Get the free Information About the Shareholder - irsvideos

Show details

671111 Schedule K-1 (Form 1120S) 2011 Department of the Treasury Internal Revenue Service ending Part III Shareholder s Share of Current Year Income, Deductions, Credits, and Other Items Ordinary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign information about form shareholder

Edit your information about form shareholder form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your information about form shareholder form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing information about form shareholder online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit information about form shareholder. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out information about form shareholder

How to fill out information about form shareholder:

01

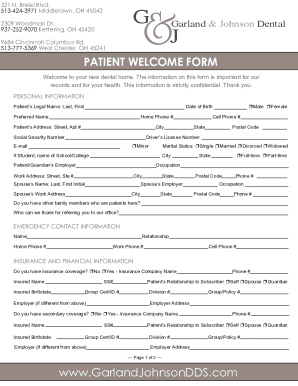

Start by gathering all the necessary information about the shareholder, including their full name, address, contact details, and any identification information required by the form.

02

Ensure that you have the correct form for the specific jurisdiction and type of company you are dealing with. Different forms may have different requirements and sections for shareholder information.

03

Begin filling out the form by entering the shareholder's personal details in the designated sections. This may include their date of birth, nationality, social security number, or any other relevant information required.

04

If the shareholder is an individual, provide their occupation and job title, if applicable. If they are representing a company or organization, include the name, address, and other relevant details of the entity they are associated with.

05

Some forms may require you to specify the number of shares the shareholder owns or is entitled to. In such cases, accurately provide this information based on their ownership or stake in the company.

06

If there are any additional fields or sections on the form relating to the shareholder, make sure to complete them accurately and as required.

07

Double-check all the information provided before submitting the form to ensure accuracy and prevent any potential errors or omissions.

Who needs information about form shareholder?

01

Company secretaries or administrators: These professionals are responsible for maintaining accurate records and documents related to shareholders. They need the information to ensure compliance with legal requirements and to update company registers.

02

Tax authorities: Government tax agencies may require information about company shareholders for tax purposes, such as calculating capital gains tax or assessable income.

03

Auditors and financial institutions: External auditors or financial institutions may request shareholder information to verify the ownership structure, assess potential risks, or evaluate the company's financial position.

04

Regulators or government agencies: Certain regulatory bodies or government agencies may require shareholder information to ensure compliance with rules and regulations, prevent money laundering, or monitor corporate governance.

05

Shareholders themselves: Shareholders may need to provide their information when participating in corporate actions, such as voting, receiving dividends, or exercising their rights as owners of the company.

In summary, accurately filling out information about a form shareholder involves gathering the necessary details and providing them in the designated sections of the form. This information is required by various stakeholders, including company secretaries, tax authorities, auditors, regulators, financial institutions, and the shareholders themselves.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is information about form shareholder?

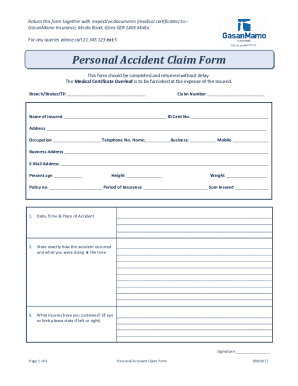

Information about form shareholder includes details about individuals or entities that own shares in a company.

Who is required to file information about form shareholder?

Shareholders, company directors, and authorized representatives are required to file information about form shareholder.

How to fill out information about form shareholder?

Information about form shareholder can be filled out online through the company's official website or submitted in person at the company's office.

What is the purpose of information about form shareholder?

The purpose of information about form shareholder is to provide transparency and accountability regarding ownership of shares in a company.

What information must be reported on information about form shareholder?

Information about form shareholder must include the name, address, contact details, and shareholding percentage of each shareholder.

How can I modify information about form shareholder without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your information about form shareholder into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an eSignature for the information about form shareholder in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your information about form shareholder and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I edit information about form shareholder on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing information about form shareholder, you need to install and log in to the app.

Fill out your information about form shareholder online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Information About Form Shareholder is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.