Get the free COMMERCIAL LOAN APPLICATION - Self-Help Credit Union - self-help

Show details

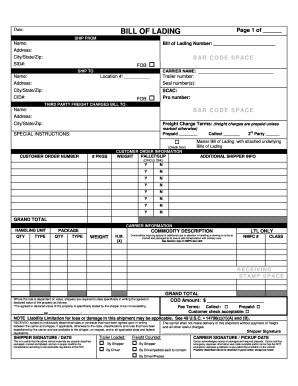

COMMERCIAL LOAN APPLICATION BASIC INFORMATION Please tell us about your business or organization. Business or Organization Name Who referred you to us? Street Address City State Zip Code County Date

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial loan application

Edit your commercial loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit commercial loan application online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit commercial loan application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial loan application

How to fill out a commercial loan application:

01

Gather all necessary documents: Before you start filling out the application, make sure you have all the required documents handy. This may include financial statements, tax returns, business plan, personal identification, and any other relevant paperwork. Having them ready will help streamline the process.

02

Provide accurate information: Fill out all the sections of the application form accurately and honestly. This includes personal information, business details, financial history, and any other requested information. Double-check your entries to avoid any mistakes or inconsistencies.

03

Include supporting documents: Along with the application form, many lenders may require additional supporting documents to assess your eligibility for a commercial loan. Make sure to attach these documents, such as bank statements, personal and business credit reports, invoices, or any other relevant paperwork.

04

Be clear and concise: When describing your business and its financial needs, be clear and concise in your responses. Use specific figures and examples where appropriate to provide a comprehensive understanding of your business's situation and loan requirements.

05

Seek professional assistance if needed: Commercial loan applications can be complex, especially if you are unfamiliar with the process. Therefore, it might be beneficial to consult a loan officer, accountant, or other financial professionals to guide you through the application and ensure accuracy.

Who needs a commercial loan application?

01

Business owners: Commercial loan applications are typically needed by business owners who require financing to expand their operations, purchase equipment, or fulfill other business-related needs. Whether you have a startup or an established company, if you are seeking funds from a financial institution, you will likely need to complete a commercial loan application.

02

Entrepreneurs: Individuals planning to start a new business venture may need to submit a commercial loan application to secure the necessary funding. The application process allows lenders to evaluate the viability of the business concept and the borrower's ability to repay the loan.

03

Real estate investors: Commercial loan applications are also relevant for real estate investors who aim to acquire or renovate commercial properties. These investors often seek commercial loans to finance their projects and may need to go through the application process to demonstrate their financial capability and the potential profitability of the investment.

In summary, anyone, be it business owners, entrepreneurs, or real estate investors, who require financial assistance for business-related purposes might need to fill out a commercial loan application.

Fill

form

: Try Risk Free

People Also Ask about

What is a SBA Express loan?

SBA Express loans are the standard form of Express loan available to eligible small businesses operating in the U.S. or its territories. Approval times are much shorter than for most SBA loans, with the SBA responding to applications within 36 hours. Loans are available up to $500,000, with up to 50% backed by the SBA.

What is the biggest credit union by asset size?

The largest credit union in the U.S. is Navy Federal Credit Union, with $156.65 billion in assets. As of 2022, the U.S. credit union industry has a market size of $103.3 billion.

What is the largest natural member credit union?

Navy Federal is the largest natural member (or retail) credit union in the United States, both in asset size and in membership. As of January 2023, Navy Federal has US$156.8 billion in assets and has 12.4 million members.

What is Self Help Federal Credit Union mission statement?

Our mission is creating and protecting ownership and economic opportunity for all, especially people of color, women, rural residents and low-wealth families and communities.

How much assets do credit unions have?

Total shares and deposits rose by $61.3 billion, or 3.4 percent, over the year to $1.85 trillion in the fourth quarter of 2022. The return on average assets for federally insured credit unions was 89 basis points in 2022, down from 107 basis points in 2021.

How big is self help federal credit union assets?

Self-Help Federal Credit Union Self-Help Federal now has over 38 branches, $2.1 billion in assets, and serves over 100,000 people.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit commercial loan application from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your commercial loan application into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make changes in commercial loan application?

The editing procedure is simple with pdfFiller. Open your commercial loan application in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete commercial loan application on an Android device?

Use the pdfFiller mobile app and complete your commercial loan application and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is commercial loan application?

A commercial loan application is a formal request submitted to a financial institution for a loan intended for business purposes, providing essential information about the business and its financial needs.

Who is required to file commercial loan application?

Business entities seeking funding for operations, expansion, real estate, or other commercial activities are required to file a commercial loan application. This includes sole proprietorships, partnerships, limited liability companies, and corporations.

How to fill out commercial loan application?

To fill out a commercial loan application, a borrower must gather necessary documents such as business financial statements, tax returns, and a business plan. The application typically requires details about the business structure, funding purpose, and personal financial information of the business owners.

What is the purpose of commercial loan application?

The purpose of a commercial loan application is to provide lenders with comprehensive information to assess the creditworthiness of a business, evaluate its ability to repay the loan, and determine the risk involved in lending.

What information must be reported on commercial loan application?

A commercial loan application must report information including business details (name, structure, and ownership), financial statements, purpose of the loan, amount requested, and details about the business's cash flow and collateral.

Fill out your commercial loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.