Keating & Associates Distribution Request Form 2022-2026 free printable template

Show details

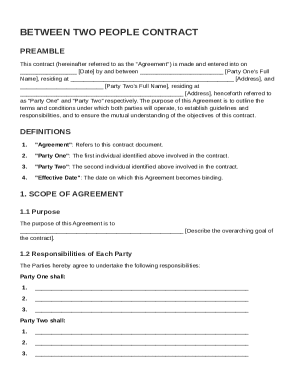

DISTRIBUTION REQUEST FORM A 1099R WILL BE ISSUED BY JANUARY 31ST FOLLOWING THE CALENDAR YEAR OF DISTRIBUTIONSECTION 1 PARTICIPANT INFORMATION Participant Name___ SSN___ DOB___ Beneficiary Name___

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Keating Associates Distribution Request Form

Edit your Keating Associates Distribution Request Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Keating Associates Distribution Request Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Keating Associates Distribution Request Form online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Keating Associates Distribution Request Form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Keating & Associates Distribution Request Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Keating Associates Distribution Request Form

How to fill out Keating & Associates Distribution Request Form

01

Begin by downloading the Keating & Associates Distribution Request Form from the official website or request a physical copy.

02

Fill out the top section with your personal information, including your name, address, and contact details.

03

Specify the distribution amount you are requesting and the reason for the distribution in the designated fields.

04

Provide any necessary financial account information related to the distribution.

05

Review the form for accuracy to ensure all required fields are completed.

06

Sign and date the form at the bottom to validate your request.

07

Submit the completed form via email or mail to the designated department at Keating & Associates.

Who needs Keating & Associates Distribution Request Form?

01

Clients or beneficiaries of Keating & Associates who wish to request a distribution from their accounts.

02

Individuals managing inheritance or trust accounts that require distributions.

03

Financial planners or advisors assisting their clients with the distribution process from Keating & Associates.

Fill

form

: Try Risk Free

People Also Ask about

Is Raymond James a good investment bank?

Raymond James is a full-service investment bank with national as well as international capabilities. Comprised of more than 500 capital markets professionals, Raymond James is one of the most highly regarded middle-market equity offering and advisory practices in investment banking today.

Are Charles Schwab fees high?

Fund fees. Charles Schwab fund fees are high except for around 4,000 mutual funds that are free to trade. This represents almost half of the more than 10,000 fund offering. The standard charge is $49.95 per purchase while redemption is free of charge.

Are Merrill Lynch fees high?

Like its account minimum, Merrill's account management fee is higher than most: 0.45% compared to the more typical robo-advisor fee of around 0.25% or less.

Where does Raymond James rank?

Raymond James Financial's brand is ranked #936 in the list of Global Top 1000 Brands, as rated by customers of Raymond James Financial. Their current market cap is $17.42B.Merrill Lynch vs Raymond James Financial. 29%Promoters8%Passive63%Detractors

Which is better Edward Jones or Raymond James?

Raymond James Financial scored higher in 8 areas: Overall Rating, Culture & Values, Senior Management, Compensation & Benefits, Career Opportunities, CEO Approval, Recommend to a friend and Positive Business Outlook. Edward Jones scored higher in 1 area: Work-life balance. Both tied in 1 area: Diversity & Inclusion.

Which is better Charles Schwab or Raymond James?

Overall, Charles Schwab Corp stock has a Momentum Score of 23, Estimate Revisions Score of 46 and Quality Score of 72. Raymond James Financial Inc stock has a Momentum Score of 44, Estimate Revisions Score of 39 and Quality Score of 32.

Does Raymond James charge high fees?

Raymond James Commissions Stocks, ETFs, REIT's, and UIT's are $9.95 on both the buy and sell sides. This charge is also applied to OTC and preferred stocks. Bonds, certificates of deposit, option contracts, and mutual funds cost $30 per transaction.

What percentage does Raymond James charge?

Fees Under Raymond James Account valueAccount types$1MM up to $2MMEquity, Balanced & ETF: 2.50% Fixed Income: 2.30% Laddered Bonds & Short-Term Conservative: 2.20%2.00%$2MM up to $5MMEquity, Balanced & ETF: 2.25% Fixed Income: 2.05% Laddered Bonds & Short-Term Conservative: 1.95%1.75%4 more rows • Aug 5, 2022

Which is better Merrill Lynch or Raymond James?

Merrill Lynch scored higher in 1 area: Compensation & Benefits. Raymond James Financial scored higher in 8 areas: Overall Rating, Culture & Values, Work-life balance, Senior Management, Career Opportunities, CEO Approval, Recommend to a friend and Positive Business Outlook.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Keating Associates Distribution Request Form directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your Keating Associates Distribution Request Form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit Keating Associates Distribution Request Form online?

With pdfFiller, the editing process is straightforward. Open your Keating Associates Distribution Request Form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I complete Keating Associates Distribution Request Form on an Android device?

Use the pdfFiller mobile app and complete your Keating Associates Distribution Request Form and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is Keating & Associates Distribution Request Form?

The Keating & Associates Distribution Request Form is a document used to formally request the distribution of funds or assets managed by Keating & Associates.

Who is required to file Keating & Associates Distribution Request Form?

Individuals or entities who wish to request a distribution from their account or fund managed by Keating & Associates are required to file the form.

How to fill out Keating & Associates Distribution Request Form?

To fill out the form, provide the required personal and account information, specify the distribution amount, and sign where indicated to authorize the request.

What is the purpose of Keating & Associates Distribution Request Form?

The purpose of the form is to facilitate the process of requesting distributions while ensuring proper documentation and authorization for the transactions.

What information must be reported on Keating & Associates Distribution Request Form?

The form must report personal identification information, account details, the requested distribution amount, and the signature of the account holder.

Fill out your Keating Associates Distribution Request Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Keating Associates Distribution Request Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.