Get the free REPOSSESSION AGENCY AND REPOSSESSION AGENCY QUALIFED MANAGER - bsis ca

Show details

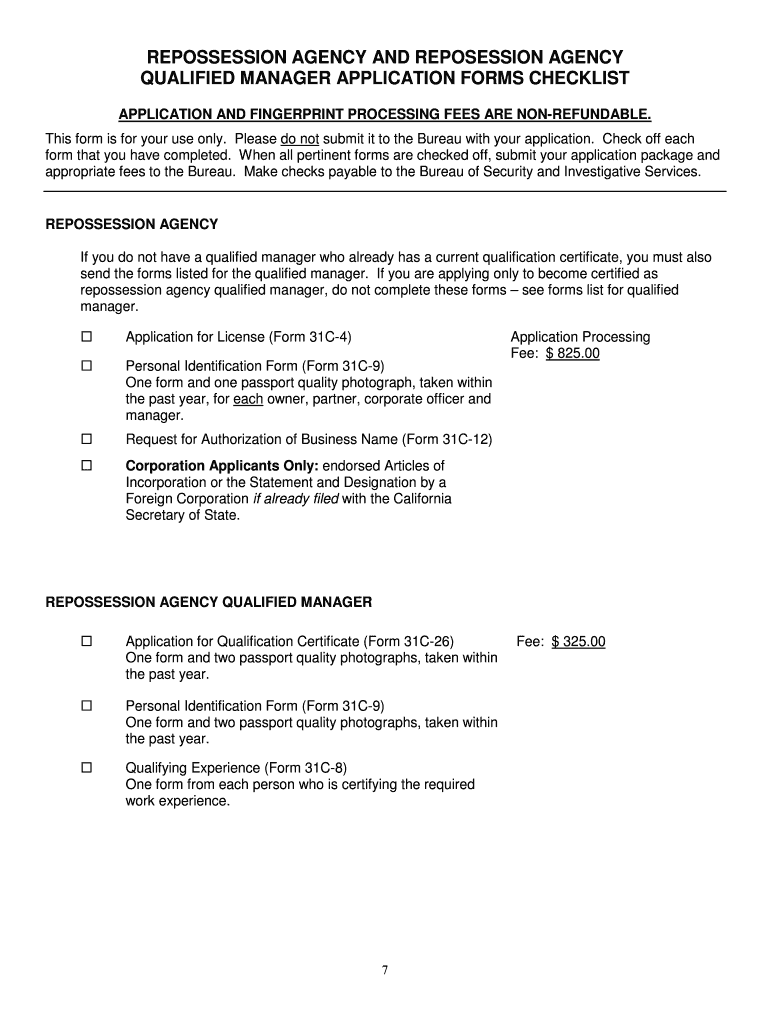

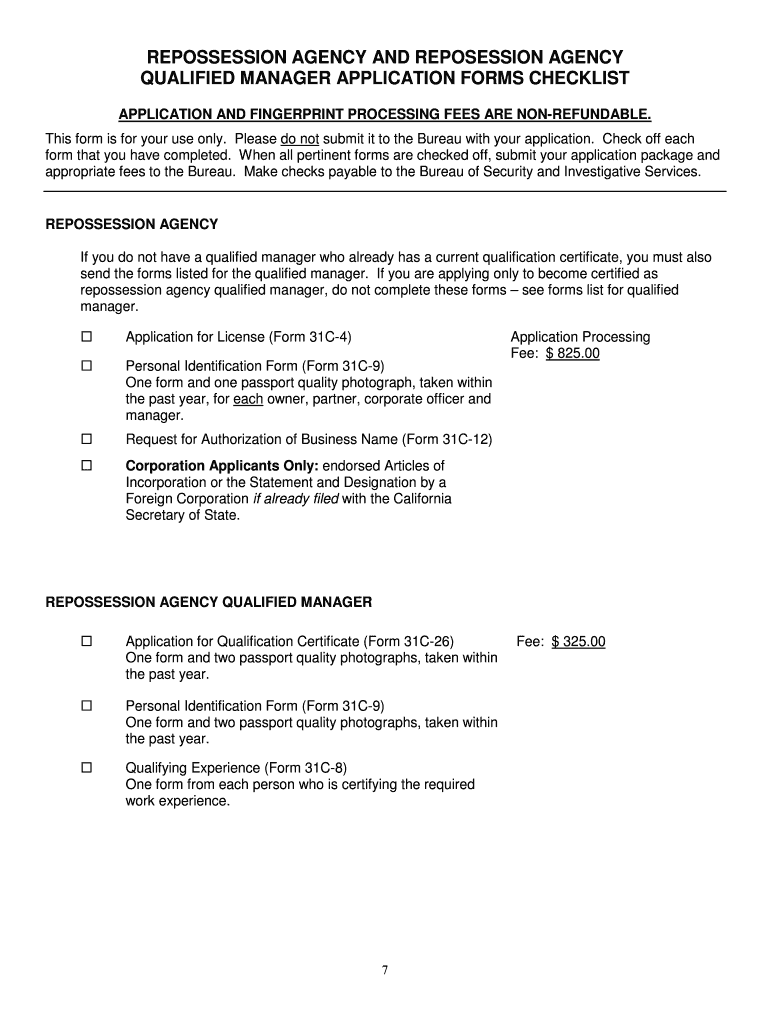

INFORMATION ABOUT LICENSING REPOSSESSION AGENCY AND REPOSSESSION AGENCY QUALIFIED MANAGER This packet contains information about obtaining a Repossession Agency license and a Repossession Agency Qualified

