Get the free FORM 3800N 2014 Nebraska Incentives Credit Computation

Show details

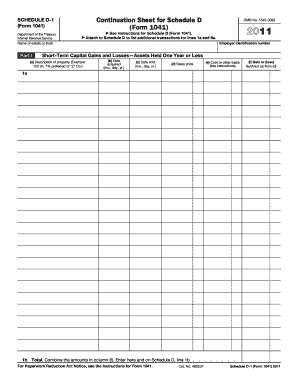

FORM for Tax Years After 2014 For tax year beginning Attach this form to the original or amended return. , and ending, Name PRINT RESET Nebraska Incentives Credit Computation 3800 N Social Security

We are not affiliated with any brand or entity on this form

Instructions and Help about form 3800n 2014 nebraska

How to edit form 3800n 2014 nebraska

How to fill out form 3800n 2014 nebraska

Instructions and Help about form 3800n 2014 nebraska

How to edit form 3800n 2014 nebraska

To edit form 3800n 2014 Nebraska, you can use the pdfFiller platform, which allows users to make changes to the document easily. Begin by uploading the original form to the platform. Next, utilize the editing tools to modify text, add or remove fields, or annotate the form as necessary. Once your edits are complete, save the changes before proceeding to print or submit the form.

How to fill out form 3800n 2014 nebraska

Filling out form 3800n 2014 Nebraska requires gathering some essential information. Follow these steps:

01

Download the form from the Nebraska Department of Revenue website or upload it to pdfFiller.

02

Enter your personal information, including name, address, and Social Security number (or tax identification number).

03

Record any applicable business income and deductions.

04

Calculate the final tax amount based on the form’s instructions.

05

Sign and date the form upon completion.

Latest updates to form 3800n 2014 nebraska

Latest updates to form 3800n 2014 nebraska

As of the latest updates, form 3800n remains consistent in its structure and requirements. However, it is advisable for filers to check the Nebraska Department of Revenue’s website regularly for updates or changes in filing procedures or requirements pertinent to subsequent tax years.

All You Need to Know About form 3800n 2014 nebraska

What is form 3800n 2014 nebraska?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About form 3800n 2014 nebraska

What is form 3800n 2014 nebraska?

Form 3800n 2014 Nebraska is a tax form used by individuals and businesses to report and calculate income tax owed to the state of Nebraska. This form helps the Department of Revenue collect accurate tax information for processing and auditing purposes, ensuring compliance with state tax laws.

What is the purpose of this form?

The purpose of form 3800n 2014 Nebraska is to report various types of income and to facilitate the calculation of state income tax liability. This form allows taxpayers to declare their earnings, claims for exemptions, and any applicable credits, which collectively determine their final tax obligation to the state.

Who needs the form?

Individuals, partnerships, and corporations that earn income within the state of Nebraska must file form 3800n. Taxpayers who meet the income thresholds set by Nebraska tax regulations should utilize this form to ensure accurate reporting and compliance with state tax requirements.

When am I exempt from filling out this form?

Filers may be exempt from filling out form 3800n 2014 Nebraska if their total income falls below the required taxable threshold. Additionally, certain organizations such as nonprofits or tax-exempt entities may not be required to file this form. It is crucial to review specific criteria set by the Nebraska Department of Revenue to determine eligibility for exemptions.

Components of the form

The form consists of several key components, including sections for personal information, income reporting, exemptions, deductions, and tax calculations. Each component must be accurately completed to ensure proper assessment and processing of the tax return by the Nebraska Department of Revenue.

What are the penalties for not issuing the form?

Failure to issue or file form 3800n 2014 Nebraska may result in various penalties, including fines and interest on unpaid taxes. The state may also initiate collection actions against taxpayers who neglect to comply with filing requirements, which can have significant financial implications.

What information do you need when you file the form?

When filing form 3800n, you need specific information, such as your Social Security number or tax identification number, income documentation (W-2s, 1099s, etc.), and details of any deductions or credits you plan to claim. Having all relevant documents organized beforehand simplifies the filing process.

Is the form accompanied by other forms?

Form 3800n 2014 Nebraska may be accompanied by additional forms depending on your individual tax situation. For example, filers claiming specific deductions or credits may need to submit supplementary forms to provide the necessary information for state tax processing.

Where do I send the form?

After completing form 3800n, you should send it to the Nebraska Department of Revenue at the address specified in the form's instructions. Ensure that you send the form by the due date to avoid any penalties or interest on unpaid taxes.

See what our users say