Get the free EXCESS FLOOD INSURANCE APPLICATION

Show details

Este documento es una solicitud para obtener un seguro de inundación excesivo, cubriendo propiedades residenciales y comerciales en los Estados Unidos y Canadá. Incluye condiciones del programa,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign excess flood insurance application

Edit your excess flood insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your excess flood insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit excess flood insurance application online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit excess flood insurance application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

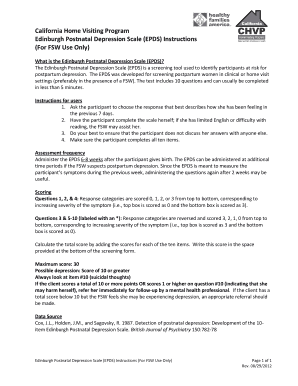

How to fill out excess flood insurance application

How to fill out EXCESS FLOOD INSURANCE APPLICATION

01

Obtain the EXCESS FLOOD INSURANCE APPLICATION form from your insurance provider or relevant website.

02

Fill in your personal information, including name, address, and contact details.

03

Provide details about the property you wish to insure, including its address and specifications.

04

Indicate the type of coverage you are seeking and any additional options you may need.

05

Include any previous flood insurance information, if applicable.

06

Review the application to ensure all information is accurate and complete.

07

Sign and date the application before submitting it to the insurance provider.

Who needs EXCESS FLOOD INSURANCE APPLICATION?

01

Homeowners in flood-prone areas who want additional coverage beyond standard flood insurance.

02

Property owners looking for extra financial protection against flood damages.

03

Businesses located in flood risk zones that require coverage for potential flood loss.

04

Individuals or entities involved in real estate investment in areas susceptible to flooding.

Fill

form

: Try Risk Free

People Also Ask about

How much extra does flood insurance cost?

Average flood insurance cost by state StateAnnual rate Arizona $775 Arkansas $946 California $903 Colorado $8586 more rows

Can you self-insure flood insurance?

Theoretically, one can self-insure against any type of damage (like from flood or fire) In practice, however, most people choose to purchase insurance against potentially significant, infrequent losses.

What happens if I let my flood insurance lapse?

What happens if I let my flood insurance policy lapse? You can get a new flood insurance policy, but it will take 30 days to go into effect. You won't be covered if a flood event happens during that time.

What is the difference between primary and excess flood insurance?

While primary coverage provides essential protection, excess flood insurance plays a crucial role in mitigating financial risks for properties with higher values. Understanding these distinctions helps property owners and businesses make informed decisions about their flood coverage needs.

Can you buy excess flood insurance?

In addition to standard flood insurance policies, it is also important to consider excess flood coverage. Excess flood coverage provides additional protection beyond the limits of your standard flood insurance policy.

Is it a good idea to self-insure?

You'll pay less in premiums every year. If you're self-insured, you're not paying an insurance company every year to carry the risk of replacing your income if something happens to you. That's a huge benefit to you because you're saving money!

How do I get the most out of my flood insurance claim?

Here are essential tips to follow: Take Pictures of Damage: Document everything before making repairs. Make Temporary Repairs: You could be liable for any additional damage after the disaster. “Do not make permanent repairs until you have authorization from your insurance,” Hayley reminds homeowners.

Can you self-insure for flood insurance?

The association can self insure but when someone buys into the association and has a mortgage the mortgagee will request to see proof of flood coverage. You can leave it to the responsibility of the unit owner to get their own or just get an association flood policy.

Can you get flood insurance separate from homeowners insurance?

Flood insurance is available for renters and homeowners, but, like earthquake insurance, it is not part of standard homeowners coverage. Flood policies are provided separately by the federal government and dozens of private insurers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is EXCESS FLOOD INSURANCE APPLICATION?

EXCESS FLOOD INSURANCE APPLICATION is a form used to apply for additional flood insurance coverage beyond the limits provided by standard flood insurance policies. It helps to protect property owners from potential losses that exceed the regular coverage.

Who is required to file EXCESS FLOOD INSURANCE APPLICATION?

Property owners who need additional flood coverage beyond the maximum limits offered by standard flood insurance policies are required to file the EXCESS FLOOD INSURANCE APPLICATION.

How to fill out EXCESS FLOOD INSURANCE APPLICATION?

To fill out the EXCESS FLOOD INSURANCE APPLICATION, applicants should provide their personal information, details about the property, existing flood insurance coverage, and the amount of additional coverage they desire. It's important to ensure all information is accurate and complete.

What is the purpose of EXCESS FLOOD INSURANCE APPLICATION?

The purpose of the EXCESS FLOOD INSURANCE APPLICATION is to allow property owners to secure additional flood insurance coverage that goes beyond what is offered by standard policies, thereby providing better financial protection against flood-related losses.

What information must be reported on EXCESS FLOOD INSURANCE APPLICATION?

The EXCESS FLOOD INSURANCE APPLICATION must include information such as the applicant's name and contact details, property address and details, existing insurance policy information, desired coverage amount, and any relevant financial information needed for underwriting.

Fill out your excess flood insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Excess Flood Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.