Get the free Slides - Family Trusts and Public Financial Disclosure.pptx - hacienda pr

Show details

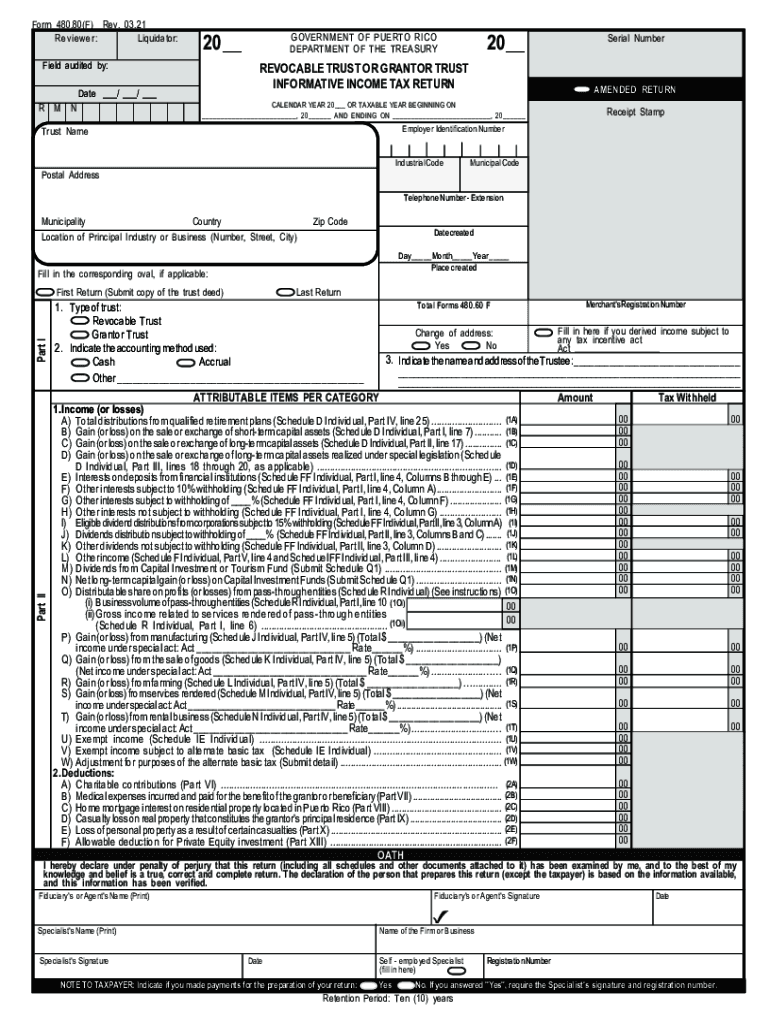

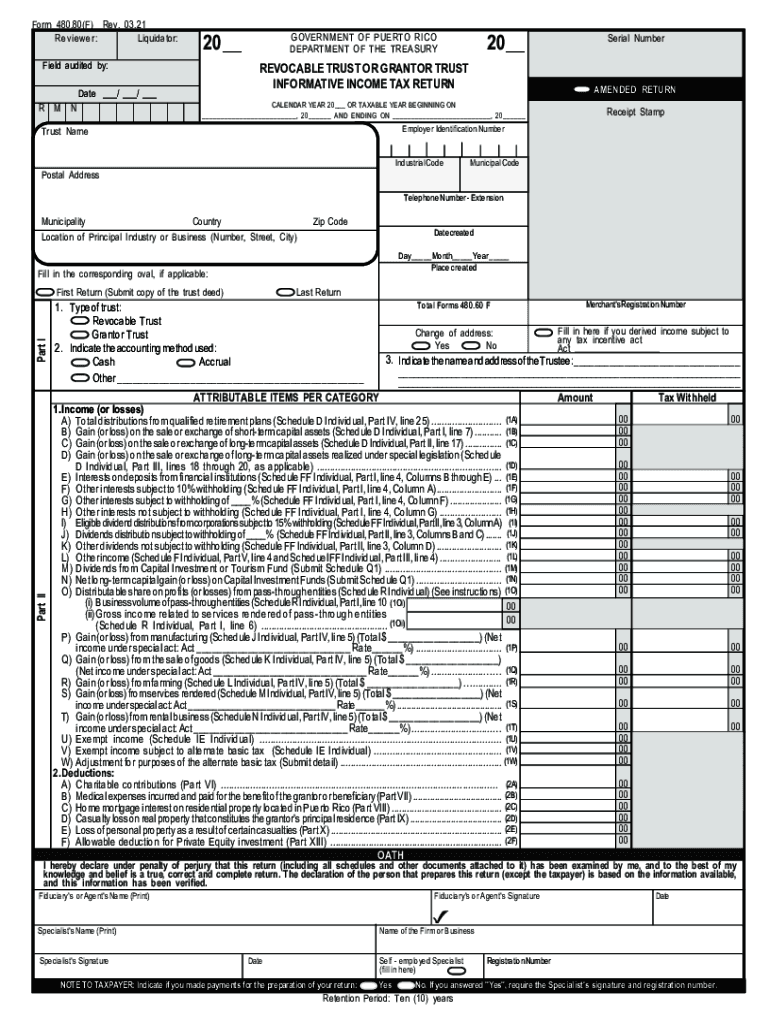

Form 480.80(F) Rev. 03.21 Reviewer: Liquidator:20__Field audited by:REVOCABLE TRUST OR GRANTER TRUST INFORMATIVE INCOME TAX Returnable ___/ ___/ ___ R MN20__GOVERNMENT OF PUERTO RICO DEPARTMENT OF

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign slides - family trusts

Edit your slides - family trusts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your slides - family trusts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit slides - family trusts online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit slides - family trusts. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out slides - family trusts

How to fill out slides - family trusts

01

Gather all relevant information about the family trust, including beneficiaries, assets held in the trust, and any specific instructions or provisions.

02

Create a new slide presentation or open an existing one in your preferred presentation software.

03

Insert a slide with the title 'Family Trust' at the beginning of the presentation to introduce the topic.

04

Outline the purpose and benefits of a family trust on the following slides.

05

Detail the key features of a family trust, such as asset protection, tax advantages, and estate planning considerations.

06

Include visuals like graphs, charts, or images to enhance the presentation and make it more engaging for the audience.

07

Ensure that the content is clear, concise, and easy to understand for the intended audience.

08

Proofread the slides for any errors or inconsistencies before finalizing the presentation.

Who needs slides - family trusts?

01

Individuals or families looking to protect their assets and pass them on to future generations in a tax-efficient manner.

02

