Get the free Request for Credit Authorization

Show details

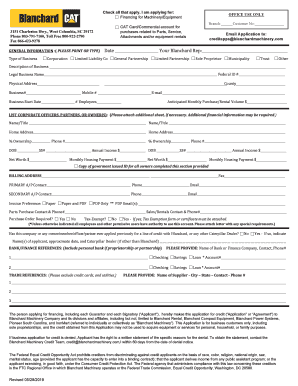

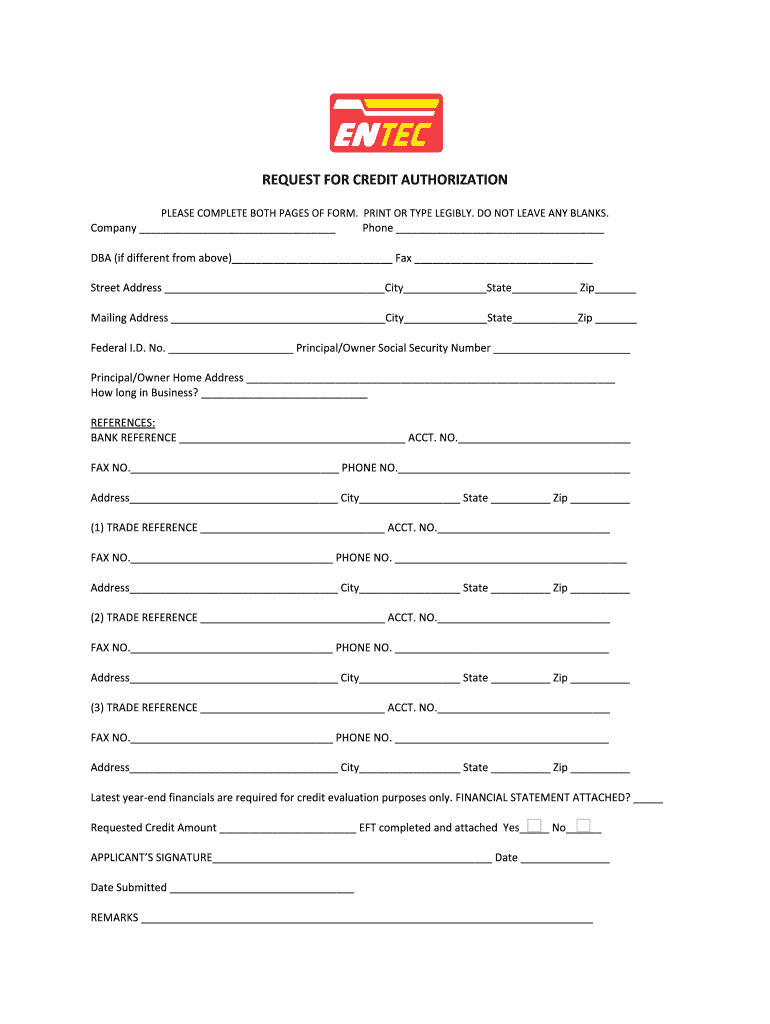

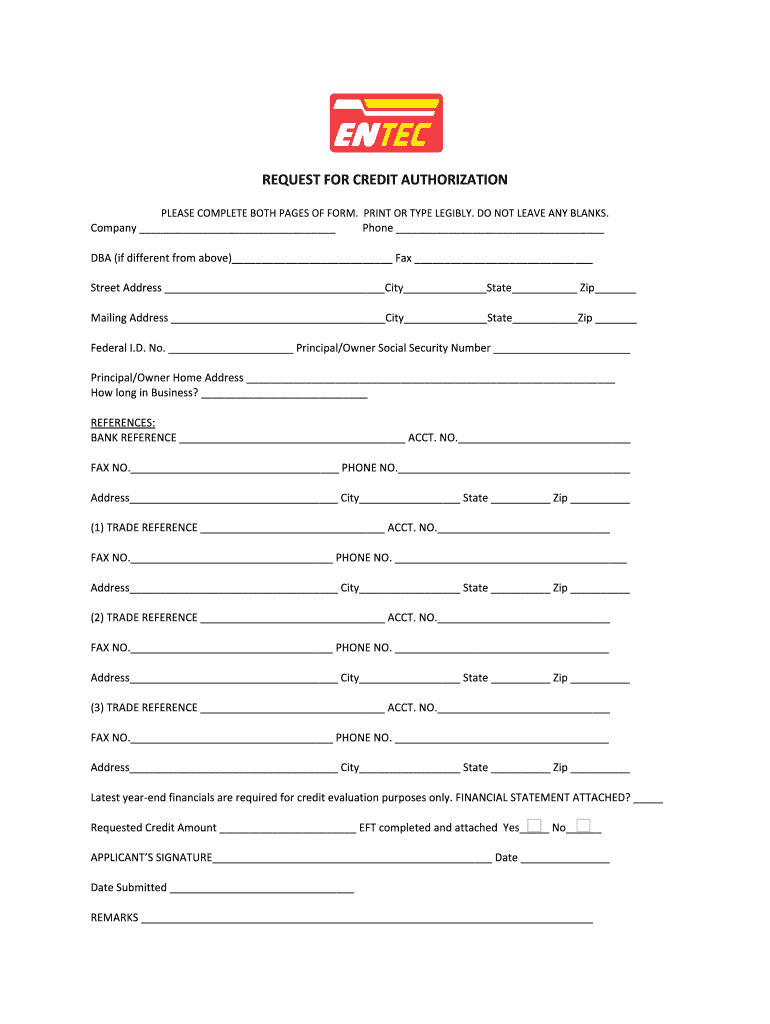

This document is used for requesting credit authorization from Entec Stations, Inc., requiring the applicant to provide personal and business information, references, and financial details.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for credit authorization

Edit your request for credit authorization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for credit authorization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request for credit authorization online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit request for credit authorization. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for credit authorization

How to fill out Request for Credit Authorization

01

Obtain the Request for Credit Authorization form from the appropriate source or organization.

02

Fill in the applicant's name and contact information in the designated fields.

03

Include any relevant account numbers related to the request.

04

Specify the amount of credit being requested and the purpose for the credit.

05

Provide any supporting documentation required, such as financial statements or business plans.

06

Review the form for accuracy and completeness before submission.

07

Submit the completed form to the appropriate department or individual responsible for processing the request.

Who needs Request for Credit Authorization?

01

Individuals or businesses seeking financial assistance or credit from a lender or financial institution.

02

Companies needing to establish credit lines with suppliers or vendors.

03

Organizations applying for funding or financial support from grants or programs.

Fill

form

: Try Risk Free

People Also Ask about

How to authorize a credit card transaction?

Here's how the card authorization process works: The customer initiates the sale. Your processor sends an authorization request. The client's bank reviews the request. It approves or declines the purchase. The payment terminal receives an authorization code.

How long does an authorization hold last on a credit card?

In the case of debit cards, authorization holds can fall off the account, thus rendering the balance available again, anywhere from one to eight business days after the transaction date, depending on the bank's policy. In the case of credit cards, holds may last as long as thirty days, depending on the issuing bank.

How do you write an authorization for a credit card?

Typically it contains: The cardholder's credit card information: Card type, Name on card, Card number, Expiration date. The merchant's business information. Cardholder's billing address. Language authorizing the merchant to charge the customer's card on file. Name and signature of the cardholder. Date.

How do I authorize a credit card transaction?

Here's how the card authorization process works: The customer initiates the sale. Your processor sends an authorization request. The client's bank reviews the request. It approves or declines the purchase. The payment terminal receives an authorization code.

