Get the free FINRA Dispute Resolution Arbitrator Applicant Consent to Background Investigation - ...

Show details

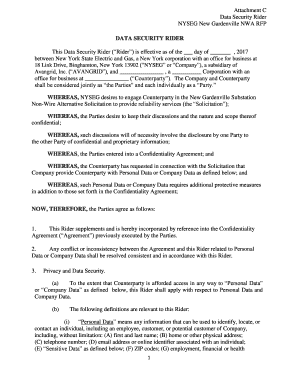

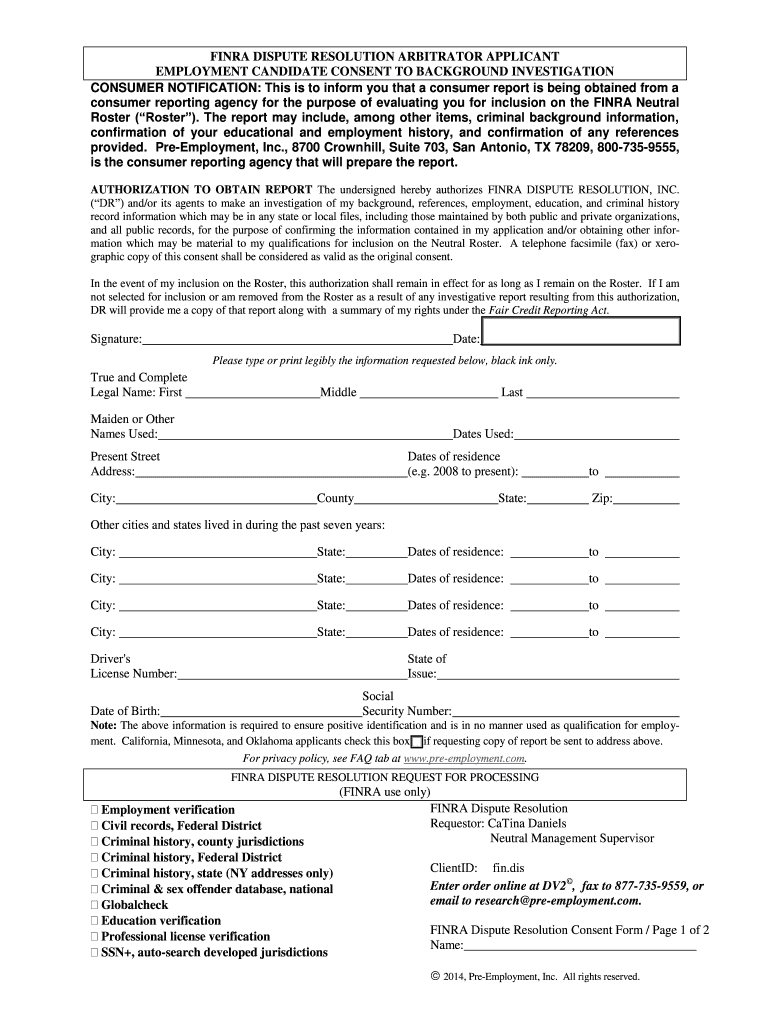

This document serves as a consent form for individuals applying for inclusion on the FINRA Neutral Roster, allowing the organization to conduct background checks including employment history, criminal

We are not affiliated with any brand or entity on this form

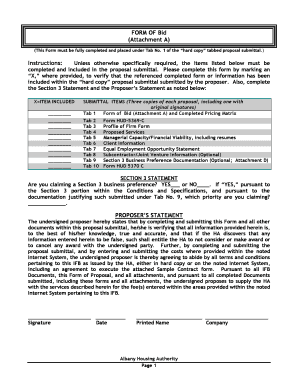

Get, Create, Make and Sign finra dispute resolution arbitrator

Edit your finra dispute resolution arbitrator form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your finra dispute resolution arbitrator form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing finra dispute resolution arbitrator online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit finra dispute resolution arbitrator. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out finra dispute resolution arbitrator

How to fill out FINRA Dispute Resolution Arbitrator Applicant Consent to Background Investigation

01

Obtain the FINRA Dispute Resolution Arbitrator Applicant Consent to Background Investigation form.

