LA LDR CIFT-620EXT-V 2013 free printable template

Show details

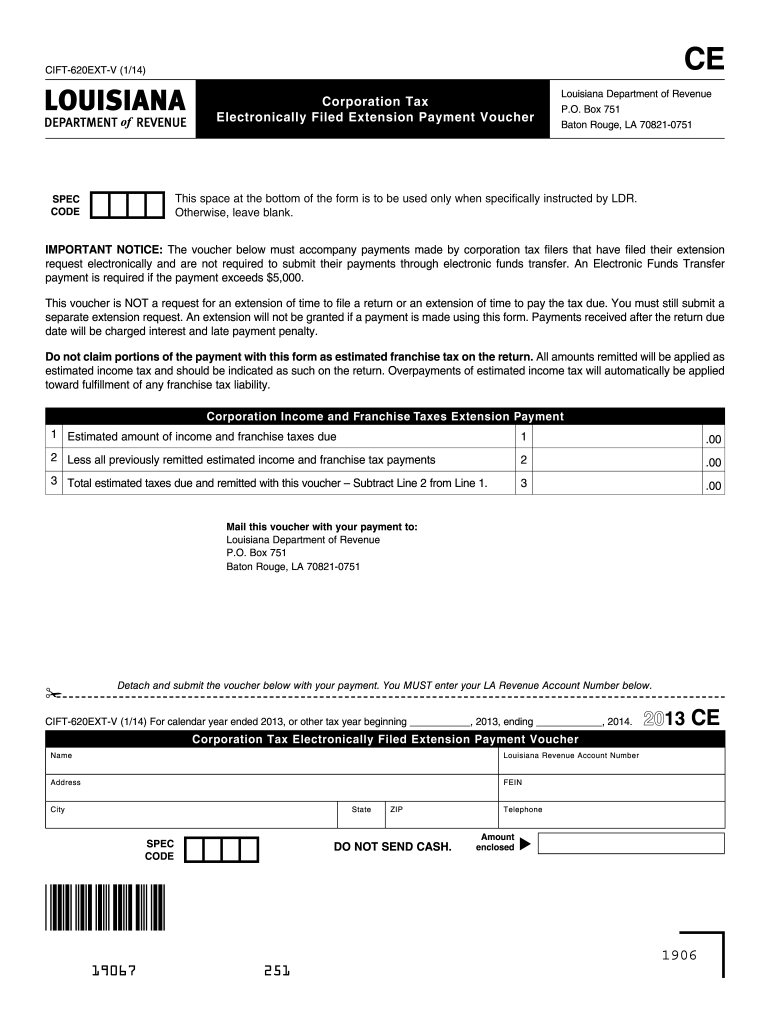

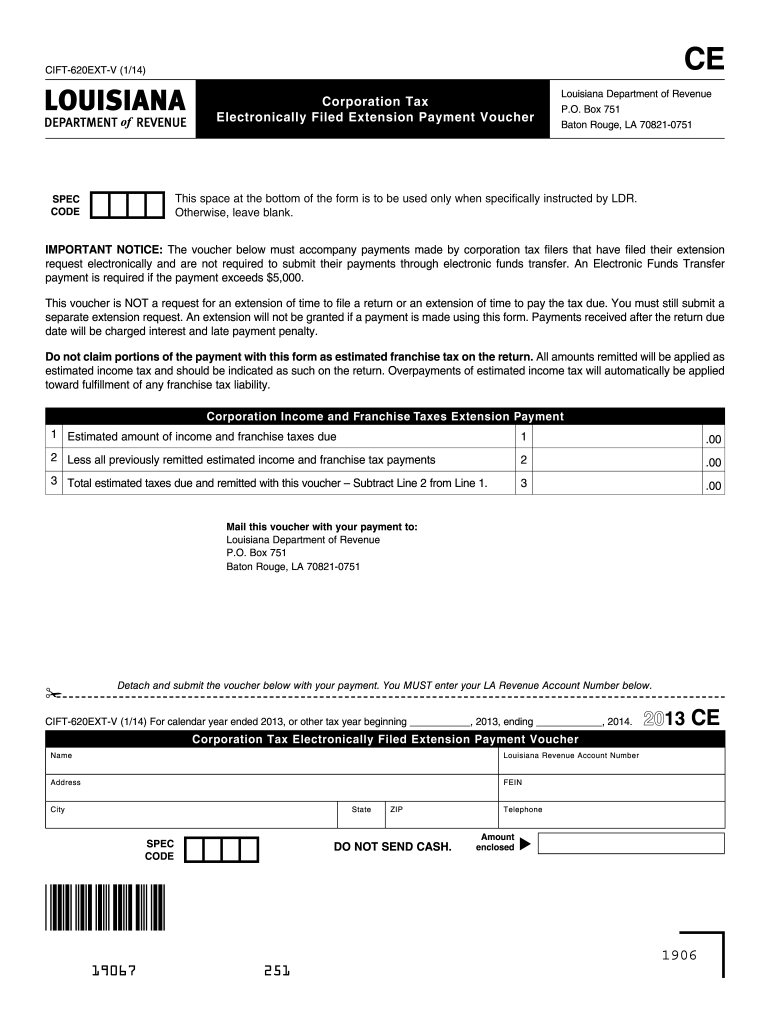

CE CIFT-620EXT-V (1/14) Corporation Tax Electronically Filed Extension Payment Voucher Louisiana Department of Revenue P.O. Box 751 Baton Rouge, LA 70821-0751 This space at the bottom of the form

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 620ext for la

Edit your form 620ext for la form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 620ext for la form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 620ext for la online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 620ext for la. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA LDR CIFT-620EXT-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 620ext for la

How to fill out LA LDR CIFT-620EXT-V

01

Obtain the LA LDR CIFT-620EXT-V form from the Louisiana Department of Revenue website or your local tax office.

02

Read the instructions provided with the form carefully to understand the requirements.

03

Fill in your personal information, including your name, address, and Social Security number.

04

Provide details regarding your business or employment, including type and location.

05

Enter the relevant financial information for the period specified on the form.

06

Include any necessary documentation to support the information provided in the form.

07

Review the completed form for accuracy before signing it.

08

Submit the form to the Louisiana Department of Revenue by the deadline specified.

Who needs LA LDR CIFT-620EXT-V?

01

Individuals and businesses in Louisiana who need to report specific income and deductions for tax purposes.

02

Tax professionals assisting clients with state income tax filing requirements.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from sales tax in Louisiana?

In Louisiana, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Examples of an exception to the Louisiana sales tax are certain types of prescription medication, farm and agricultural equipment, and some types of grocery items.

How do I apply for exemption from collection of Louisiana state sales tax?

You can apply to obtain Louisiana sales tax exemption by filing form R-1048, the Application for Exemption from Collection of Louisiana State Sales Tax with the Louisiana Department of Revenue.

How do I get my Louisiana state tax forms?

