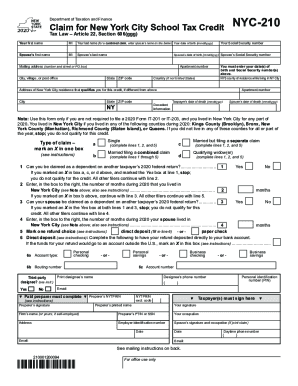

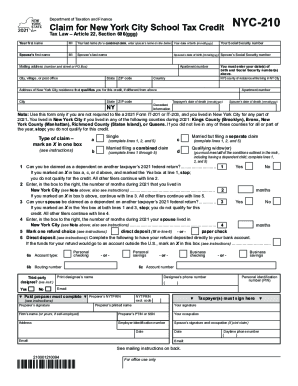

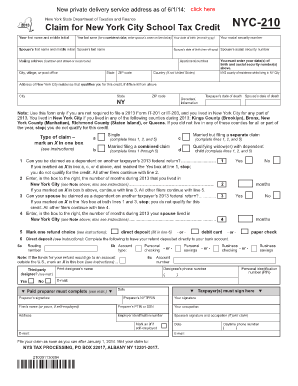

Get the free nyc 210 form 2021 pdf

Get, Create, Make and Sign nyc 210 form 2020 pdf

Editing nyc 210 form 2021 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nyc 210 form 2021

How to fill out NYC 210 form 2020:

Who needs NYC 210 form 2020:

Video instructions and help with filling out and completing nyc 210 form 2021 pdf

Instructions and Help about nyc 210 form 2021

Day two and NYC starting the day at Starbucks across the street because I need caffeine, and then I'm going to meet mark our museum who was the founder of a boy serial entrepreneur angel investor perfect dude very excited to catch up with him then a couple meetings later on this afternoon in the city with startups and then tonight I'm meeting Clark valuer for dinner I am a huge Clark fabric fanboy he's the CEO of envision he is my guru my mentor my rabbi and my friend big fan of his and a very excited to catch up with him tomorrow meeting the faculty from Torah the guys who brought me in here and then Thursday one o'clock is the big speech the commencement speech at the Torah graduation and then that night 900 pm back to Israel it's going to be a crazy week but first let's have coffee Music this is a very exciting meeting for me man I'm very excited we're happy we're finding this is like a long time we've been saying let's catch up yeah all right, so I'm sitting next to a guy but now no one for nine years ten years like that, so it's a cool story because an old friend of mine from like school and I went to I think 20 years ago reaches ask me I'd say like 10 years ago I think oh I have a good friend watching some startups take a look at like okay he literally didn't even tell me Mark's name I don't know I don't know the CEO was okay at boy was the name of company back then oh my god it's really cool they wait long story short we connected we worked together for a couple of years it was a lot of fun his company now called bridge breeze has exploded what's the current valuation oh you don't talk about no not publicly like big dollars we're ready to shove on, and I'm insane, so you now are the what's your official bridge I actually don't have the title there right now you're the co-founder in here co-founders CEO in a company in you're highly involved in yeah are we talking about what's next are you gonna talk about public Noah no let's just say the guy's own another strike of brilliance okay what's your name mark crazy mark remains you by the way I would league everywhere that like I ever mentioned your name somehow anyone well I'm sitting with a friend who knows you know he went to brand you should just know that I could me give me your background would you grow up what's your story I grew up in Edmonton Canada and why so many spoilers yeah and then went to yeshiva in Toronto actually and then Israel for six months, and then I went to she were University and during that time I launched a couple companies and then got married moved to Houston for three years that's where we thought of a boy, and then we went to South by met some investors there and then that was back in 2011 2012 interested first I totally forgot about the Houston and I actually have a favorite Haskell turn that off before I ask the favor a boy now many brave raises me will we be halfway I'm not but how long does the company but with what year do you found it I founded it when I...

People Also Ask about

Is there a 2020 NYC 208 form?

How to claim New York City School tax credit 2023?

What is a 210 form?

Where to get New York State tax forms?

How to claim New York School tax credit NYC-210?

How do I claim NYC school tax credits?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get nyc 210 form 2021?

How do I complete nyc 210 form 2021 online?

How do I fill out nyc 210 form 2021 on an Android device?

What is nyc 210 form?

Who is required to file nyc 210 form?

How to fill out nyc 210 form?

What is the purpose of nyc 210 form?

What information must be reported on nyc 210 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.