Get the free deferred retirement option plan low balance no distribution

Show details

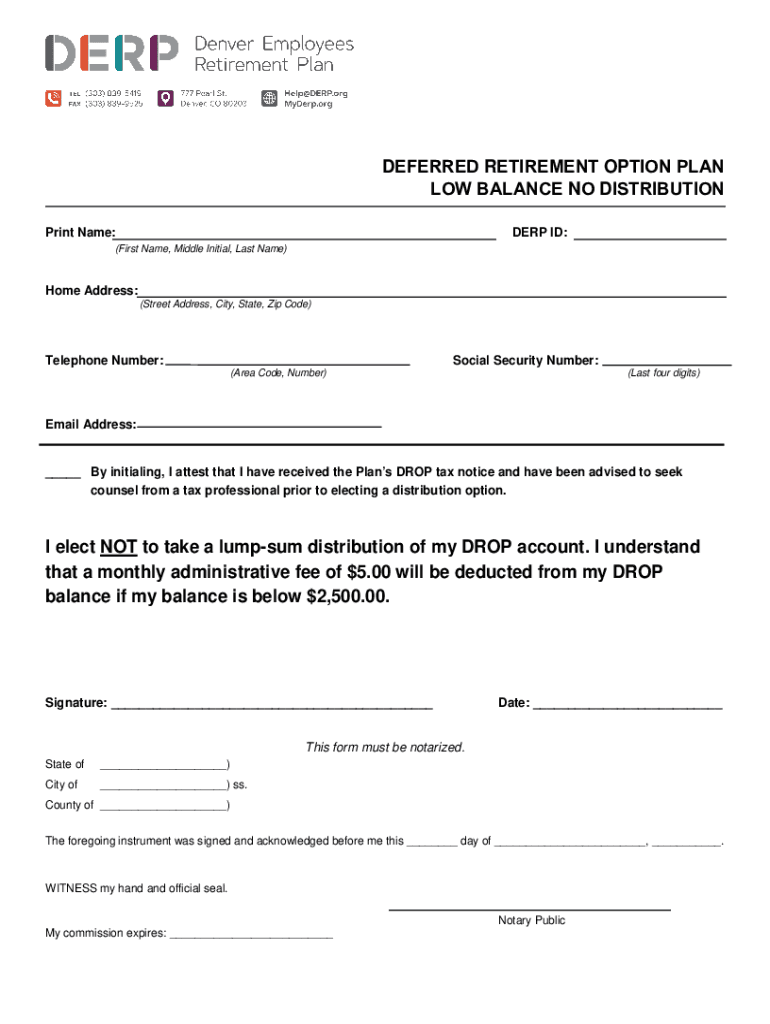

DEFERRED RETIREMENT OPTION PLAN LOW BALANCE NO DISTRIBUTION Print Name:DEEP ID:(First Name, Middle Initial, Last Name)Home Address: (Street Address, City, State, Zip Code)Telephone Number:Social Security

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deferred retirement option plan

Edit your deferred retirement option plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deferred retirement option plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deferred retirement option plan online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit deferred retirement option plan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deferred retirement option plan

How to fill out deferred retirement option plan

01

Contact your human resources department to inquire about eligibility for Deferred Retirement Option Plan (DROP)

02

Review the DROP program requirements and guidelines to understand the implications of enrolling in the plan

03

Complete the necessary forms and paperwork provided by your employer to officially enroll in DROP

04

Consult with a financial advisor to understand the impact of participating in DROP on your retirement savings and benefits

05

Submit all required documents and information to finalize your enrollment in the Deferred Retirement Option Plan

Who needs deferred retirement option plan?

01

Employees who are nearing retirement age and are looking for a way to continue working while also securing their retirement benefits

02

Individuals who want to maximize their retirement savings by taking advantage of the benefits offered through DROP

03

Workers who are eligible for DROP and are interested in exploring the option of deferring their retirement in exchange for increased benefits

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit deferred retirement option plan from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your deferred retirement option plan into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute deferred retirement option plan online?

Filling out and eSigning deferred retirement option plan is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make changes in deferred retirement option plan?

With pdfFiller, the editing process is straightforward. Open your deferred retirement option plan in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

What is deferred retirement option plan?

Deferred retirement option plan (DROP) is a program that allows eligible employees to work past their retirement eligibility date for a specified period while their retirement benefits are deposited into an interest-bearing account.

Who is required to file deferred retirement option plan?

Employees who meet the eligibility criteria and wish to participate in the program are required to file deferred retirement option plan.

How to fill out deferred retirement option plan?

Employees can fill out the deferred retirement option plan by completing the necessary forms provided by their employer and submitting them before the deadline.

What is the purpose of deferred retirement option plan?

The purpose of deferred retirement option plan is to provide employees with the flexibility to continue working while simultaneously accruing retirement benefits.

What information must be reported on deferred retirement option plan?

Deferred retirement option plan must include details such as employee's personal information, retirement eligibility date, duration of the program, and beneficiary details.

Fill out your deferred retirement option plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deferred Retirement Option Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.