Estate planning professionals, financial advisors, and lawyers who work with clients on setting up and managing family trusts.

03

Business owners who want to safeguard their personal and business assets from potential creditors or lawsuits.

04

Wealthy individuals or families with complex financial situations who wish to maintain control over their assets and provide for their loved ones.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send slides - family trusts for eSignature?

Once you are ready to share your slides - family trusts, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I edit slides - family trusts on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing slides - family trusts right away.

How do I fill out the slides - family trusts form on my smartphone?

Use the pdfFiller mobile app to fill out and sign slides - family trusts on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is slides - family trusts?

Slides - family trusts refer to the tax forms and documentation that need to be filed for family trusts to report income, deductions, and distributions.

Who is required to file slides - family trusts?

The trustee or administrator of a family trust is required to file slides for the trust.

How to fill out slides - family trusts?

Slides for family trusts can be filled out by providing detailed information about the trust's income, deductions, and distributions for the tax year.

What is the purpose of slides - family trusts?

The purpose of slides for family trusts is to report the trust's financial activity to the tax authorities and ensure compliance with tax laws.

What information must be reported on slides - family trusts?

Information such as trust income, deductions, distributions, and any other relevant financial details must be reported on slides for family trusts.

Fill out your slides - family trusts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Slides - Family Trusts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.