Get the free individual vehicle mileage and fuel record

Show details

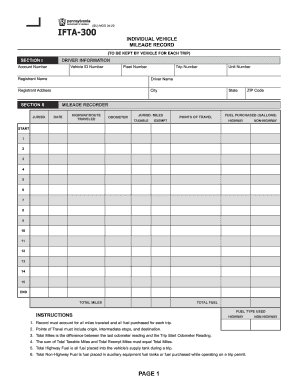

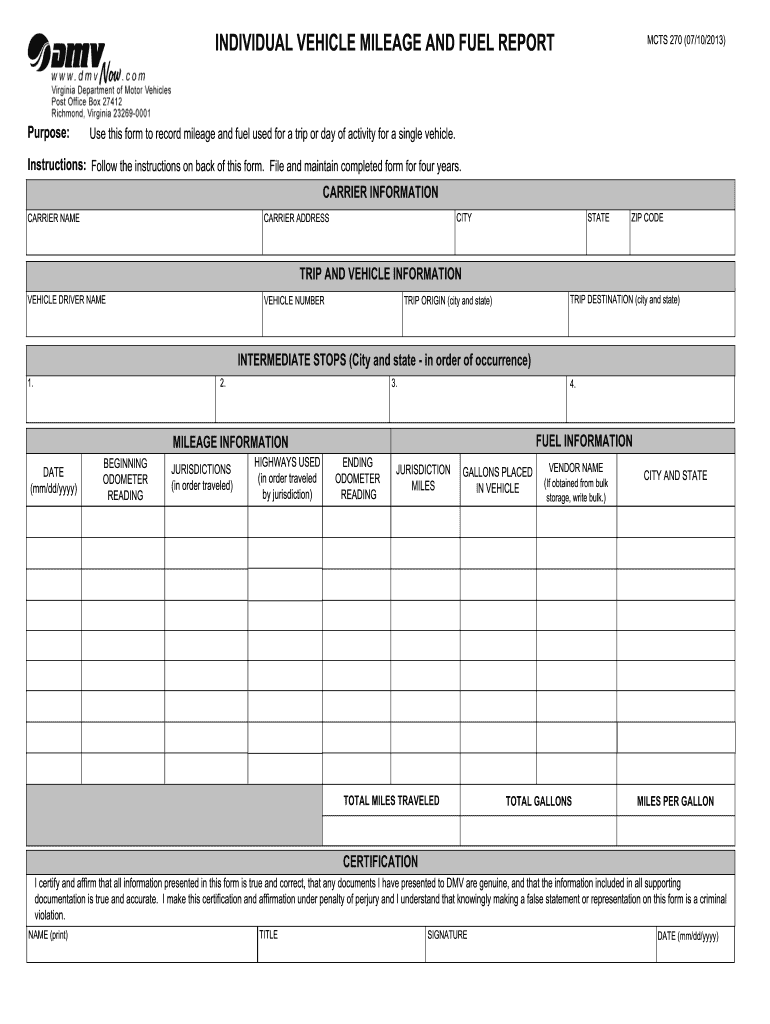

INDIVIDUAL VEHICLE MILEAGE AND FUEL REPORT Purpose MCTS 270 07/10/2013 Use this form to record mileage and fuel used for a trip or day of activity for a single vehicle. I make this certification and affirmation under penalty of perjury and I understand that knowingly making a false statement or representation on this form is a criminal violation. NAME print TITLE SIGNATURE page 2 INSTRUCTIONS Prepare an Individual Vehicle Mileage and Fuel Report ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign daily vehicle mileage and fuel report excel form

Edit your individual vehicle mileage and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual vehicle mileage and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing individual vehicle mileage and online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit individual vehicle mileage and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out individual vehicle mileage and

How to fill out individual vehicle mileage record:

01

Keep track of the date and time of each trip: Write down the date and time when the trip started and ended. It's important to have accurate and detailed information to record the mileage properly.

02

Record the purpose of the trip: Whether it's for business, personal, or any other reason, document the purpose of each trip. This will help in separating business and personal mileage for tax or reimbursement purposes.

03

Note the starting and ending odometer readings: Record the mileage on your vehicle's odometer at the beginning and end of each trip. This will determine the total distance traveled during that particular trip.

04

Calculate the total miles driven: Subtract the starting odometer reading from the ending odometer reading to calculate the total miles driven for each trip.

