WI DoR BTR-101 2014 free printable template

Show details

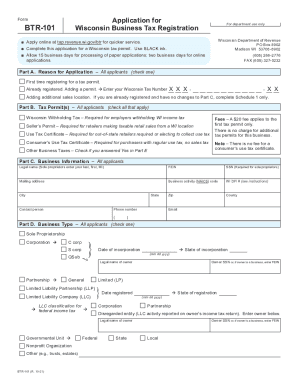

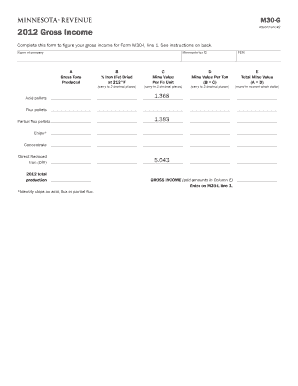

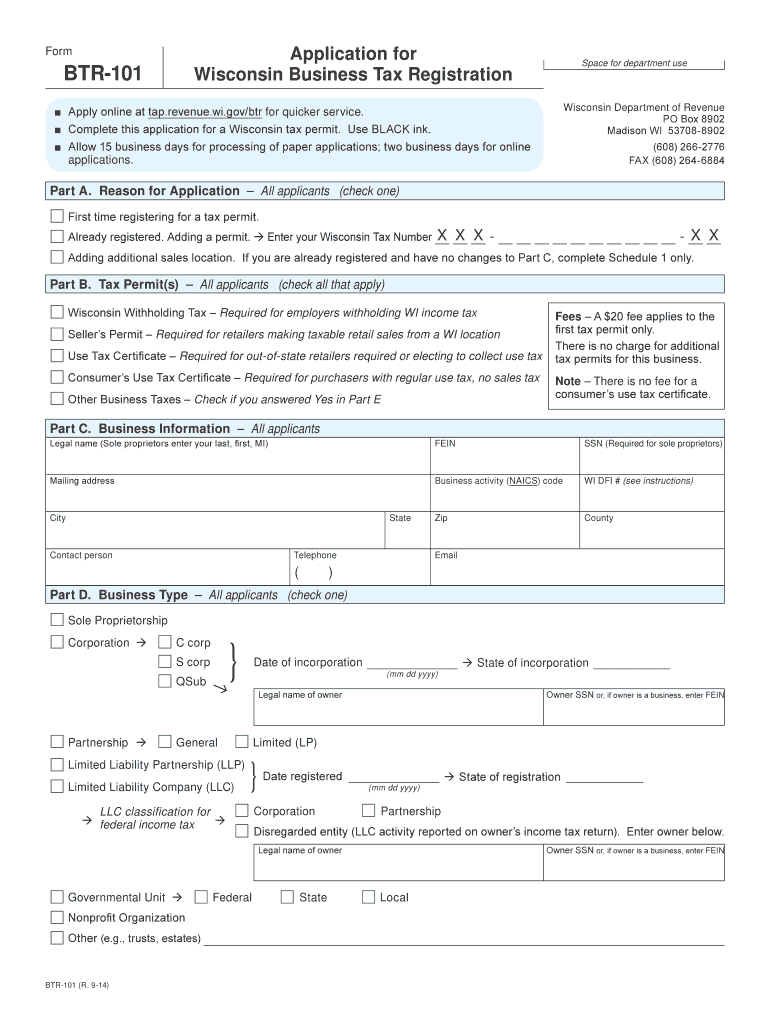

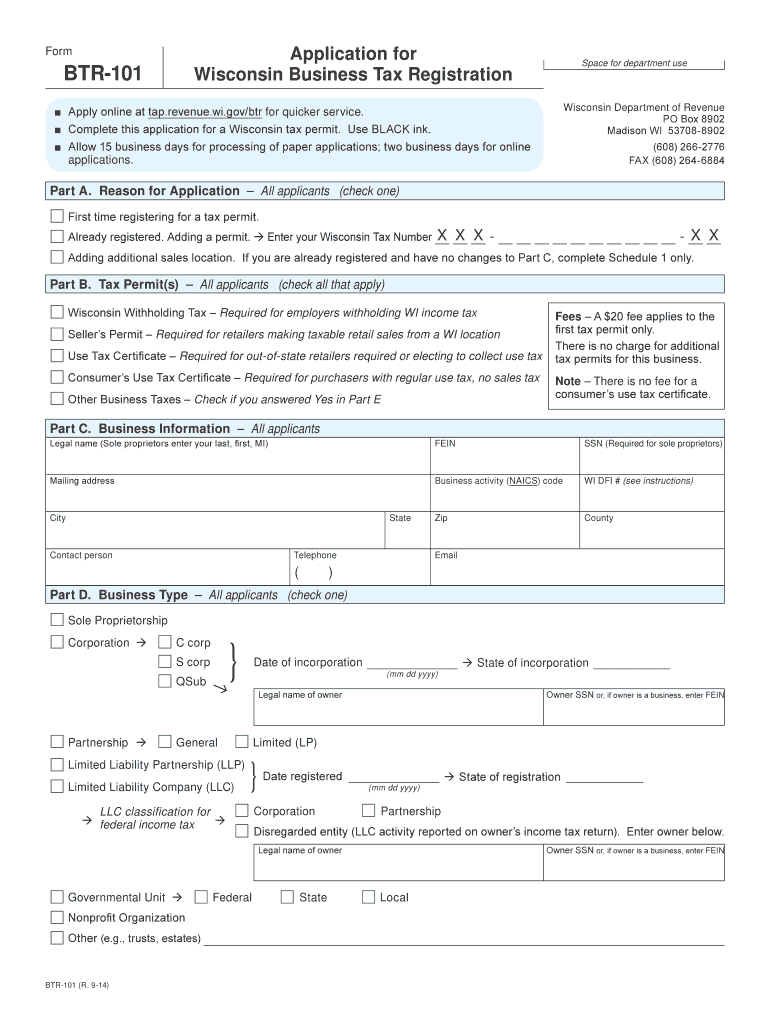

Form Application for Wisconsin Business Tax Registration BTR-101 Space for department use Wisconsin Department of Revenue PO Box 8902 Madison WI 53708-8902 Apply online at tap.revenue. wi. gov/btr for quicker service. Complete this application for a Wisconsin tax permit. Use BLACK ink. Allow 15 business days for processing of paper applications two business days for online applications. 608 266 2776 FAX 608 264 6884 Part A. Reason for Application All applicants check one First time...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI DoR BTR-101

Edit your WI DoR BTR-101 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI DoR BTR-101 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI DoR BTR-101 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit WI DoR BTR-101. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI DoR BTR-101 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI DoR BTR-101

How to fill out WI DoR BTR-101

01

Start by downloading the WI DoR BTR-101 form from the official website.

02

Provide your full name and contact information in the designated fields.

03

Enter your business entity details, including the legal name and address.

04

Fill in the tax identification number (TIN) or employer identification number (EIN) if applicable.

05

Indicate the type of business you are operating (e.g., sole proprietorship, partnership, corporation).

06

List any applicable deductions or exemptions you are claiming.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form before submitting it.

Who needs WI DoR BTR-101?

01

Any business operating in Wisconsin that needs to report or pay a business tax.

02

Individuals who have a registered business entity in Wisconsin.

03

Tax professionals assisting clients with state business tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is St 12 form Wisconsin?

Wisconsin businesses must file a sales and use tax return with the state Department of Revenue after every reporting period even if they have not made sales or do not owe any use tax. The form is found on the website of the state's Department of Revenue.

How much does it cost to get a tax ID number in Wisconsin?

Applying for an EIN for your Wisconsin LLC is completely free. The IRS doesn't charge any service fees for the EIN online application.

Do I need a Wisconsin tax ID number?

