Get the free Real Estate Tax Relief for Qualifying Veterans - York County

Show details

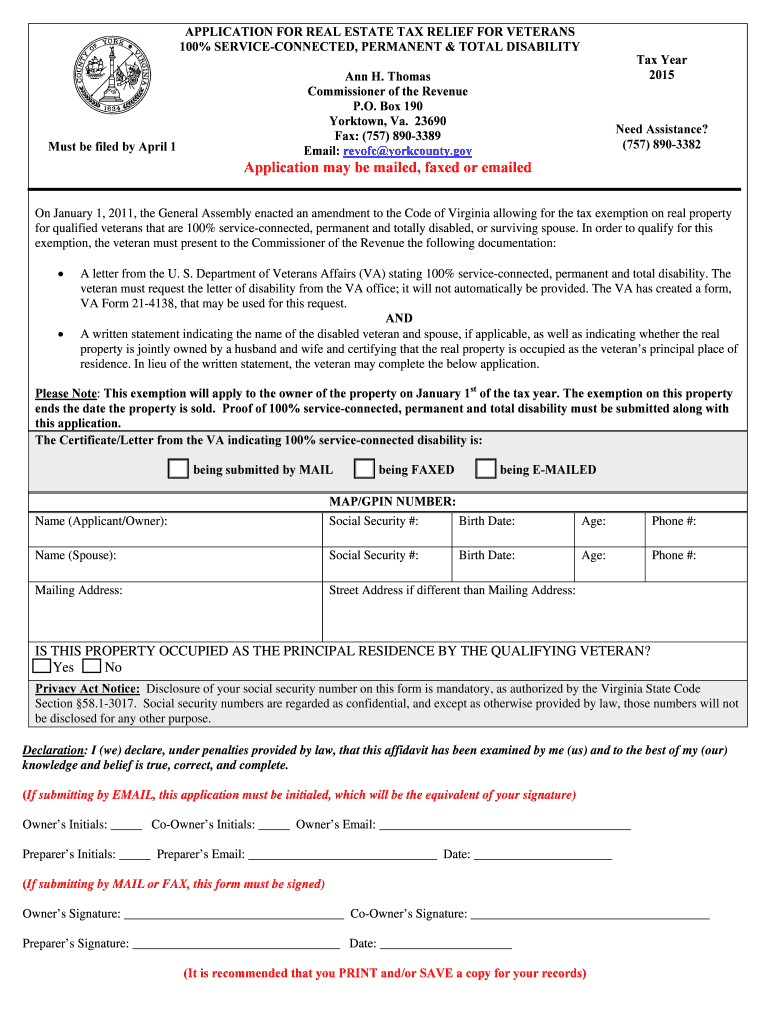

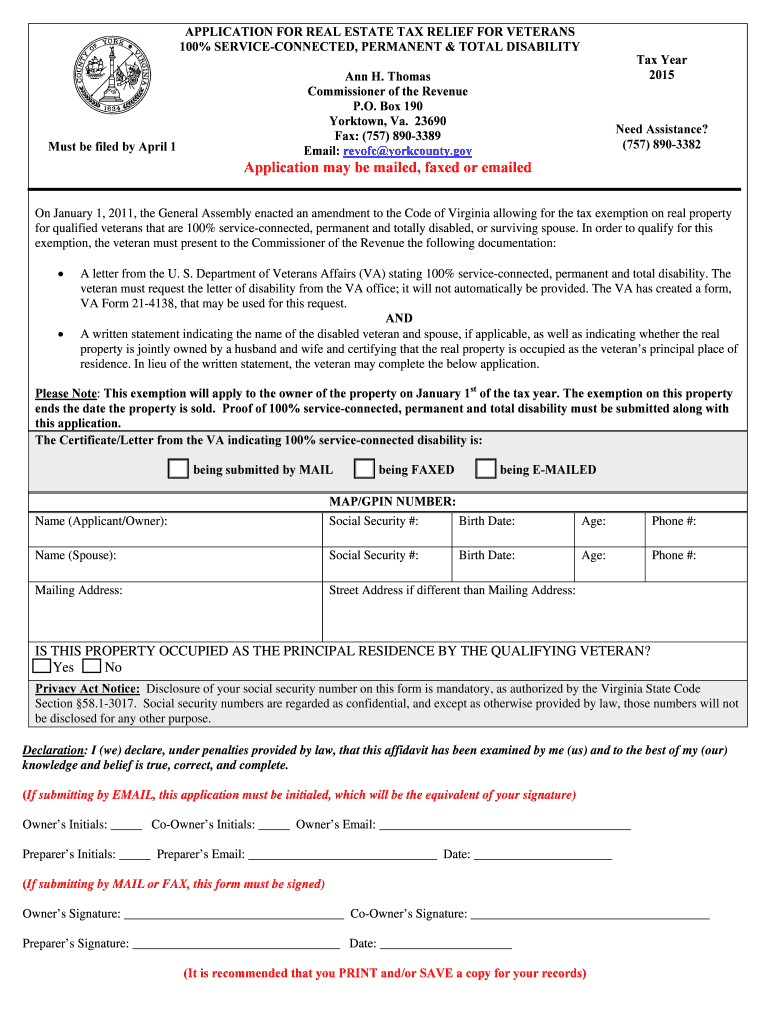

APPLICATION FOR REAL ESTATE TAX RELIEF FOR VETERANS 100% SERVICE-CONNECTED, PERMANENT & TOTAL DISABILITY Must be filed by April 1 Tax Year 2015 Ann H. Thomas Commissioner of the Revenue P.O. Box 190

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign real estate tax relief

Edit your real estate tax relief form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your real estate tax relief form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit real estate tax relief online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit real estate tax relief. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out real estate tax relief

To fill out real estate tax relief, follow these points:

01

Gather necessary documents: Collect all relevant documents such as property tax bills, income statements, and any other required financial information.

02

Determine eligibility: Check the eligibility criteria for real estate tax relief programs. These programs typically target individuals with low income, seniors, or people with disabilities. Ensure you meet the specified requirements.

03

Research available programs: Determine what real estate tax relief programs are available in your area. Local government websites or tax offices can provide information on the specific programs and their application processes.

04

Complete application forms: Obtain the application forms for the chosen program. Read the instructions carefully and provide accurate and complete information. Attach any required documents to support your application.

05

Seek assistance if needed: If you face difficulties in understanding or completing the application, reach out to local tax offices, community organizations, or legal aid clinics. They can provide guidance and support throughout the process.

06

Submit the application: After completing the application, submit it as per the instructions provided. Ensure all necessary documents are included and keep a copy of the application for your records.

07

Follow up on the application: Check the timelines mentioned for processing the applications. If you don't receive any communication within the specified time frame, contact the relevant tax office to inquire about the status of your application.

