NY NYC-210 2020 free printable template

Show details

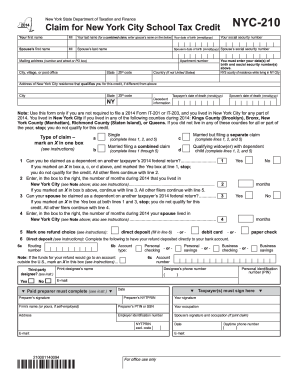

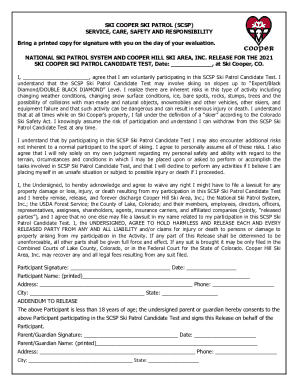

Department of Taxation and FinanceClaim for New York City School Tax Credit Tax Law Article 22, Section 606(GGG) Your first nameMISpouses last numerous last name (for a combined claim, enter spouses

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nyc 210 tax form

Edit your nyc 210 tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nyc 210 tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nyc 210 tax form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nyc 210 tax form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY NYC-210 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nyc 210 tax form

How to fill out NY NYC-210

01

Obtain the NY NYC-210 form from the New York City Department of Finance website or your local tax office.

02

Fill in your personal information including your name, address, and Social Security number.

03

Provide details about your business, including its name and address.

04

Indicate the type of business activities you are engaged in.

05

Enter the income earned and the expenses incurred for the tax year.

06

Calculate your total tax liability based on the rates provided in the form instructions.

07

Review the completed form for accuracy and completeness.

08

Submit the form by the deadline either electronically or by mail.

Who needs NY NYC-210?

01

Individuals and businesses operating in New York City who are required to report income and expenses.

02

Self-employed individuals looking to report their business income.

03

Partnerships and corporations based in NYC that need to file an annual tax return.

Fill

form

: Try Risk Free

People Also Ask about

How much is the NYC school tax credit Rate Reduction amount?

NYC school tax credit - rate reduction amount Calculation of NYC school tax credit (rate reduction amount) for single and married filing separatelyIf city taxable income is: over but not overThe credit is:$ 0 $ 12,000 12,000 500,000.171% of taxable income $ 21 plus .228% of the excess over $12,000 Mar 3, 2021

Who qualifies for NYS household credit?

New York State household credit full- or part-year resident. married or head of household with a federal adjusted gross income (FAGI) of $32,000 or less (allowed for married filing separate) single with an FAGI of $28,000 or less.

Do I qualify for NYC school tax credit?

To be eligible, you must have: qualified for a 2022 STAR credit or exemption, had income that was less than or equal to $250,000 for the 2020 income tax year, and. a school tax liability for the 2022-2023 school year that is more than your 2022 STAR benefit.

Who gets the NYC school tax credit?

You can use the check to pay your school taxes. You can receive the STAR credit if you own your home and it's your primary residence and the combined income of the owners and the owners' spouses is $500,000 or less. STAR exemption: a reduction on your school tax bill.

What is NY it 201 form?

Form IT-201, Resident Income Tax Return.

What is form IT-203 New York?

New York Resident, Nonresident, and Part-Year Resident Itemized Deductions. Used by nonresident and part-year resident (Form IT-203) filers who need to report other New York State or New York City taxes, and tax credits other than those reported directly on Form IT-203.

What is the IT-201 form for?

Form IT-201 is the standard New York income tax return for state residents. Nonresidents and part-time residents must use must use Form IT-203 instead. Form IT-201 requires you to list multiple forms of income, such as wages, interest, or alimony .

Who is eligible for the NYC School tax credit?

New York City school tax credit (fixed amount) You are entitled to this refundable credit if you: were a full-year or part-year New York City resident, cannot be claimed as a dependent on another taxpayer's federal income tax return, and. had income of $250,000 or less.

On what line of the IT-201 is the taxable income?

Net taxable income is the income reported on line 37 of your 2015 IT-201 Tax Form.

Who is eligible for the NYS Property Tax Relief credit?

You may be eligible for STAR if your home is your primary residence, you own it, and your income is less than $500,000. To confirm your eligibility, you must register for the STAR credit.

What is NY it-201 form?

Form IT-201, Resident Income Tax Return.

How do I claim my NYC school tax credit?

How to claim the credit. If you file a New York State personal income tax return, claim this credit on your return by filing Form NYC-208 with your return. If you are not required to file a New York State income tax return, you may still claim this credit.

What is tax form NYC-210?

Form NYC-210, Claim for New York City School Tax Credit.

Who is eligible for NYC enhanced real property tax credit?

New York City residents who have gross household income less than $200,000 and own or rent their residence may qualify for a refundable tax credit on their New York State income tax.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my nyc 210 tax form directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your nyc 210 tax form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I fill out nyc 210 tax form on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your nyc 210 tax form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete nyc 210 tax form on an Android device?

Use the pdfFiller Android app to finish your nyc 210 tax form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is NY NYC-210?

NY NYC-210 is a tax form used by residents of New York City to report their city income tax obligations.

Who is required to file NY NYC-210?

Residents of New York City who earn income and meet specific income thresholds are required to file NY NYC-210.

How to fill out NY NYC-210?

To fill out NY NYC-210, individuals need to provide personal information, report income earned, calculate deductions, and determine the tax owed or refund due.

What is the purpose of NY NYC-210?

The purpose of NY NYC-210 is to ensure that residents pay their fair share of New York City income taxes and to assess compliance with local tax laws.

What information must be reported on NY NYC-210?

The information that must be reported on NY NYC-210 includes personal identifying information, total income, exemptions, deductions, and the calculated tax liability or refund.

Fill out your nyc 210 tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nyc 210 Tax Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.