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign repossession agency and repossession

Edit your repossession agency and repossession form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your repossession agency and repossession form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit repossession agency and repossession online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit repossession agency and repossession. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out repossession agency and repossession

How to fill out repossession agency and repossession:

01

Research and understand the legal requirements: Before filling out any paperwork, it is essential to research and understand the legal requirements for operating a repossession agency and carrying out repossession. This includes knowing the specific laws and regulations governing repossession in your jurisdiction.

02

Obtain necessary licenses and certifications: Depending on your jurisdiction, you may need to obtain specific licenses or certifications to operate a repossession agency. Research the requirements and ensure you have all the necessary paperwork in order before proceeding.

03

Set up a business entity: If you're starting a repossession agency, it's important to establish a legal business entity, such as a limited liability company (LLC) or corporation. Consult with a lawyer or business advisor to determine the most suitable structure for your agency.

04

Obtain insurance and bonding: Repossession agencies typically require insurance coverage to protect against liability and potential damages during the repossession process. Find a reputable insurance provider that offers specialized coverage for repossession agencies. Additionally, bonding may be required in some jurisdictions to demonstrate financial responsibility.

05

Develop standard operating procedures: Establish clear and comprehensive standard operating procedures (SOPs) for your repossession agency. These SOPs should outline the process for handling repossession orders, communicating with clients, and addressing any potential issues that may arise during repossession.

06

Hire qualified repossession agents: To carry out repossession, you will need to hire qualified repossession agents. Look for individuals who possess the necessary licensing, training, and experience in the repossession industry. Conduct thorough background checks and ensure they comply with all legal requirements.

07

Implement record-keeping practices: Maintaining meticulous records is crucial in the repossession business. Develop a system for documenting each repossession, including relevant dates, times, locations, and any necessary documentation or evidence. This will help protect both your agency and your clients in case of any disputes or legal issues that may arise.

08

Ensure compliance with debt collection laws: Repossession agencies, by nature, often engage in debt collection activities. Familiarize yourself with the debt collection laws in your jurisdiction, and ensure your agency operates in full compliance. This includes adhering to proper communication practices, seeking legal advice when necessary, and respecting debtor rights.

Who needs repossession agency and repossession:

01

Financial institutions: Banks, credit unions, and other financial institutions frequently partner with repossession agencies to recover collateral that was used as security for loans, such as vehicles and real estate properties.

02

Auto dealerships: Car dealerships often rely on repossession agencies to repossess vehicles from customers who have defaulted on their loan or lease payments.

03

Property owners and management companies: Landlords, property owners, and management companies may require repossession services to recover possession of rental properties from tenants who have violated lease agreements or failed to pay rent.

04

Government agencies: Government agencies, such as tax authorities or law enforcement, may enlist the services of repossession agencies to recover property or assets related to delinquent tax payments or criminal investigations.

05

Insurance companies: Insurance companies may need repossession agencies to assist in the recovery of stolen or fraudulently obtained insurance assets, such as vehicles or high-value equipment.

Overall, repossession agencies and repossession services play a vital role for various entities in recovering assets and enforcing legal rights in cases of default or noncompliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify repossession agency and repossession without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your repossession agency and repossession into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit repossession agency and repossession straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing repossession agency and repossession.

How do I complete repossession agency and repossession on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your repossession agency and repossession. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is repossession agency and repossession?

Repossession agency is a company or entity that specializes in repossessing property or assets from individuals or businesses who have defaulted on their payments. Repossession is the act of taking back this property or asset.

Who is required to file repossession agency and repossession?

Any repossession agency or individual who engages in repossession activities is required to file repossession reports.

How to fill out repossession agency and repossession?

Repossession agencies and individuals can fill out repossession reports by providing details such as the date of repossession, the reason for repossession, and any relevant documentation.

What is the purpose of repossession agency and repossession?

The purpose of repossession agency and repossession is to legally repossess property or assets from individuals or businesses who have failed to make their payments.

What information must be reported on repossession agency and repossession?

Repossession reports must include details such as the name of the debtor, description of the property repossessed, and the date of repossession.

Fill out your repossession agency and repossession online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Repossession Agency And Repossession is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.