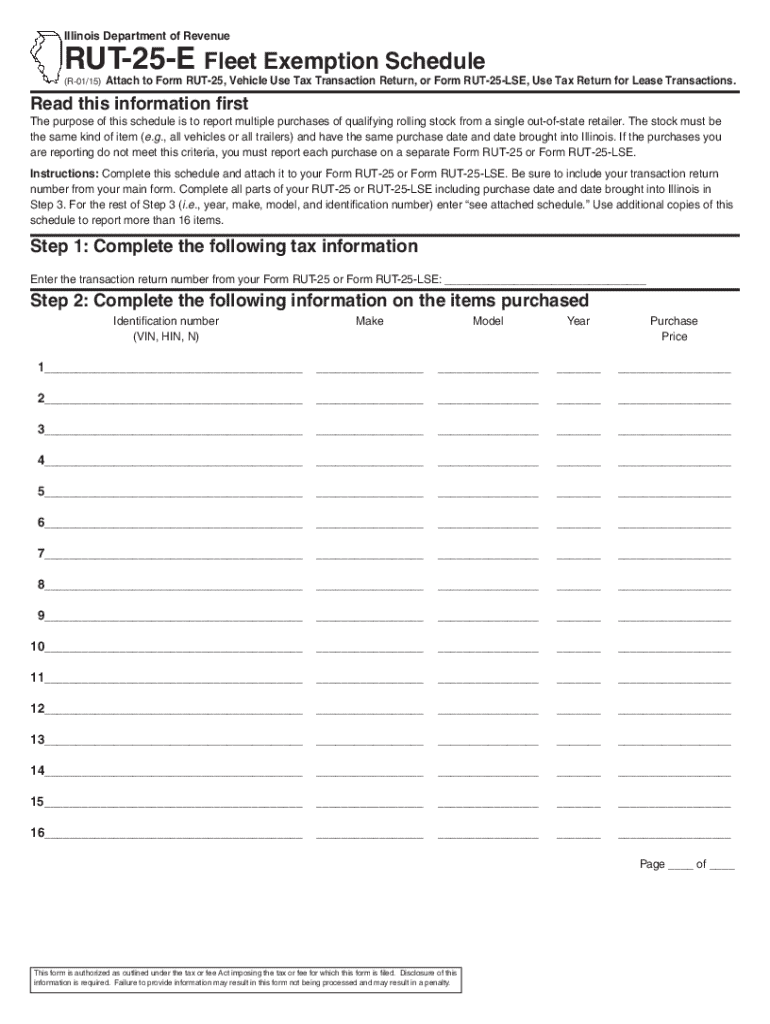

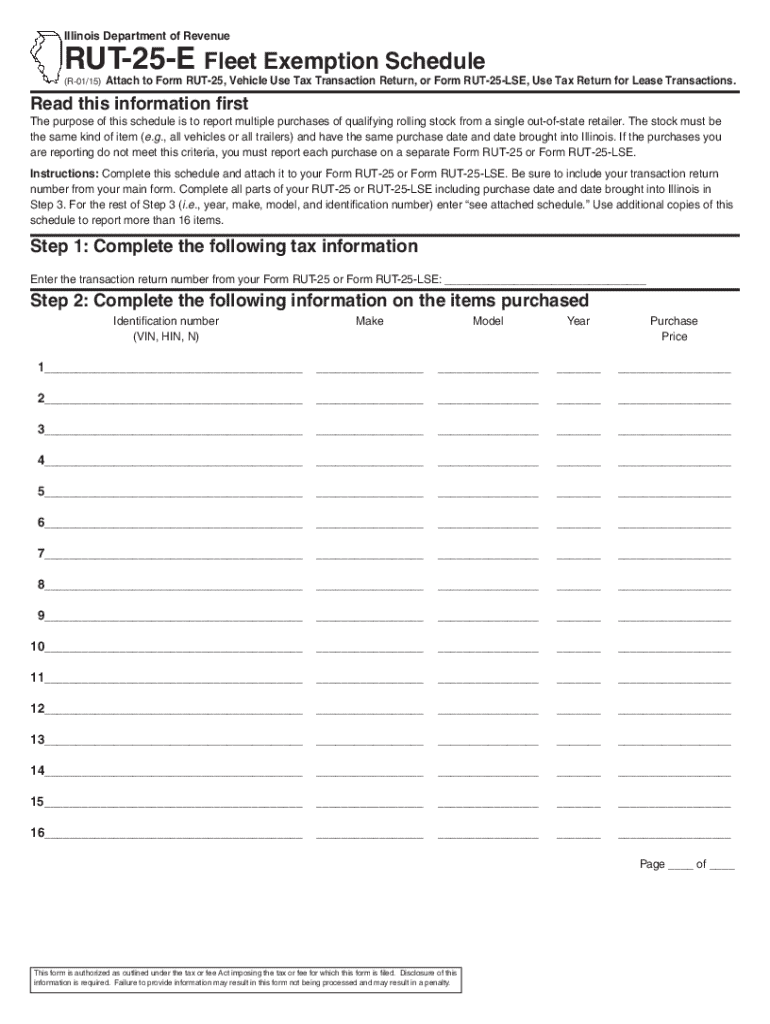

IL RUT-25-E 2015-2026 free printable template

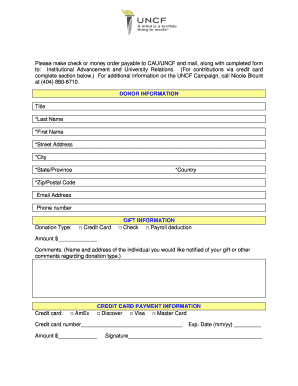

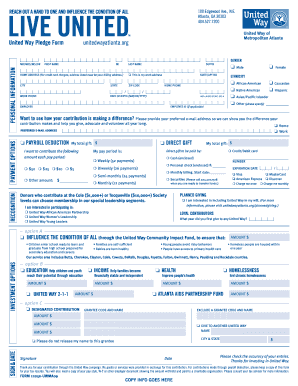

Get, Create, Make and Sign rut 25 e form

Editing IL RUT-25-E online

Uncompromising security for your PDF editing and eSignature needs

IL RUT-25-E Form Versions

How to fill out IL RUT-25-E

How to fill out rut25-e fleet exemption schedule

Who needs rut25-e fleet exemption schedule?

Comprehensive Guide to the RUT-25-E Fleet Exemption Schedule Form

Understanding the RUT-25-E fleet exemption schedule form

The RUT-25-E Fleet Exemption Schedule Form is a crucial document for fleet owners and operators seeking exemption from specific fuel and vehicle use taxes. It plays a vital role in streamlining operations and ensuring compliance with various regulatory requirements.

This form is primarily filed under the guidelines set forth by the state. It is essential for businesses that operate commercial vehicles and are looking to take advantage of available tax exemptions to reduce operational costs.

Key components of the RUT-25-E form

The RUT-25-E form consists of several key components that facilitate efficient filling and processing. Understanding each section is imperative for accurate submissions and to avoid common pitfalls.

The main sections of the form include Vehicle Information, Operator Information, and Exemption Qualifiers, which cover the pertinent details needed to evaluate eligibility for exemptions based on specific criteria.

Common terms and definitions

Familiarity with specific terms can enhance the clarity and efficiency of completing the RUT-25-E form. Understanding relevant terminology reduces confusion during the filing process.

Step-by-step instructions for filling out the form

Filling out the RUT-25-E form can seem daunting, but breaking down the process into manageable steps can greatly simplify it. Ensure you have all necessary information on hand to facilitate a smoother submission.

Editing and managing the RUT-25-E form

Once you've filled out the RUT-25-E form, using tools like pdfFiller provides an easy platform for editing, managing, and sharing your forms. Their interactive features streamline customization and facilitate electronic submission.

