NY NYC-210 2012 free printable template

Show details

See updated information for this form on our website

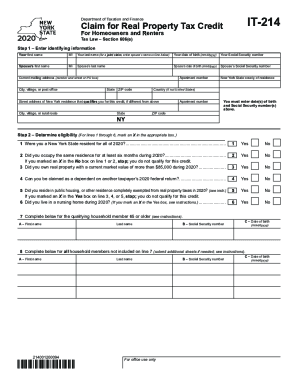

Department of Taxation and FinanceClaim for New York City School Tax Credit

Your first nameMISpouses last numerous last name (for a combined claim,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign it214 form - tax

Edit your it214 form - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it214 form - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing it214 form - tax online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit it214 form - tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY NYC-210 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out it214 form - tax

How to fill out NY NYC-210

01

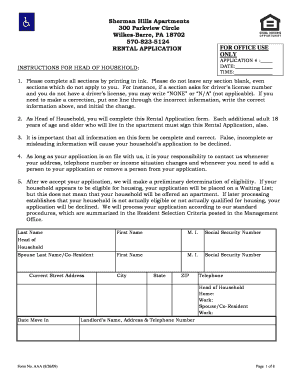

Begin by downloading the NY NYC-210 form from the official New York City Department of Finance website.

02

Fill out your personal information at the top of the form, including your name, address, and contact details.

03

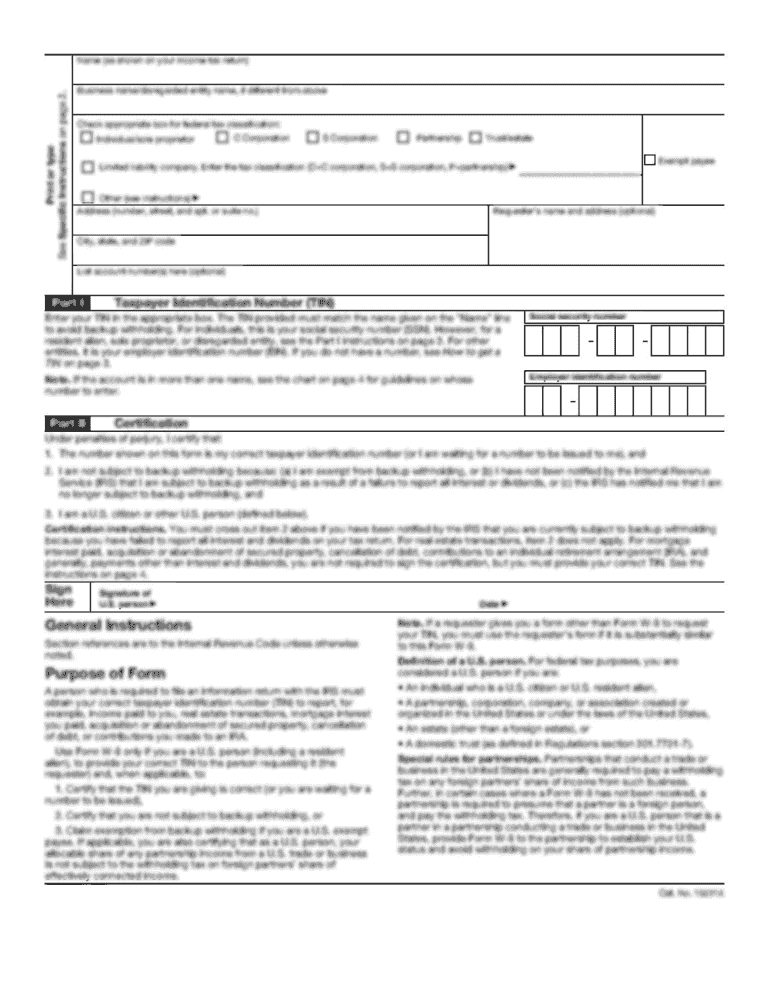

Provide your Social Security Number or Employer Identification Number (EIN) in the designated field.

04

Specify the tax year for which you are filing this form.

05

Complete the sections related to your income, deductions, and credits as applicable.

06

Review the instructions provided on the form to ensure all fields are filled out correctly.

