Get the free ENTITY - Corporation, Partnership,

Show details

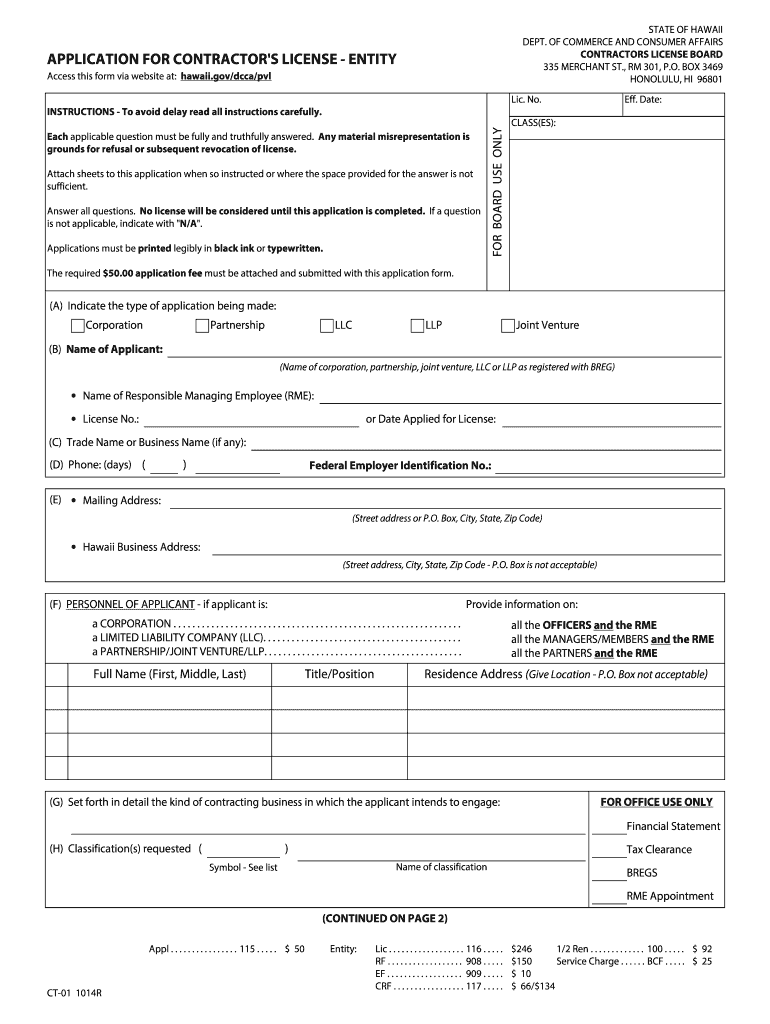

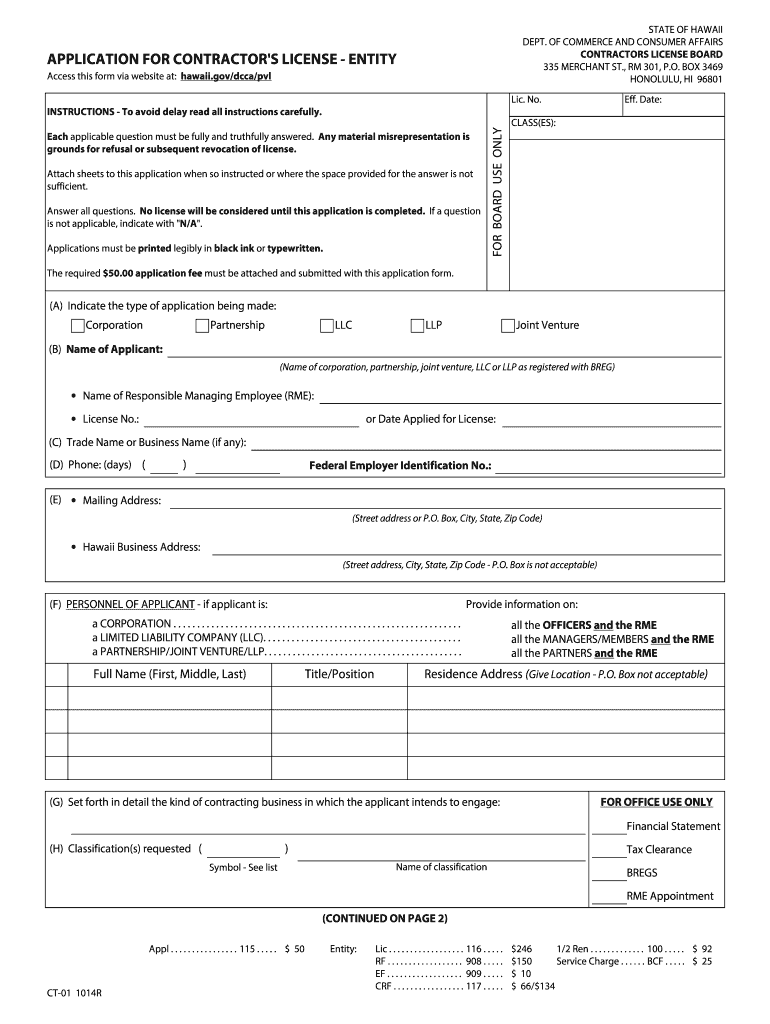

Access this form via website at: hawaii.gov/dcca/pvl ... 1) Applicant files application, fee and other required items on or before the 20th .... C-14 Sign contractor;.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign entity - corporation partnership

Edit your entity - corporation partnership form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your entity - corporation partnership form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing entity - corporation partnership online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit entity - corporation partnership. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out entity - corporation partnership

How to fill out entity - corporation partnership?

01

Gather necessary information: Collect all the required details about the corporation partnership, such as the names and contact information of the partners involved, their roles and responsibilities within the partnership, and any specific terms or conditions agreed upon.

02

Choose a business name: Decide on a unique and suitable name for your corporation partnership, ensuring it complies with any legal requirements or regulations specific to your jurisdiction. Conduct a thorough search to ensure the chosen name is not already in use.

03

Draft a partnership agreement: Create a comprehensive partnership agreement that outlines the rights, obligations, and responsibilities of each partner, including profit and loss distribution, decision-making processes, dispute resolution mechanisms, and any other important provisions. It may be advisable to seek legal advice when drafting this agreement.

04

Register the partnership: Depending on your jurisdiction's regulations, you might need to register your corporation partnership with the relevant government authority. This typically involves submitting the necessary forms, paying any required fees, and providing the requested information.

05

Obtain necessary licenses and permits: Determine if your corporation partnership requires any specific licenses or permits to operate legally in your industry or location. Research and comply with the applicable rules and regulations, ensuring all necessary licenses are obtained before commencing operations.

06

Obtain an Employer Identification Number (EIN): If your corporation partnership intends to hire employees or conduct financial transactions, it will likely need an EIN from the Internal Revenue Service (IRS) in the United States. Check with your local tax authorities for the applicable process in your jurisdiction.

Who needs entity - corporation partnership?

01

Entrepreneurs starting a business together: A corporation partnership is suitable for individuals who wish to combine their resources, skills, and expertise to form a business entity. It allows multiple partners to share the risks, responsibilities, and profits while maintaining a specific legal structure.

