Get the free Tax Deferral Program

Show details

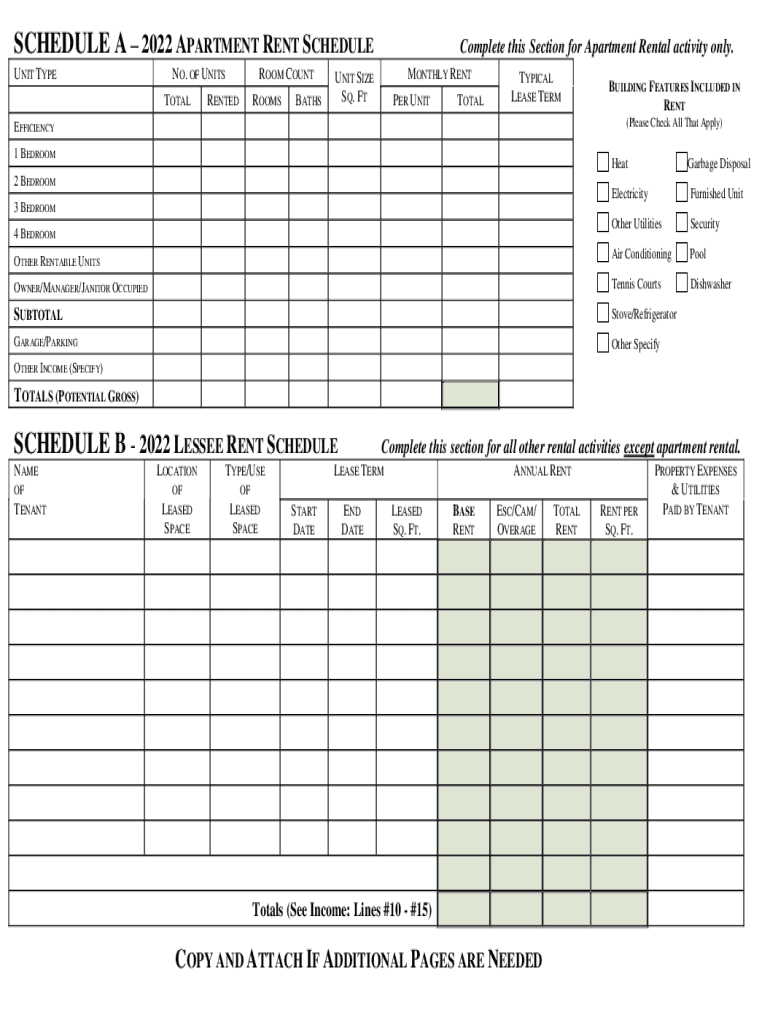

SCHEDULE A 2022 APARTMENT RENT SCHEDULE UNIT TYPE NO. OF UNITS TOOLROOM COUNTRENTEDROOMSBATHSComplete this Section for Apartment Rental activity only. MONTHLY RENT UNIT SIZE SQ. FTPERS UNITTOTALTYPICAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax deferral program

Edit your tax deferral program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax deferral program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax deferral program online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax deferral program. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax deferral program

How to fill out tax deferral program

01

Determine if you are eligible for the tax deferral program based on your income and financial situation.

02

Review the application form provided by the tax department and gather all necessary documents including income statements, tax returns, and any other relevant financial information.

03

Fill out the application form carefully, making sure to provide accurate information and double-checking all calculations.

04

Submit the completed application form along with supporting documents to the tax department by the specified deadline.

05

Wait for a response from the tax department regarding your eligibility for the tax deferral program and any further instructions or requirements.

Who needs tax deferral program?

01

Individuals or businesses who are having difficulty paying their taxes on time due to financial hardship.

02

Those who may benefit from spreading out their tax payments over a longer period of time to better manage their cash flow.

03

Taxpayers who have experienced a sudden change in their financial situation, such as job loss or medical expenses, and need temporary relief from their tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax deferral program directly from Gmail?

tax deferral program and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I sign the tax deferral program electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your tax deferral program in minutes.

How do I fill out tax deferral program using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign tax deferral program. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is tax deferral program?

A tax deferral program allows individuals or entities to postpone paying taxes on certain income or assets until a later date.

Who is required to file tax deferral program?

Individuals or entities that participate in a tax deferral program, such as retirement accounts or other specific investment vehicles, are required to file.

How to fill out tax deferral program?

To fill out a tax deferral program, you typically need to complete the relevant forms provided by the tax authority and report your income, deductions, and details about the deferral plan.

What is the purpose of tax deferral program?

The purpose of a tax deferral program is to encourage saving for future use, such as retirement, by allowing individuals to defer taxes on their income until they withdraw the funds.

What information must be reported on tax deferral program?

You must report income earned, contributions made, withdrawals taken, and any applicable deductions related to the tax deferral program.

Fill out your tax deferral program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Deferral Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.