07

Attach any necessary documentation or proof as required by the form.

08

Sign and date the form at the bottom before submission.

09

Submit the completed form through the appropriate method as indicated in the instructions.

Who needs NY NYC-210?

01

Individuals and businesses in New York City who are required to report tax information.

02

Those who have an obligation to file for specific tax credits or deductions offered by the NYC Department of Finance.

03

Residents and non-residents earning income in NYC who need to report their earnings.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for NYS household credit?

New York State household credit full- or part-year resident. married or head of household with a federal adjusted gross income (FAGI) of $32,000 or less (allowed for married filing separate) single with an FAGI of $28,000 or less.

How do I calculate my education tax credit?

You calculate the lifetime learning credit by taking 20% of the first $10,000 of the qualified educational expenses you paid during the taxable year for all individuals. For a taxpayer with high modified adjusted gross income, a phaseout may apply.

Why am I getting NYC school tax credits?

New York City school tax credit (fixed amount) You are entitled to this refundable credit if you: were a full-year or part-year New York City resident, cannot be claimed as a dependent on another taxpayer's federal income tax return, and. had income of $250,000 or less.

Who qualifies for the education tax credit?

Be you, your spouse or your dependent that you listed on your tax return. Be pursuing a degree or other recognized education credential. Have qualified education expenses at an eligible educational institution. Be enrolled at least half time for at least one academic period* beginning in the tax year.

Why am I getting tax credits?

Tax credits reduce the amount of income tax you owe to the federal and state governments. Credits are generally designed to encourage or reward certain types of behavior that are considered beneficial to the economy, the environment or to further any other purpose the government deems important.

How much is nyc school tax credit?

The NYC School Tax Credit You can take a refundable credit of $125 if you're married, file a joint return, and have an income of $250,000 or less. All other taxpayers with incomes of $250,000 or less can receive a refundable credit of up to $63.

Who can claim NYC 208?

– You or a member of your household paid rent for your residence. How do I claim the credit? Complete Form NYC-208, Claim for New York City Enhanced Real Property Tax Credit for Homeowners and Renters, and submit it with your New York State personal income tax return, Form IT-201.

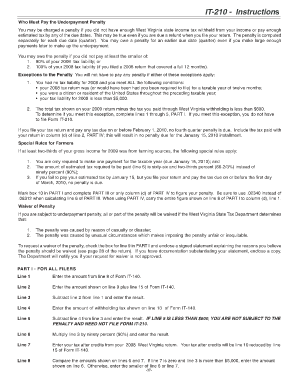

How is the NYS Star credit calculated?

Determine the total amount of school taxes owed before adjusting the bill for the STAR exemption. Multiply the Enhanced STAR exemption amount by the school tax rate (excluding any library levy portion) divided by 1000. The lesser of Steps 1, 2, or 3 is the Enhanced STAR savings amount.

What is a New York City school tax credit?

New York City school tax credit (fixed amount) You are entitled to this refundable credit if you: were a full-year or part-year New York City resident, cannot be claimed as a dependent on another taxpayer's federal income tax return, and. had income of $250,000 or less.

What is tax form NYC-210?

Electronic filing for income tax is closed; you cannot submit e-filed income tax returns until the new filing season opens in 2023.

How much is the NYC school tax credit?

The NYC School Tax Credit You can take a refundable credit of $125 if you're married, file a joint return, and have an income of $250,000 or less. All other taxpayers with incomes of $250,000 or less can receive a refundable credit of up to $63.

Who is eligible for the NYC School tax credit?

New York City school tax credit (fixed amount) You are entitled to this refundable credit if you: were a full-year or part-year New York City resident, cannot be claimed as a dependent on another taxpayer's federal income tax return, and. had income of $250,000 or less.

How much will my NYS STAR rebate check be?

The homeowner tax rebate credit is a one-year program providing direct property tax relief to about 2.5 million eligible homeowners in 2022. If your 2020 income wasyour homeowner tax rebate credit will be this percentage of the 2021 STAR exemption savings for your community$75,000.01 to $150,000115%3 more rows • Dec 9, 2022

Who qualifies for NY tuition credit?