02

Small or medium-sized businesses: Corporation partnerships are often preferred by small or medium-sized businesses seeking to pool resources, expand their operations, or access new markets. It provides a flexible business structure that allows for shared decision-making and a division of labor among partners.

03

Professionals in certain fields: Professionals, such as lawyers, doctors, or accountants, may choose to form a corporation partnership to operate their practice collectively. This structure allows the sharing of liabilities and expenses while maintaining individual professional independence.

In summary, filling out an entity - corporation partnership involves collecting necessary information, choosing a business name, drafting a partnership agreement, registering the partnership, obtaining licenses, permits, and an EIN if required. Corporation partnerships are commonly sought after by entrepreneurs, small or medium-sized businesses, and professionals in specific fields.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send entity - corporation partnership to be eSigned by others?

Once your entity - corporation partnership is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find entity - corporation partnership?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the entity - corporation partnership in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I edit entity - corporation partnership on an iOS device?

Create, modify, and share entity - corporation partnership using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is entity - corporation partnership?

An entity-corporation partnership is a legal relationship established between a corporation and another entity for business purposes.

Who is required to file entity - corporation partnership?

Both the corporation and the other entity involved in the partnership are required to file entity-corporation partnership.

How to fill out entity - corporation partnership?

The entity-corporation partnership can be filled out by providing relevant information about the partnership agreement, structure, and financial activities.

What is the purpose of entity - corporation partnership?

The purpose of entity-corporation partnership is to establish a formal business relationship between a corporation and another entity to work together on specific projects or ventures.

What information must be reported on entity - corporation partnership?

The information that must be reported on entity-corporation partnership includes details of the partnership agreement, financial transactions, ownership structure, and any other relevant information.

Fill out your entity - corporation partnership online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Entity - Corporation Partnership is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.