You'll need one if you're hiring employees in Wisconsin, or if you need to account for excise taxes and sales taxes in the state. To get a Wisconsin state tax ID number, you'll need to provide a federal tax ID number, which means you need to get one if you haven't already.

Do I need a business tax registration in Wisconsin?

The majority of businesses operating in Wisconsin must complete the Business Tax Registration, which allows businesses to register for a number of different tax permits—especially the main state-level tax permit in Wisconsin, often called the seller's permit.

How do I get a Wisconsin tax account number?

Register online with the Department of Revenue by selecting Register Qualified WI Business. It generally will take a few business days for you to receive your tax number. For more information, visit the Department of Revenue website.

How much is the business tax registration fee in Wisconsin?

The initial Business Tax Registration (BTR) fee of $20 covers a period of two years. At the end of the two-year period, a $10 BTR renewal fee applies for the next two-year period. The renewal fee applies to all persons holding permits or certificates subject to the BTR provisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my WI DoR BTR-101 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your WI DoR BTR-101 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I modify WI DoR BTR-101 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including WI DoR BTR-101. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an electronic signature for signing my WI DoR BTR-101 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your WI DoR BTR-101 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is WI DoR BTR-101?

WI DoR BTR-101 is a form utilized in Wisconsin for reporting business tax information, specifically in relation to Wisconsin's Department of Revenue.

Who is required to file WI DoR BTR-101?

Any business operating in Wisconsin that meets specific criteria for tax reporting is required to file WI DoR BTR-101.

How to fill out WI DoR BTR-101?

To fill out WI DoR BTR-101, businesses must complete the form with accurate financial information, including revenue and deduction details, and submit it to the Wisconsin Department of Revenue.

What is the purpose of WI DoR BTR-101?

The purpose of WI DoR BTR-101 is to collect essential tax information from businesses for proper assessment and compliance with Wisconsin tax regulations.

What information must be reported on WI DoR BTR-101?

The WI DoR BTR-101 requires reporting of details such as gross receipts, deductions, and other financial data pertinent to a business's tax obligations.

Fill out your WI DoR BTR-101 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI DoR BTR-101 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.