05

Document any business-related expenses: If the trip is for business purposes, keep track of any additional expenses related to the trip, such as parking fees, tolls, or fuel costs. These expenses can be used for reimbursement or tax deduction purposes.

06

Maintain a logbook or use mileage tracking software: Organize all the recorded information in a logbook or use mileage tracking software for easier recordkeeping. This will help in keeping all the information together and can be useful when it comes to generating reports or analyzing your mileage trends.

Who needs individual vehicle mileage record:

01

Individuals for personal expenses: Keeping an individual vehicle mileage record can be helpful for tracking personal vehicle usage and associated costs. This information can be used for personal budgeting or for evaluating the efficiency of your vehicle.

02

Self-employed or freelancers: Individuals who are self-employed or work as freelancers often need to track their mileage for tax purposes. This record helps in differentiating between personal and business mileage, which can be used for tax deductions or reimbursements.

03

Company employees: Certain job roles or companies may require employees to maintain an individual vehicle mileage record, especially if they use their personal vehicles for work-related purposes. This record is necessary to reimburse employees for business-related mileage or to track company vehicles' usage.

Note: It is always advisable to consult with a tax professional or accountant for specific requirements and regulations regarding individual vehicle mileage record-keeping, as it can vary based on individual circumstances and local laws.

Fill

form

: Try Risk Free

People Also Ask about

Can mileage correction be detected?

MILEAGE BLOCKER — THE LEGAL AND EFFECTIVE DEVICE It simply stops counting up miles while a vehicle is in motion. Now the question is — Can mileage blocker be detected? The answer is NO. They have developed this technology only for car testing and tuning purposes.

What is a Ivmr?

Individual Vehicle Mileage Report (IVMR)

How can I check the actual mileage of a car?

Request a vehicle history report to check for odometer discrepancies in the vehicle's history. If the seller does not have a vehicle history report, use the car's VIN to order a vehicle history report online. If you suspect fraud, contact your state's enforcement agency.

How do I find the original mileage of my car?

Request a vehicle history report to check for odometer discrepancies in the vehicle's history. If the seller does not have a vehicle history report, use the car's VIN to order a vehicle history report online.

Why is my odometer showing the wrong mileage?

Any electronic interference or voltage spike can cause a stray signal, and yes, cause the odometer to skip a beat and/or alter mileage. The signal is called EMI (electronic magnetic interference). There are multiple electronic signals in the airwaves and some can cause all kinds of issues.

What is the actual mileage of a car?

A vehicle's odometer reading is one of the key factors in determining what that vehicle is worth because it indicates the number of miles a vehicle has traveled. Actual miles is the exact distance the vehicle has traveled (accrued mileage) as displayed on the odometer.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify individual vehicle mileage and without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your individual vehicle mileage and into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit individual vehicle mileage and on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share individual vehicle mileage and on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete individual vehicle mileage and on an Android device?

Complete individual vehicle mileage and and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is daily vehicle mileage?

Daily vehicle mileage refers to the total distance traveled by a vehicle within a single day.

Who is required to file daily vehicle mileage?

Typically, businesses that operate vehicles for work purposes are required to file daily vehicle mileage, including fleet operators and companies with employees using vehicles for business-related tasks.

How to fill out daily vehicle mileage?

To fill out daily vehicle mileage, you record the starting odometer reading at the beginning of the day, the ending odometer reading at the end of the day, and provide any relevant details regarding the trips taken.

What is the purpose of daily vehicle mileage?

The purpose of daily vehicle mileage is to track usage for reimbursement, maintenance scheduling, tax reporting, and to assess overall vehicle performance and efficiency.

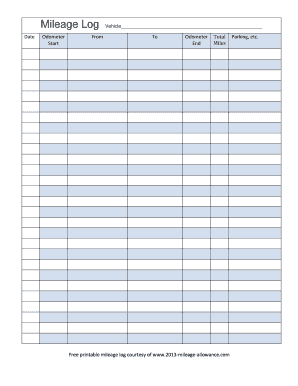

What information must be reported on daily vehicle mileage?

The information that must be reported includes the date, starting and ending odometer readings, total miles driven, purpose of each trip, and any relevant notes pertaining to vehicle use.

Fill out your individual vehicle mileage and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual Vehicle Mileage And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.