Get the free Form IT-209 Claim for Noncustodial Parent New York state Earned Income Credit 2014 -...

Show details

New York State Earned Income Credit New York City Earned Income Credit. 4 Did you ... Page 2 of 4 IT-209 (2014).

We are not affiliated with any brand or entity on this form

Instructions and Help about form it-209 claim for

How to edit form it-209 claim for

How to fill out form it-209 claim for

Instructions and Help about form it-209 claim for

How to edit form it-209 claim for

To edit form it-209 claim for, use a reliable PDF editor like pdfFiller. You can upload the completed form and utilize the editing tools to correct any inaccuracies. Once edits are made, ensure to save your document to confirm the changes.

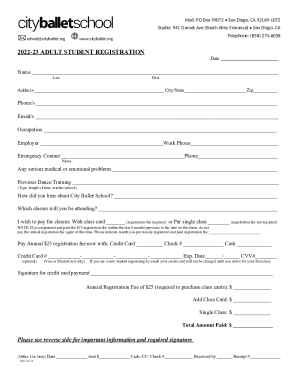

How to fill out form it-209 claim for

Filling out form it-209 claim for involves a series of steps to gather the required information accurately. First, ensure you have all necessary documentation ready, such as identification and income records. Then, follow these steps:

01

Download form it-209 from the IRS website or access it through a tax software.

02

Begin filling out your personal details, including your name, address, and Social Security number.

03

Complete the sections regarding income and deductions as pertinent to your financial situation.

04

Review the form for accuracy before submission.

Latest updates to form it-209 claim for

Latest updates to form it-209 claim for

It is essential to stay informed about any updates to form it-209 claim for, as tax laws may change annually. Regularly check the IRS website or consult with a tax professional to ensure compliance with the latest requirements.

All You Need to Know About form it-209 claim for

What is form it-209 claim for?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About form it-209 claim for

What is form it-209 claim for?

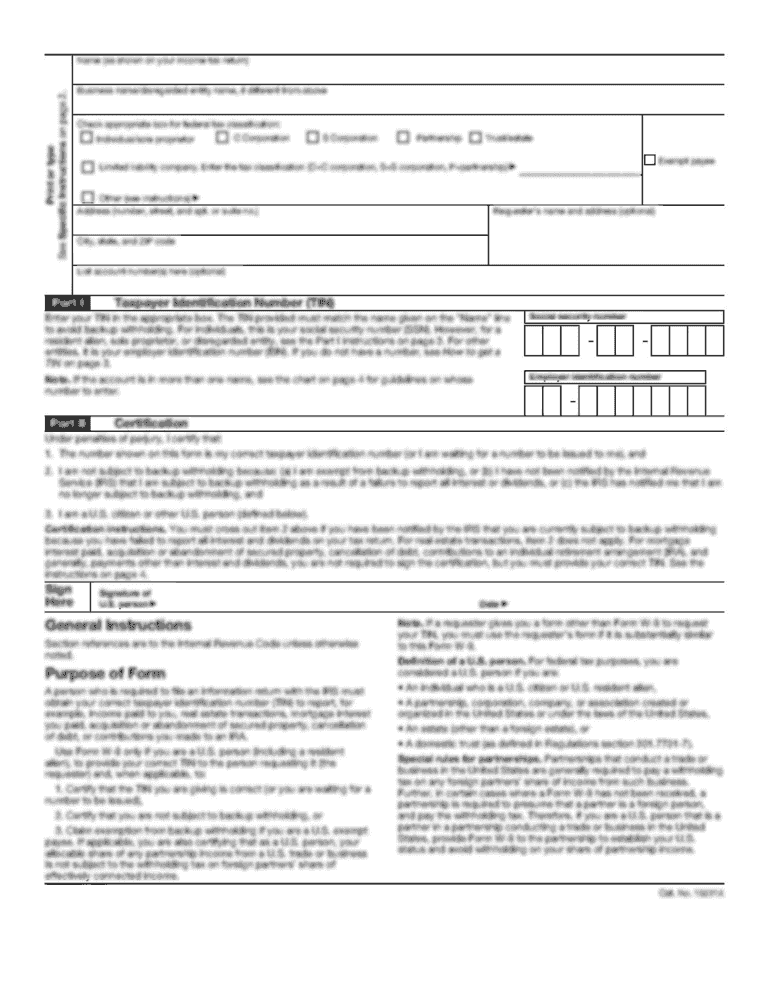

Form it-209 claim for is a tax form used to report certain income types and claim tax benefits. This form is typically utilized by individuals and businesses to declare specific financial transactions to the IRS.

What is the purpose of this form?

The purpose of form it-209 claim for is to provide a structured way for taxpayers to report income and apply for deductions or credits. Accurate completion of this form can significantly affect tax liabilities and potential refunds.

Who needs the form?

Taxpayers who have specific types of income or claim deductions related to business expenses typically need form it-209. Individuals who are self-employed or have received certain payments may also be required to file this claim.

When am I exempt from filling out this form?

Taxpayers may be exempt from filling out form it-209 claim for under certain conditions. For example, if your income falls below a specific threshold or if you do not earn income from the sources reported on this form, you may be exempt. Always confirm with IRS guidelines to ensure compliance.

Components of the form

The components of form it-209 claim for generally include personal identification information, sections detailing various types of income, and opportunities to claim eligible deductions. Each section must be completed with accuracy to reflect your financial situation accurately.

Due date

Form it-209 claim for should be filed by the designated IRS tax deadline, which is typically April 15 each year. Failing to submit by this date could result in penalties or interest on unpaid taxes.

What are the penalties for not issuing the form?

Penalties for not issuing form it-209 claim for can include monetary fines and potential audits by the IRS. If you fail to submit the form or provide inaccurate information, you may also face additional scrutiny during tax assessments.

What information do you need when you file the form?

When filing form it-209 claim for, you will need various pieces of information including:

01

Your personal identification details (name, address, Social Security number).

02

Documentation of income sources and amounts.

03

Receipts and records for applicable deductions.

Is the form accompanied by other forms?

Form it-209 claim for may need to be accompanied by additional forms, depending on your specific tax situation. It’s crucial to check IRS guidelines to determine if supplemental documents are required.

Where do I send the form?

You should send form it-209 claim for to the address specified on the form itself, which typically depends on your state of residence. Ensure you verify the submission address to avoid delays in processing your claim.

See what our users say