Most Requested Louisiana Tax Forms Please contact the Dept. of Revenue at 1-888-829-3071 to receive a form by mail or click here to request a form. Please note that if you choose to download and print a form at the State Library or at your library, you may be charged for the cost of printing.

Who must file Louisiana franchise tax return?

All corporations and entities taxed as corporations for federal income tax purposes deriving income from Louisiana sources, whether or not they have any net income, must file an income tax return.

Who has to collect sales tax in Louisiana?

In Louisiana, sales tax is levied on the sale of tangible goods and some services. The tax is collected by the seller and remitted to state tax authorities.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 620ext for la directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your form 620ext for la and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send form 620ext for la to be eSigned by others?

form 620ext for la is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in form 620ext for la?

The editing procedure is simple with pdfFiller. Open your form 620ext for la in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

What is LA LDR CIFT-620EXT-V?

LA LDR CIFT-620EXT-V is an extension request form used in Louisiana for certain taxpayers who need additional time to file their state income tax returns.

Who is required to file LA LDR CIFT-620EXT-V?

Taxpayers who are unable to file their Louisiana state income tax returns by the original due date and wish to request an extension are required to file LA LDR CIFT-620EXT-V.

How to fill out LA LDR CIFT-620EXT-V?

To fill out LA LDR CIFT-620EXT-V, taxpayers must provide their identifying information, the type of tax for which the extension is being requested, and the estimated amount of tax due, if any.

What is the purpose of LA LDR CIFT-620EXT-V?

The purpose of LA LDR CIFT-620EXT-V is to formally request an extension of time to file a Louisiana state income tax return without incurring penalties for late filing.

What information must be reported on LA LDR CIFT-620EXT-V?

Information that must be reported includes the taxpayer's name, address, Social Security number or Federal Employer Identification Number, the type of return for which the extension is being requested, and any estimated tax liability.

Fill out your form 620ext for la online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 620ext For La is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.