Get the free Individual or Joint Credit Application

Show details

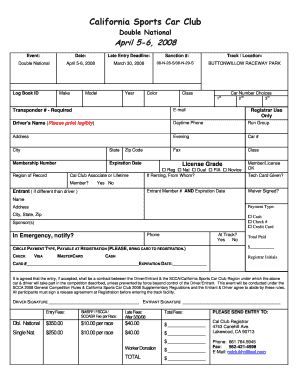

This document is an application form for obtaining credit from Bloedorn Lumber Company. Applicants must fill out the form completely on both sides, providing personal, employment, and financial information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign individual or joint credit

Edit your individual or joint credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual or joint credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing individual or joint credit online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit individual or joint credit. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out individual or joint credit

How to fill out Individual or Joint Credit Application

01

Gather necessary documents: Collect personal identification, income verification, and any outstanding debts.

02

Decide on application type: Determine if you will be applying individually or jointly with another party.

03

Complete personal information section: Fill out your name, address, Social Security number, and contact information.

04

Provide employment details: Include your current employer, job title, duration of employment, and income.

05

Detail financial information: List bank accounts, assets, and liabilities accurately to reflect your financial status.

06

Review jointly if applicable: If applying jointly, repeat personal information section for the co-applicant and include their financial details.

07

Sign and date the application: Ensure all required signatures are provided and review for accuracy before submission.

Who needs Individual or Joint Credit Application?

01

Individuals seeking personal loans or credit lines.

02

Couples looking to combine incomes for a mortgage or large credit applications.

03

People with limited credit history who need a co-signer to improve their chances of approval.

04

Anyone wanting to consolidate debt or apply for higher credit limits.

Fill

form

: Try Risk Free

People Also Ask about

Is it better to apply for a loan with a co-applicant?

Adding a co-applicant's financial profile – credit history, income and savings – to your application will greatly increase your chances of obtaining a loan. Not only that, but the terms of the loan (the interest rate, for example) are likely to be more favorable.

Is it better to apply for a loan individually or jointly?

The benefit of a joint application is higher income, so you'll get approved for more. But if your income alone is enough to get to your price range, you can apply alone to get a better rate (probably just slightly better, since 740+ is very good too). You can ask your lender to run both scenarios and compare.

What does a joint application mean?

Joint Application: An Overview In a joint application, all applicants' income, assets, debts, and credit scores are taken into account. This can significantly increase the borrowing capacity, as lenders consider the combined income and assets of all applicants.

Are you more likely to be accepted for a joint loan?

If you apply for a loan together, the lender will look at both your credit records when assessing affordability. This means you might be more likely to be accepted. But the loan will also appear on both your credit reports.

Is it better to apply for joint credit?

Applying for a joint credit card - when your partner has a higher credit score than you - can open up opportunities for better interest rates, higher credit limits, and more attractive rewards programs than your credit score can qualify for on its own.

Is it better to apply for a mortgage jointly or separately?

The benefit of a joint application is higher income, so you'll get approved for more. But if your income alone is enough to get to your price range, you can apply alone to get a better rate (probably just slightly better, since 740+ is very good too). You can ask your lender to run both scenarios and compare.

Is it better to have two people on a loan or one?

Getting another co-borrower or co-signer to join you in the transaction can improve your chances of securing a mortgage loan and get a competitive interest rate.

Is it better to apply for a loan jointly or separately?

The benefit of a joint application is higher income, so you'll get approved for more. But if your income alone is enough to get to your price range, you can apply alone to get a better rate (probably just slightly better, since 740+ is very good too). You can ask your lender to run both scenarios and compare.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Individual or Joint Credit Application?

An Individual or Joint Credit Application is a form used by individuals or couples to apply for credit, such as loans or credit cards, either independently or together.

Who is required to file Individual or Joint Credit Application?

Any individual or couple seeking to obtain credit or financing is required to file an Individual or Joint Credit Application.

How to fill out Individual or Joint Credit Application?

To fill out an Individual or Joint Credit Application, provide personal information, financial details, and credit history. For joint applications, both parties must complete their respective sections.

What is the purpose of Individual or Joint Credit Application?

The purpose of the Individual or Joint Credit Application is to assess the creditworthiness of applicants and determine eligibility for loan or credit approval.

What information must be reported on Individual or Joint Credit Application?

The information that must be reported includes personal identification details, income, employment status, debts, and any other financial obligations.

Fill out your individual or joint credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual Or Joint Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.