02

Read the instructions carefully to understand the purpose of the consent form.

03

Provide your full name, contact information, and other personal details as required.

04

Complete the section that authorizes FINRA to conduct a background investigation.

05

Carefully review the disclosures regarding the use of your information.

06

Sign and date the form at the designated section.

07

Submit the completed form to the appropriate FINRA office or designated contact as instructed.

Who needs FINRA Dispute Resolution Arbitrator Applicant Consent to Background Investigation?

01

Individuals applying to become arbitrators in FINRA dispute resolution cases.

02

Current arbitrators who are undergoing re-evaluation or renewal of their status.

03

Anyone in the financial industry who intends to serve as a neutral in dispute resolutions handled by FINRA.

Fill

form

: Try Risk Free

People Also Ask about

What disqualifies you from FINRA?

Any felony conviction within the previous 10 years is an automatic disqualification for FINRA. However, even after 10 years, any felony conviction of fraud, theft, or of a fraudulent nature must still be disclosed. In these instances FINRA would conduct an individual review to determine eligibility.

What disqualifies you on a FINRA background check?

FINRA Disqualification Criteria Felony convictions for 10 years following the conviction date. Certain misdemeanor convictions for 10 years from the conviction date. Temporary or permanent injunctions for unlawful securities or investment banking activities.

How far back does the FINRA background check go?

FINRA, other self-regulatory organizations (SROs) and jurisdictions use the Form U4 to elicit employment history, disciplinary and other information about individuals to register them.

What disqualifies you from a FINRA background check?

FINRA Disqualification Criteria Felony convictions for 10 years following the conviction date. Certain misdemeanor convictions for 10 years from the conviction date. Temporary or permanent injunctions for unlawful securities or investment banking activities.

What crimes disqualify you from FINRA?

Some events that may cause an individual to be subject to statutory disqualification include an SEC or SRO bar from association with a broker-dealer, all felony convictions and certain misdemeanor convictions within the last ten years, certain investment-related temporary or permanent injunctions, as well as a variety

What is the FINRA rule for background checks?

The FINRA Rule 3110(e) sets forth precise requirements about the steps that member institutions must follow to review applicant backgrounds, employment experience, and criminal and regulatory disciplinary histories before onboarding an employee.

How far back does FINRA Broker check go?

A BrokerCheck report for an individual who meets any of these criteria will typically include the same information categories as outlined above for individuals registered within the last 10 years. BrokerCheck may have limited information for individuals whose last registration ended before August 1999.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FINRA Dispute Resolution Arbitrator Applicant Consent to Background Investigation?

It is a form that grants permission for FINRA to conduct a background check on individuals applying to become arbitrators in dispute resolution proceedings.

Who is required to file FINRA Dispute Resolution Arbitrator Applicant Consent to Background Investigation?

Individuals who wish to be considered for appointment as arbitrators by FINRA are required to file this consent form.

How to fill out FINRA Dispute Resolution Arbitrator Applicant Consent to Background Investigation?

Applicants must complete the form by providing personal information, such as name, address, date of birth, and other identifying details, and then sign and date the form to provide consent.

What is the purpose of FINRA Dispute Resolution Arbitrator Applicant Consent to Background Investigation?

The purpose is to ensure that FINRA can verify the background and qualifications of applicants to maintain the integrity of the arbitration process.

What information must be reported on FINRA Dispute Resolution Arbitrator Applicant Consent to Background Investigation?

Applicants must report personal identification information, previous employment history, educational background, relevant professional licenses, and any legal or regulatory actions that could affect their suitability as arbitrators.

Fill out your finra dispute resolution arbitrator online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Finra Dispute Resolution Arbitrator is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.