NC NCUI 685 2024-2026 free printable template

Show details

A Social Security Number Refund Total 12. Reason 13. This information is true and accurate. Signed Title NCUI 685 Rev. 01/2012 Instructions for Completing Form NCUI 685 1. 11. The remainder of Form NCUI 685 is to be used to correct individual employee s wages that were previously reported incorrectly. 3. Enter the quarter and year to be corrected in the format Q-YYYY. Example 1-2001 Note A separate Form NCUI 685 for each quarter to be corrected i...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ncui 685 form

Edit your ncui 685 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC NCUI 685 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NC NCUI 685 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NC NCUI 685. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC NCUI 685 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC NCUI 685

How to fill out NC NCUI 685

01

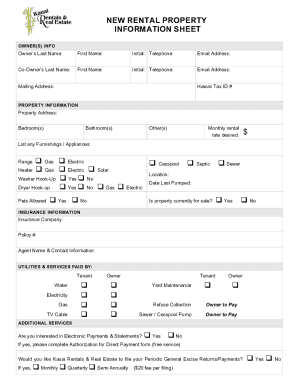

Start by downloading the NC NCUI 685 form from the official website.

02

Fill out your personal information in Section A, including your name, address, and contact details.

03

Move to Section B and provide information regarding your employment history.

04

In Section C, detail the reason for your unemployment.

05

Ensure all information is accurate and complete to prevent delays.

06

Review the form thoroughly before submitting.

07

Sign and date the form in the designated area.

08

Submit the form via the prescribed method, whether online or by mail.

Who needs NC NCUI 685?

01

Individuals who are applying for unemployment benefits in North Carolina.

02

Employees who have lost their job through no fault of their own.

03

Workers who have sufficient wage credits to qualify for benefits.

Fill

form

: Try Risk Free

People Also Ask about

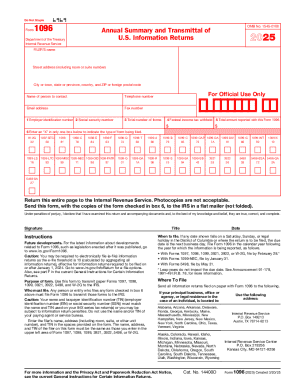

What is the federal unemployment tax rate for 2023?

The 2023 FUTA tax rate is 6% of the first $7,000 from each employee's annual wages. Therefore, employers shouldn't pay more than $420 annually for each employee (6.0% x $7,000).

How long do you have to work to get unemployment in NC?

You must have worked in employment subject to UI tax (known as covered employment) and received wages in at least two (2) quarters of your base period. You must also have been paid wages totaling at least six (6) times the average weekly insured wage during your base period.

What is the penalty for filing Ncui 101 late?

The maximum late filing penalty is 25% (. 25).

What is the NC unemployment tax rate for 2023?

Important Information for Annual Experience Rating for 2023 Tax Rates Taxable Wage Base for 2023$29,600UI Tax Rate for Beginning Employers1%Minimum UI Tax Rate0.06%Maximum UI Tax Rate5.76%Mail Date for Unemployment Tax Rate Assignments For 2022November 14, 20224 more rows

What is the penalty for filing NC franchise tax late?

A penalty for failure to timely file a return (5% of the net tax due per month, maximum 25%) will be assessed for failure to file a withholding return by the due date of the return. In addition, criminal penalties are provided for willful failure to comply with the withholding statutes.

What is the penalty for failure to file NCDOR?

Penalties. A taxpayer will be assessed a penalty of $50 per day, up to a maximum of $1,000, for failure to file the informational return by the date the return is due.

What is the employer tax rate in NC?

Based on economic conditions, an employer's tax rate could be as low as 0.060% or as high as 5.760%.

What is a Ncui 685 form?

Instructions for Completing the Adjustment to Employer's Quarterly Tax and Wage Report. (Form NCUI 685)

How to file for unemployment in Charlotte NC?

You can apply for benefits online 24 hours a day, seven days a week. If you need help, contact our Customer Call Center at 888-737-0259.Create an Online Account to: Apply for unemployment benefits. Complete your weekly certifications. Check your claim status.

What is the SUTA rate for 2023 in NC?

For Tax Year 2023, the North Carolina individual income tax rate is 4.75% (0.0475). For Tax Year 2022, the North Carolina individual income tax rate is 4.99% (0.0499).

What is the employer's quarterly tax and wage report NC?

The Employer's Quarterly Tax and Wage Report (Form NCUI 101) is used to report wage and tax information. You may download a blank Employer's Quarterly Tax and Wage Report (Form NCUI 101) from our website, or contact the Employer Call Center at 919-707-1150 to request that a blank form be mailed to you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in NC NCUI 685?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your NC NCUI 685 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for signing my NC NCUI 685 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your NC NCUI 685 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit NC NCUI 685 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as NC NCUI 685. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is NC NCUI 685?

NC NCUI 685 is a form used in North Carolina for reporting unemployment insurance contributions and wages paid to employees.

Who is required to file NC NCUI 685?

Employers in North Carolina who are subject to unemployment insurance laws are required to file NC NCUI 685.

How to fill out NC NCUI 685?

To fill out NC NCUI 685, employers must provide information about their business, the wages paid to their employees, and any contributions owed for unemployment insurance.

What is the purpose of NC NCUI 685?

The purpose of NC NCUI 685 is to report wages and contributions for unemployment insurance to ensure compliance with state laws and regulations.

What information must be reported on NC NCUI 685?

Information that must be reported on NC NCUI 685 includes the employer's identification details, total wages paid, and any unemployment insurance contributions due.

Fill out your NC NCUI 685 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC NCUI 685 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.