Who needs real estate tax relief?

Real estate tax relief is typically targeted towards individuals or groups facing financial challenges or who meet specific criteria set by local governments. This may include low-income individuals, senior citizens, people with disabilities, or those who have experienced a significant change in their financial circumstances. Eligibility requirements can vary depending on the location and the specific program. It is essential to research and understand the eligibility criteria of the real estate tax relief program in your area to determine if you qualify.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send real estate tax relief for eSignature?

Once your real estate tax relief is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get real estate tax relief?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the real estate tax relief in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out real estate tax relief on an Android device?

Complete your real estate tax relief and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is real estate tax relief?

Real estate tax relief is a program designed to provide financial assistance to property owners by reducing their property tax liabilities.

Who is required to file real estate tax relief?

Property owners who meet certain eligibility criteria, such as income limits or property value thresholds, are required to file for real estate tax relief.

How to fill out real estate tax relief?

To fill out real estate tax relief, property owners need to complete a specific application form provided by the tax authority and submit any required documentation.

What is the purpose of real estate tax relief?

The purpose of real estate tax relief is to help property owners who may be struggling to pay their property taxes due to financial constraints.

What information must be reported on real estate tax relief?

Property owners must report information such as their income, property value, and any other relevant financial details to qualify for real estate tax relief.

Fill out your real estate tax relief online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Real Estate Tax Relief is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.