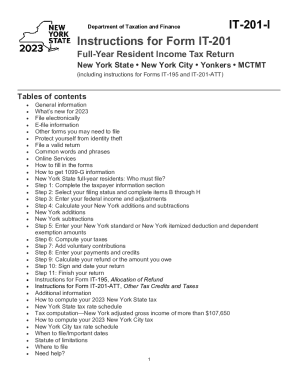

NY IT-201-I 2013 free printable template

Instructions and Help about NY IT-201-I

How to edit NY IT-201-I

How to fill out NY IT-201-I

About NY IT-201-I 2013 previous version

What is NY IT-201-I?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about NY IT-201-I

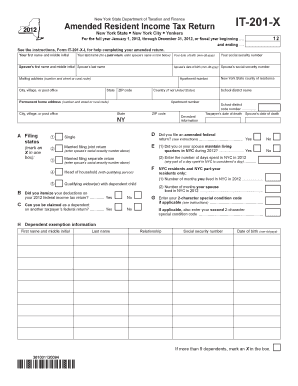

What should I do if I need to correct a mistake on my it 201 d new?

If you realize there's an error after submitting your it 201 d new, you can file an amended return to correct it. Ensure you indicate the corrections clearly and provide any necessary documentation that supports the changes you're making.

How can I track the status of my it 201 d new after filing?

To verify the status of your it 201 d new, you can use the tax agency's online tracking system. Input the necessary details such as your Social Security number and the filing date to view the processing status and any potential issues.

Are there specific e-file rejection codes for the it 201 d new I should be aware of?

Yes, when e-filing your it 201 d new, you may encounter specific rejection codes. Each code corresponds to a particular error, so reviewing the rejection messages can guide you on what corrections are needed for successful submission.

How long should I retain records related to my it 201 d new?

It's advisable to retain records related to your it 201 d new for at least three years from the original filing date. This ensures you have the necessary documentation available if required for audits or future reference.

What should I do if I receive a notice from the tax agency regarding my it 201 d new?

If you receive a notice concerning your it 201 d new, promptly review the information provided. Respond within the indicated time frame, and gather any required documentation to address the issue or explain your situation clearly.