NY NYC-210 2012 free printable template

Show details

See updated information for this form on our website

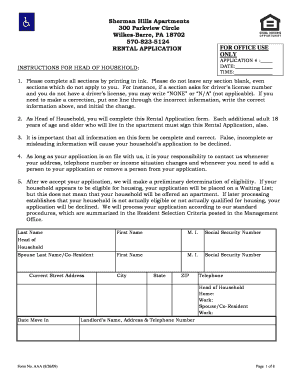

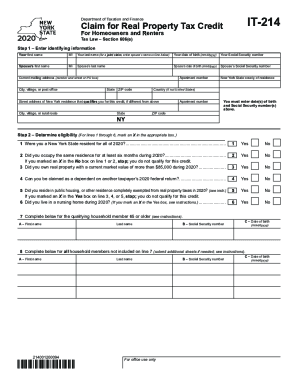

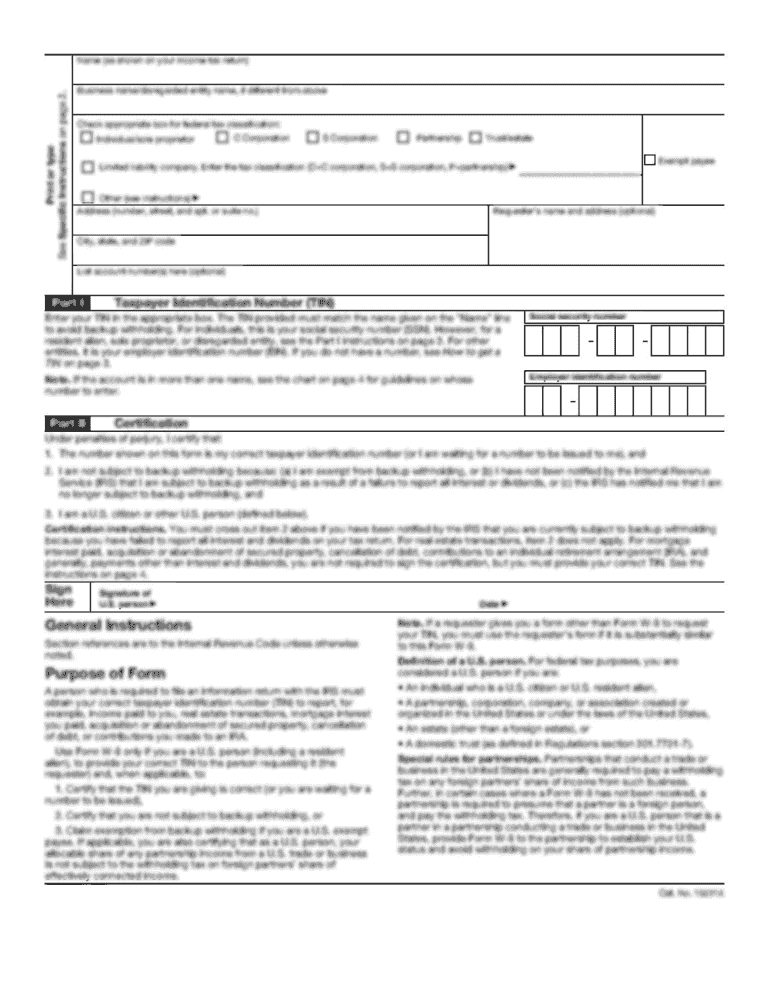

Department of Taxation and FinanceClaim for New York City School Tax Credit

Your first nameMISpouses last numerous last name (for a combined claim,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign it214 form - tax

Edit your it214 form - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it214 form - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing it214 form - tax online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit it214 form - tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY NYC-210 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out it214 form - tax

How to fill out NY NYC-210

01

Begin by downloading the NY NYC-210 form from the official New York City Department of Finance website.

02

Fill out your personal information at the top of the form, including your name, address, and contact details.