How do I approve a credit card transaction?

Most merchant banks work with a processor network, such as Visa or Mastercard, which allows the merchant to accept various cards from different issuers. When a transaction has been initiated, the payment processor contacts the cardholder's financial institution, also called the issuing bank, to request approval.

Is it safe to fill out a credit card authorization form?

Credit card authorization forms and security Before completing a card authorization form, make sure you're aware of the security risks of sharing your information this way. Both physical and digital forms have disadvantages relating to security, so it's crucial to be mindful of them.

What is a credit card authorization request?

**Definition:**Credit card authorization is an approval from a card issuer, usually through a credit card processor, that the customer has sufficient funds to cover the cost of the transaction.

Why is my credit card transaction not authorized?

Contact your card issuer right away if: you notice an unauthorized or suspicious transaction on your credit or debit account. you lose your card.

How do you write an authorization for a credit card?

Typically it contains: The cardholder's credit card information: Card type, Name on card, Card number, Expiration date. The merchant's business information. Cardholder's billing address. Language authorizing the merchant to charge the customer's card on file. Name and signature of the cardholder. Date.

Can I authorize someone to receive my credit card?

You may assign an authorized representative to receive the card on your behalf in case you will not be around to receive the card upon delivery.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Request for Credit Authorization?

Request for Credit Authorization is a formal document submitted to seek approval for extending credit to a customer or client, particularly in financial or lending institutions.

Who is required to file Request for Credit Authorization?

Entities or individuals seeking to extend credit to customers or clients, such as banks, credit unions, and other financial institutions, are typically required to file a Request for Credit Authorization.

How to fill out Request for Credit Authorization?

To fill out a Request for Credit Authorization, one should provide relevant details such as the applicant's personal and financial information, credit history, the amount of credit requested, and any supporting documentation required by the lender.

What is the purpose of Request for Credit Authorization?

The purpose of Request for Credit Authorization is to evaluate the creditworthiness of an applicant and to obtain necessary approval in order to proceed with extending credit.

What information must be reported on Request for Credit Authorization?

The information that must be reported includes the applicant's name, address, Social Security number or tax ID, income details, credit history, requested credit amount, and any collateral offered.

Fill out your request for credit authorization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Credit Authorization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.