pdfFiller enables users to save documents effortlessly and track submission statuses, ensuring that all operators can maintain compliance without hassle.

Common mistakes to avoid when filing the RUT-25-E form

Many filers encounter issues due to common mistakes during the completion of the RUT-25-E form. Understanding these pitfalls can lead to more successful filings and prevent delays.

Typical errors include omitted details, incorrect exemption qualifiers, and submission to the wrong office or department. Adhering to best practices will help mitigate these risks.

Frequently asked questions (FAQ)

Addressing common queries regarding the RUT-25-E form can alleviate concerns for fleet operators. A proactive approach in understanding these frequently asked questions is beneficial.

Linked topics

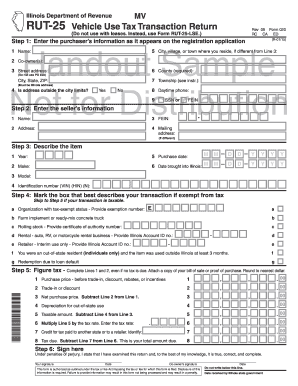

Understanding related forms and additional regulatory requirements is key for comprehensive fleet management. The RUT-25-E form often interacts with other related documentation.

Utilizing pdfFiller for effective document management

Adopting a cloud-based platform like pdfFiller facilitates efficient document management for fleet operators. The advantages encompass not only ease of access but also enhanced collaboration and security.

Case studies demonstrate how businesses have improved their operational efficiency by relying on pdfFiller’s comprehensive tools to manage documents effectively.

Related documents

Fleet operators should familiarize themselves with state agency resources and compliance checklists to ensure a thorough understanding of their duties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IL RUT-25-E to be eSigned by others?

How can I fill out IL RUT-25-E on an iOS device?

Can I edit IL RUT-25-E on an Android device?

What is rut25-e fleet exemption schedule?

Who is required to file rut25-e fleet exemption schedule?

How to fill out rut25-e fleet exemption schedule?

What is the purpose of rut25-e fleet exemption schedule?

What information must be reported on rut25-e fleet exemption schedule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.