Who is eligible? You are entitled to this credit or deduction if: you were a full-year New York State resident, you, your spouse, or dependent (for whom you have taken an exemption) were an undergraduate student who was enrolled at or attended an institution of higher education and paid qualified tuition expenses, and.

What is 201 NYS tax form?

Form IT-201, Resident Income Tax Return.

How do I get the 2500 education tax credit?

To be eligible for AOTC, the student must: Be pursuing a degree or other recognized education credential. Be enrolled at least half time for at least one academic period* beginning in the tax year. Not have finished the first four years of higher education at the beginning of the tax year.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

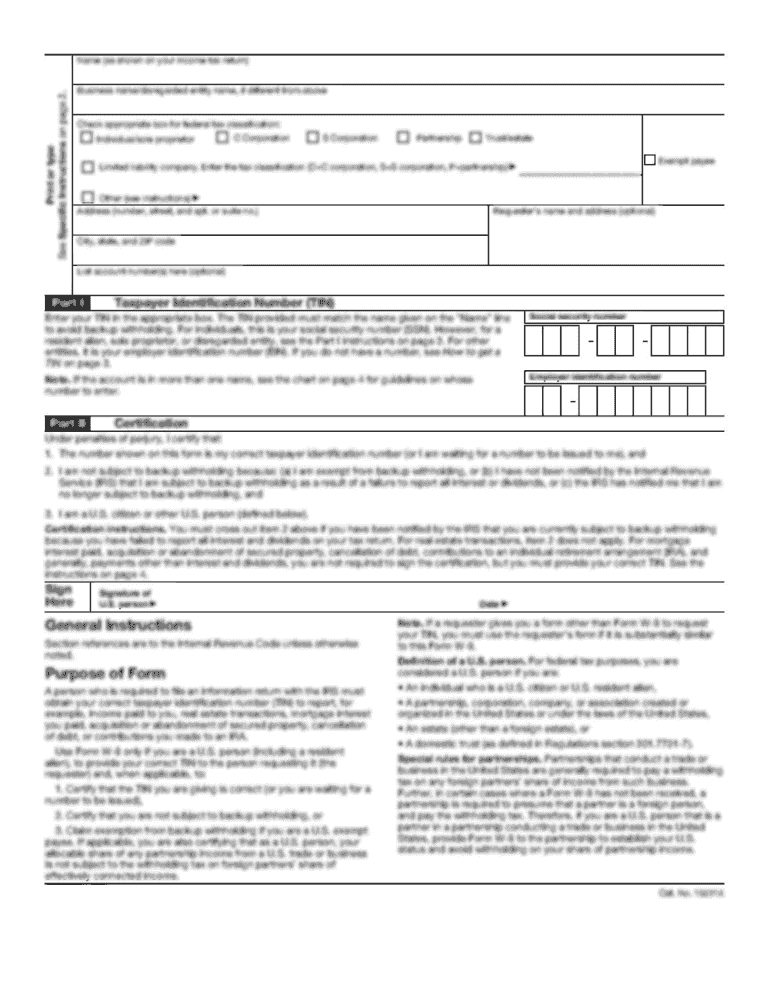

How can I manage my it214 form - tax directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign it214 form - tax and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make edits in it214 form - tax without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing it214 form - tax and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my it214 form - tax in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your it214 form - tax right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is NY NYC-210?

NY NYC-210 is a form used for the New York City Unincorporated Business Tax (UBT) to report and pay taxes for unincorporated businesses operating in New York City.

Who is required to file NY NYC-210?

Unincorporated businesses, including sole proprietorships and partnerships that operate in New York City and meet certain income thresholds, are required to file NY NYC-210.

How to fill out NY NYC-210?

To fill out NY NYC-210, businesses must provide their identifying information, report their gross income and allowable deductions, calculate the taxable income, and determine the UBT owed.

What is the purpose of NY NYC-210?

The purpose of NY NYC-210 is to assess and collect the Unincorporated Business Tax from eligible businesses operating in New York City, ensuring compliance with local tax laws.

What information must be reported on NY NYC-210?

Information reported on NY NYC-210 includes business identification details, gross receipts, business expenses, net income, and the calculated amount of Unincorporated Business Tax due.

Fill out your it214 form - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

it214 Form - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.