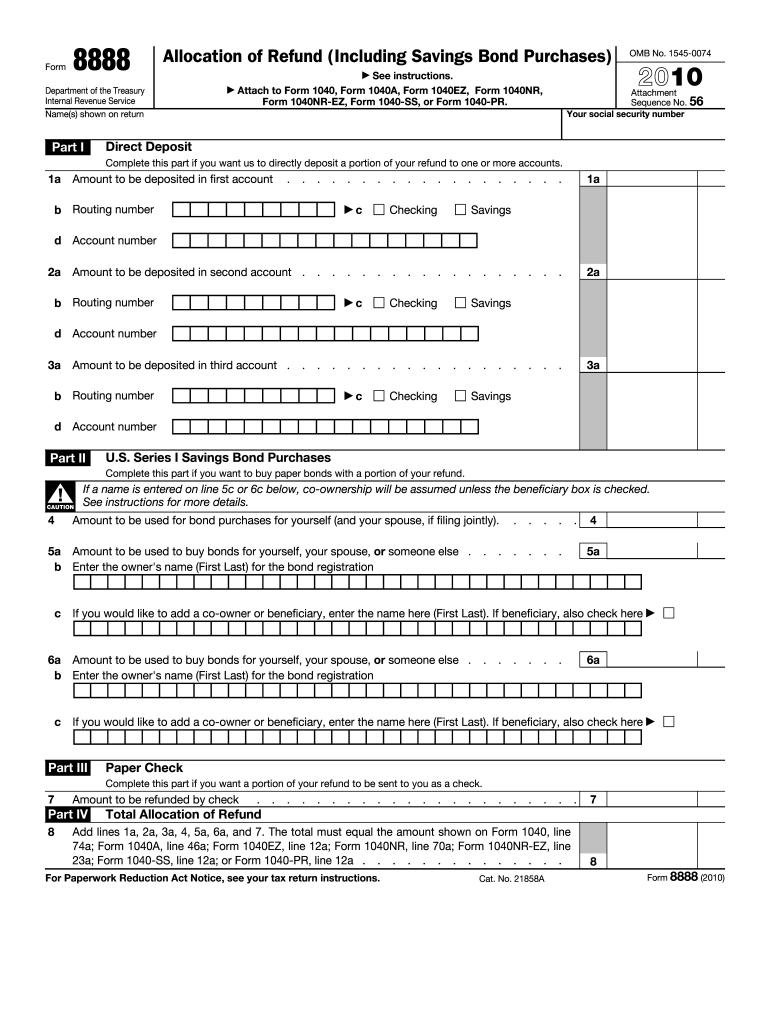

IRS 8888 2010 free printable template

Instructions and Help about IRS 8888

How to edit IRS 8888

How to fill out IRS 8888

About IRS 8 previous version

What is IRS 8888?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8888

What should I do if I need to correct a mistake on my 2010 8888 form?

If you need to correct a mistake on your 2010 8888 form, you should submit an amended version of the form as soon as you realize the error. Clearly indicate that it is an amended form to avoid confusion. It's important to retain a copy of both the original and amended forms for your records.

How can I verify if my 2010 8888 form has been received and processed?

To verify the receipt and processing status of your 2010 8888 form, you can check the online tracking system provided by the relevant tax authority. Keep track of the confirmation email or code you received upon submission, as it will facilitate the tracking process.

What should I do if my e-file submission of the 2010 8888 form gets rejected?

If your e-file submission of the 2010 8888 form gets rejected, review the rejection codes provided to identify the issue. Correct any errors and resubmit the form promptly. If necessary, contact the technical support of your e-filing service for assistance.

Are e-signatures accepted on the 2010 8888 form?

Yes, e-signatures are accepted for the 2010 8888 form when filed electronically. However, ensure that you are using a compliant e-signature solution that meets the required legal standards and security measures.

What are common errors to watch out for when submitting a 2010 8888 form?

Common errors when submitting a 2010 8888 form include incorrect taxpayer identification numbers, mismatched names, and overlooking required fields. To avoid these errors, double-check all entries for accuracy before submission and ensure compliance with the latest filing guidelines.

See what our users say