, an individual must possess a teaching certificate. The Option 9 alternative route only provides for initial certification once the candidate completes the bachelor's degree and certification assessments.

Can I teach in Kentucky without a teaching degree?

Though this route requires a candidate to be employed in a classified position while completing coursework, it does not allow the candidate to serve as a teacher while enrolled in the route. To serve as a teacher, an individual must possess a teaching certificate.

How long does a Ky teaching certificate last?

Five-year renewal requires: Appropriate payment through the KECS system via the ePay online payment service for certification fees.

What is Option 6 in Education Kentucky?

The most commonly used alternative route for pursuing teacher certification, Option 6 is a University-Based program that allows individuals who hold a minimum of a bachelor's degree in a non-teaching major to pursue initial teacher certification through an EPSB approved teacher preparation program at a participating

How do I contact the EPSB in Kentucky?

For information or to schedule a meeting, contact 502-564-5846 .

How do I add a certification to my teaching certificate in Kentucky?

How do I add new areas to my certificate? Kentucky issued certification is generally added based upon completion of an approved certification program. You need to contact a Kentucky college or university. An advisor will evaluate your transcript and outline a curriculum contract listing specific coursework needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including , without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get ?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific and other forms. Find the template you need and change it using powerful tools.

Can I edit on an Android device?

You can make any changes to PDF files, such as , with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is KY CA-2?

KY CA-2 is a form used for reporting certain financial information related to tax obligations in the state of Kentucky.

Who is required to file KY CA-2?

Individuals or businesses that meet specific criteria defined by the Kentucky Department of Revenue must file KY CA-2, particularly those involved in certain types of tax calculations or compliance.

How to fill out KY CA-2?

To fill out KY CA-2, provide accurate financial data as required by the form, ensuring all sections are completed as per the instructions provided by the Kentucky Department of Revenue.

What is the purpose of KY CA-2?

The purpose of KY CA-2 is to collect information necessary for the assessment of taxes and to ensure compliance with Kentucky tax laws.

What information must be reported on KY CA-2?

KY CA-2 requires reporting of financial information including income details, deductions, credits, and other relevant data as specified in the form's guidelines.

Fill out your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.