Get the free General Obligation Capital Improvement Refunding Bonds, Series 2012

Show details

This official statement details the issuance of $4,015,000 General Obligation Capital Improvement Refunding Bonds by Carlton County, Minnesota, aimed at refunding certain indebtedness. It provides

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign general obligation capital improvement

Edit your general obligation capital improvement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your general obligation capital improvement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit general obligation capital improvement online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit general obligation capital improvement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

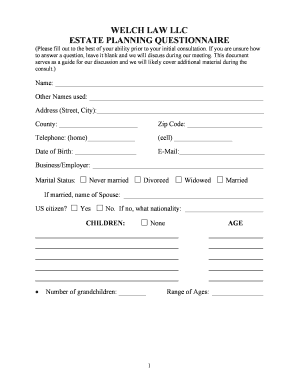

How to fill out general obligation capital improvement

How to fill out General Obligation Capital Improvement Refunding Bonds, Series 2012

01

Gather necessary information about the bonds, including the bond issue date, maturity dates, and interest rates.

02

Obtain the official statement or offering document for the General Obligation Capital Improvement Refunding Bonds, Series 2012.

03

Complete the bond application form, providing required details such as issuer information and fiscal year end.

04

Calculate the debt service coverage ratio to ensure compliance with financial policies.

05

Review and include any pre-qualification output from the financial advisor, if applicable.

06

Submit the completed application along with any required financial documentation to the relevant authority for approval.

07

Await confirmation or feedback before finalizing the bond issuance process.

Who needs General Obligation Capital Improvement Refunding Bonds, Series 2012?

01

Local government entities looking to refinance existing debt to potentially lower interest rates.

02

Municipalities aiming to fund public capital improvement projects efficiently.

03

Investors seeking to purchase stable, tax-exempt securities.

Fill

form

: Try Risk Free

People Also Ask about

How are general obligation bonds paid back?

When a G.O. bond is issued, the municipal government borrows from investors and pays them back over time. Because the bonds can't be paid off with revenue obtained from the project, the municipality must use taxes to repay their borrowed funds.

What is a general obligation refunding bond?

Refunding bonds are bonds that are issued to replace and refinance outstanding general obligation or revenue bonds (chapter 39.53 RCW). The use of a refunding mechanism is often driven by the desire to lower interest rates and reduce payment amounts on older, more expensive debt.

Are general obligation bonds good?

GO bonds tend to be higher-rated than revenue bonds, on average. Given the more diverse makeup of revenue bonds, they also tend to have more diverse credit ratings.

Are general obligation bonds backed by taxes?

General obligation bonds account for 28% of the investment-grade muni market and are usually backed by the taxing authority of the bond issuer. Most states and local governments issue GO bonds to help fund operations or specific projects.

Who backs general obligation bonds?

GO bonds are backed by the issuer's full faith and credit, meaning they can use the issuer's full taxation and borrowing authority to service the debt.

What are general obligation municipal bonds backed by?

General obligation bonds are issued by states, cities or counties and not secured by any assets. Instead, general obligation are backed by the “full faith and credit” of the issuer, which has the power to tax residents to pay bondholders.

How are general obligation bonds repaid?

When a G.O. bond is issued, the municipal government borrows from investors and pays them back over time. Because the bonds can't be paid off with revenue obtained from the project, the municipality must use taxes to repay their borrowed funds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is General Obligation Capital Improvement Refunding Bonds, Series 2012?

General Obligation Capital Improvement Refunding Bonds, Series 2012 are debt securities issued by a government entity to refinance existing capital improvement bonds. These bonds are backed by the full faith and credit of the issuing authority and are used to reduce interest costs or adjust financial terms.

Who is required to file General Obligation Capital Improvement Refunding Bonds, Series 2012?

Entities such as local governments, municipalities, or any issuing authorities that have issued General Obligation Capital Improvement Refunding Bonds are required to file related financial and disclosure documents as mandated by regulatory agencies.

How to fill out General Obligation Capital Improvement Refunding Bonds, Series 2012?

To fill out General Obligation Capital Improvement Refunding Bonds, Series 2012 forms, issuers need to provide details such as the bond amount, date of issue, description of the project being financed, and compliance with relevant regulations. Following prescribed guidelines and including necessary supporting documentation is essential.

What is the purpose of General Obligation Capital Improvement Refunding Bonds, Series 2012?

The purpose of General Obligation Capital Improvement Refunding Bonds, Series 2012 is to refinance existing debt, improve cash flow, lower interest rates, and potentially reallocate funds for additional capital improvement projects, ultimately benefiting the public.

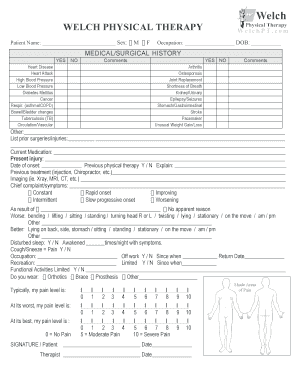

What information must be reported on General Obligation Capital Improvement Refunding Bonds, Series 2012?

Reported information for General Obligation Capital Improvement Refunding Bonds, Series 2012 typically includes the bond's purpose, amounts issued, interest rates, maturity dates, repayment schedule, and the financial health of the issuing entity.

Fill out your general obligation capital improvement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

General Obligation Capital Improvement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.