03

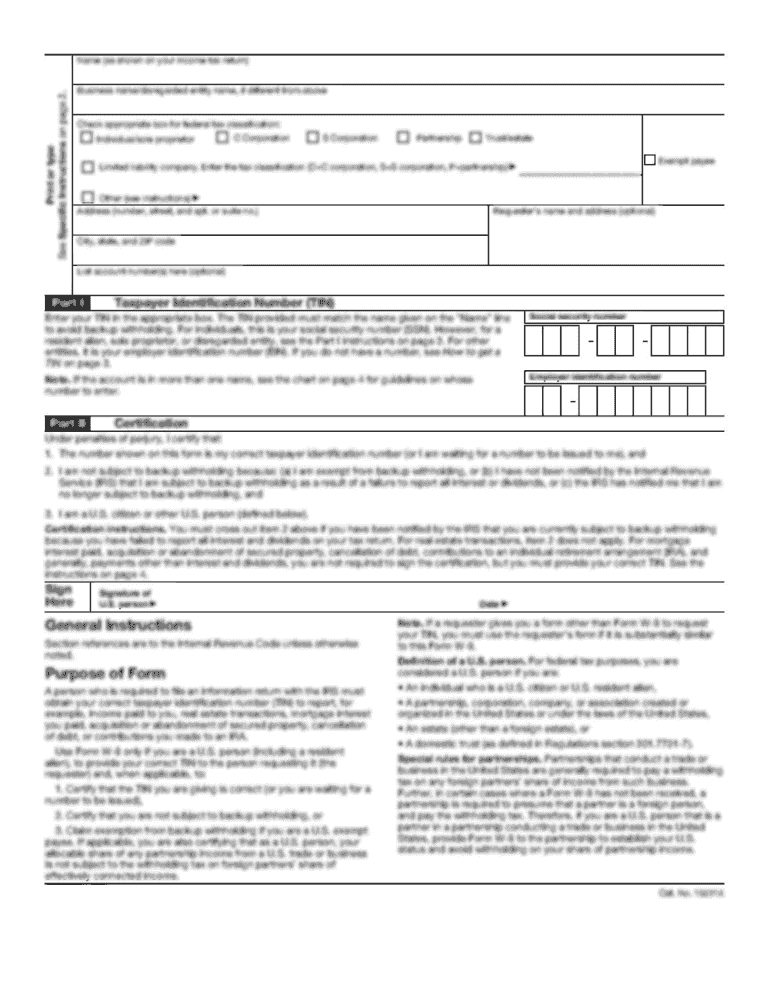

Provide your Social Security Number or Employer Identification Number (EIN) in the designated field.

04

Specify the tax year for which you are filing this form.

05

Complete the sections related to your income, deductions, and credits as applicable.

06

Review the instructions provided on the form to ensure all fields are filled out correctly.

07

Attach any necessary documentation or proof as required by the form.

08

Sign and date the form at the bottom before submission.

09

Submit the completed form through the appropriate method as indicated in the instructions.

Who needs NY NYC-210?

01

Individuals and businesses in New York City who are required to report tax information.

02

Those who have an obligation to file for specific tax credits or deductions offered by the NYC Department of Finance.

03

Residents and non-residents earning income in NYC who need to report their earnings.

Fill

form

: Try Risk Free

People Also Ask about

How to download Spanish tax form 210 in English?

A Form 210 can be accessed on the Spanish tax authority's' website at .aeat.es. To access the English version of the website click on “English” at the top right hand side. Then click on "Forms" and then "Non- resident Income Tax," then scroll down to “Form 210.

Can I file NYC-210 online?

Can I file NYC-210 online? If your 2021 income is $73,000 or less-yes! You can prepare and e-file both your federal and state returns using Free File.

What form is needed for college tax credit?

In general, a student must receive a Form 1098-T to claim an education credit.

How to get a $10,000 tax refund?

Individuals who are eligible for the Earned Income Tax Credit (EITC) and the California Earned Income Tax Credit (CalEITC) may be able to receive a refund of more than $10,000. “If you are low-to-moderate income and worked, you may be eligible for the Federal and State of California Earned Income Tax Credits (EITC).

Can I file New York State tax return by mail?

You have the following options: Pay all of your NY income taxes online at New York Tax Online Service. Complete Form IT-370 with your Check or Money Order and mail both to the address on Form IT-370. Even if you filed an extension, you will still need to file your NY tax return either via eFile or by paper by Oct.

How to claim New York City School tax credit NYC 210?

To claim the New York City (NYC) school tax credit, you must have lived in NYC for all or part of 2021. However, you cannot claim this credit if you can be claimed as a dependent on another taxpayers federal return.

Should I claim New York City School tax credit?

New York City school tax credit (rate reduction amount) You are entitled to this refundable credit if you: were a full-year or part-year New York City resident, cannot be claimed as a dependent on another taxpayer's federal income tax return, and. had New York City taxable income of $500,000 or less.

What is a Form 210?

Form NYC-210 :Claim for New York City School Tax Credit Tax Year 2021.

How do I claim NYC school tax credits?

How to claim this credit. Full-year New York City residents claim this credit directly on Form IT-201, Resident Income Tax Return. Part-year New York City residents must complete Form IT-360.1, Change of City Resident Status, and attach it to their return.

What is the NYC-210 form?

If you qualify for the NYC school tax credit and are not filing a tax return on Form IT-201 or IT-203 for 2022, use Form NYC-210 to claim your NYC school tax credit. File your Form NYC-210 as soon as you can after January 1, 2023. You must file your 2022 claim no later than April 15, 2026.

Can I file my New York tax return online?

Most New York State taxpayers can e-file their returns. If you earned $73,000 or less last year, you can Free File using brand name software accessed through our website. If you earned more, you can purchase approved commercial software or use a paid tax preparer to e-file your return.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my it214 form - tax directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign it214 form - tax and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make edits in it214 form - tax without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing it214 form - tax and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my it214 form - tax in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your it214 form - tax right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is NY NYC-210?

NY NYC-210 is a form used for the New York City Unincorporated Business Tax (UBT) to report and pay taxes for unincorporated businesses operating in New York City.

Who is required to file NY NYC-210?

Unincorporated businesses, including sole proprietorships and partnerships that operate in New York City and meet certain income thresholds, are required to file NY NYC-210.

How to fill out NY NYC-210?

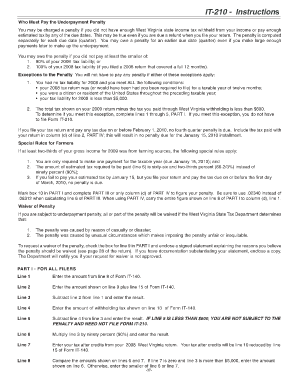

To fill out NY NYC-210, businesses must provide their identifying information, report their gross income and allowable deductions, calculate the taxable income, and determine the UBT owed.

What is the purpose of NY NYC-210?

The purpose of NY NYC-210 is to assess and collect the Unincorporated Business Tax from eligible businesses operating in New York City, ensuring compliance with local tax laws.

What information must be reported on NY NYC-210?

Information reported on NY NYC-210 includes business identification details, gross receipts, business expenses, net income, and the calculated amount of Unincorporated Business Tax due.

Fill out your it214 form - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

it214 Form - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.