VA Request for Verification of Mortgage or Deed of Trust - Fairfax County 2007-2026 free printable template

Show details

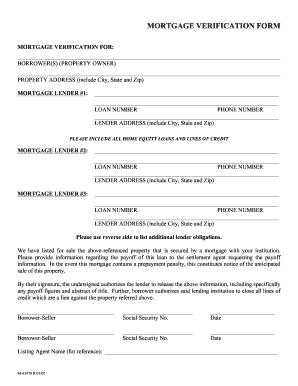

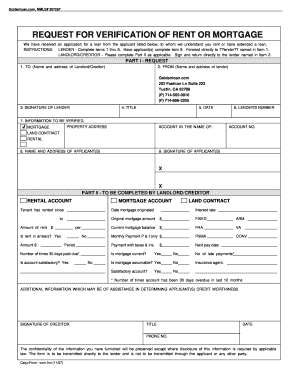

This document is utilized to request verification of mortgage details such as applicant information, mortgage data, financial data, and authorization by the applicant.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA Request for Verification of Mortgage or Deed

Edit your VA Request for Verification of Mortgage or Deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA Request for Verification of Mortgage or Deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing VA Request for Verification of Mortgage or Deed online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit VA Request for Verification of Mortgage or Deed. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out VA Request for Verification of Mortgage or Deed

How to fill out VA Request for Verification of Mortgage or Deed of Trust

01

Obtain the VA Request for Verification of Mortgage or Deed of Trust form from the VA website or your mortgage lender.

02

Fill out your personal information at the top of the form, including your name, address, and social security number.

03

Provide details about the mortgage, including the lender's name, loan number, and property address.

04

Specify the reason for the request and any additional information that may assist in the verification process.

05

Sign and date the form to authorize the release of your mortgage information.

06

Submit the completed form to your mortgage lender or the appropriate department within the VA.

Who needs VA Request for Verification of Mortgage or Deed of Trust?

01

Veterans applying for VA home loans who need mortgage verification for their application.

02

Homeowners seeking a VA benefit that requires verification of their existing mortgage or deed of trust.

03

Lenders needing to confirm the details of a veteran's mortgage as part of the loan application process.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a VOM verification for my mortgage?

If you need to request a VOM, you'll need to reach out to your lender or loan servicer. Start by calling your lender or servicer using the contact information on your monthly mortgage statement. Your lender or servicer may be able to provide you with the information you need.

How long does a verification of mortgage take?

The employee verification process for mortgages can take anywhere from a few days to weeks if your lender is working off of PDFs and physical forms. However, if you work with a lender that requests payroll access for underwriting the process could take just a few hours.

Why is a verification of mortgage needed?

One of the main factors why verification of mortgage is required is it shows the habit of a borrower in paying mortgage payments in the past 12 months. Borrowers who have been timely with making their housing payments in the past 12 to 24 months show financial responsibility to the borrower.

What is the purpose of verification of mortgage?

A verification of mortgage, or VOM, is a form used within the mortgage industry as a means to obtain borrower payment history on any existing mortgage accounts they may have.

How long does it take to get a verification of mortgage?

Once you have provided the necessary information, it will take a few days for the lender to verify the information and issue you a pre-approval letter. The letter will state how much you are approved to borrow, the interest rate, and how long the approval is good for.

What is a verification of mortgage document?

When a borrower refinances their current loan, the lender sends us a “Verification of mortgage” form. This form asks for information and payment history for the current loan, which includes: Origination date. First interest rate. First original amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in VA Request for Verification of Mortgage or Deed?

The editing procedure is simple with pdfFiller. Open your VA Request for Verification of Mortgage or Deed in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my VA Request for Verification of Mortgage or Deed in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your VA Request for Verification of Mortgage or Deed and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit VA Request for Verification of Mortgage or Deed on an iOS device?

Use the pdfFiller mobile app to create, edit, and share VA Request for Verification of Mortgage or Deed from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is VA Request for Verification of Mortgage or Deed of Trust?

The VA Request for Verification of Mortgage or Deed of Trust is a form used by the Department of Veterans Affairs to verify the details of a mortgage or deed of trust for veterans seeking benefits or financing options.

Who is required to file VA Request for Verification of Mortgage or Deed of Trust?

Typically, lenders or mortgage companies handling the loan application for veterans are required to file the VA Request for Verification of Mortgage or Deed of Trust.

How to fill out VA Request for Verification of Mortgage or Deed of Trust?

To fill out the VA Request for Verification of Mortgage or Deed of Trust, provide information such as the veteran's name, loan number, property address, and lender details. Make sure to follow the specific instructions on the form.

What is the purpose of VA Request for Verification of Mortgage or Deed of Trust?

The purpose of the VA Request for Verification of Mortgage or Deed of Trust is to confirm the financial details of a mortgage or deed of trust to assess eligibility for VA benefits and streamline the loan approval process.

What information must be reported on VA Request for Verification of Mortgage or Deed of Trust?

The information that must be reported includes the borrower's name, social security number, loan amount, property address, account status, payment history, and any other specific details related to the mortgage or deed of trust.

Fill out your VA Request for Verification of Mortgage or Deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA Request For Verification Of Mortgage Or Deed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.