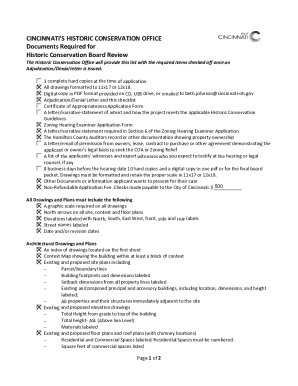

Get the free CREDIT APPLICATION/CREDIT AGREEMENT

Show details

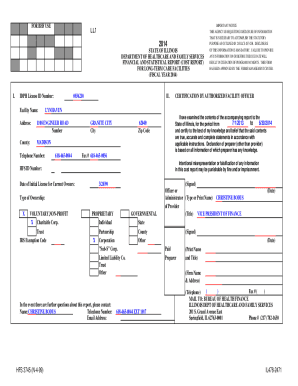

This document is a credit application and agreement, outlining the terms and conditions for extending credit to a business. It requires the applicant to provide business details, owner information,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit applicationcredit agreement

Edit your credit applicationcredit agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit applicationcredit agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit applicationcredit agreement online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit applicationcredit agreement. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit applicationcredit agreement

How to fill out CREDIT APPLICATION/CREDIT AGREEMENT

01

Begin by entering your personal information such as name, address, and contact details.

02

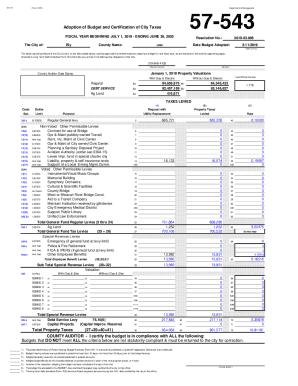

Provide your Social Security Number (SSN) or Tax Identification Number (TIN).

03

Specify your employment details, including employer name, job title, and income.

04

List any additional sources of income you may have.

05

Fill in your financial obligations, such as monthly rent or mortgage payments.

06

Indicate the amount of credit you are applying for and the purpose of the credit.

07

Review all the information for accuracy and completeness.

08

Sign and date the application.

Who needs CREDIT APPLICATION/CREDIT AGREEMENT?

01

Individuals seeking to obtain credit for personal loans or credit cards.

02

Businesses looking to secure financing or lines of credit for operations.

03

Consumers applying for installment loans or financing options for large purchases.

04

Anyone looking to lease a vehicle or property may also need to fill out a credit application.

Fill

form

: Try Risk Free

People Also Ask about

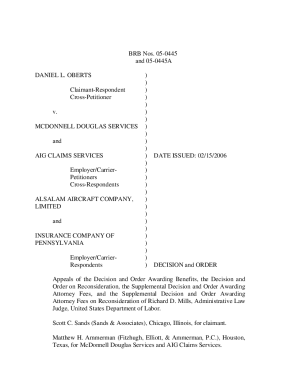

What is an example of a credit agreement?

Credit cards are one example, as are lines of credit, including home equity lines of credit (HELOCs). Non-revolving loans, such as mortgages and auto loans, have a fixed end date and a prescribed repayment schedule.

What does it mean when a credit agreement is being added to your report?

Changed: This means that something has changed on your electoral roll record. Credit agreement. What does this mean? Added: This could mean that you've recently opened a new account, or it might be because a lender has just shared some information relating to an old account.

How do you write a credit agreement?

The Lender agrees to loan (total amount of the credit) to the Borrower. The Borrower agrees to repay the total amount in full before , along with any interest incurred on the unpaid monies at the rate of _% per year, beginning on (date).

What are the three types of credit agreements?

A credit agreement can be (i) a credit facility; (ii) a credit transaction; (iii) a credit guarantee; or (iv) an incidental credit agreement. Below, each of these types of credit agreement is defined and illustrated with examples.

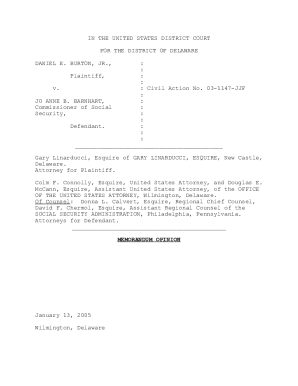

Can I write my own loan agreement?

7 Best Practices When Drafting Simple Agreements Start with a clear statement of purpose. Define key terms and definitions. Use clear and concise language. Include dispute resolution provisions. Consider the potential consequences of the breach. Include termination and renewal provisions. Use a standard contract template.

What is an example of a credit agreement?

Credit cards are one example, as are lines of credit, including home equity lines of credit (HELOCs). Non-revolving loans, such as mortgages and auto loans, have a fixed end date and a prescribed repayment schedule.

How do you write a simple agreement?

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT APPLICATION/CREDIT AGREEMENT?

A credit application or credit agreement is a formal document that a borrower submits to a lender, requesting credit or a loan and agreeing to the terms and conditions set forth by the lender.

Who is required to file CREDIT APPLICATION/CREDIT AGREEMENT?

Individuals or businesses seeking to obtain credit, loans, or financing are required to file a credit application or credit agreement with the lending institution.

How to fill out CREDIT APPLICATION/CREDIT AGREEMENT?

To fill out a credit application, provide accurate personal or business information, financial details, employment history, and any other required documentation as specified by the lender.

What is the purpose of CREDIT APPLICATION/CREDIT AGREEMENT?

The purpose of a credit application or credit agreement is to assess the creditworthiness of the borrower, establish the terms of the loan, and outline the borrower's obligations to the lender.

What information must be reported on CREDIT APPLICATION/CREDIT AGREEMENT?

Information that must be reported includes personal identification details, income, employment history, existing debts, requested loan amount, and any other relevant financial information.

Fill out your credit applicationcredit agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Applicationcredit Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.