CA DE 926C 2003 free printable template

Show details

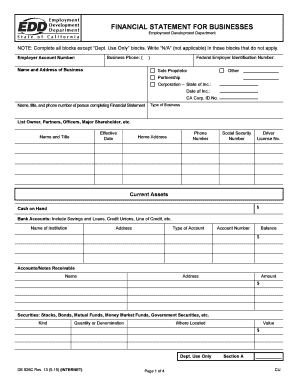

DE 926C Rev. ... CA Corp. ID No. Name, title, and phone number of person completing Financial Statement Type of Business ... EDD Taxes (Employer portion).

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA DE 926C

Edit your CA DE 926C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA DE 926C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA DE 926C online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA DE 926C. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA DE 926C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA DE 926C

How to fill out CA DE 926C

01

Obtain a blank copy of CA DE 926C from the California Employment Development Department website or your local office.

02

Fill in your personal information such as your name, address, and Social Security number in the designated fields.

03

Provide details about your employment history and reason for filing the claim.

04

Indicate the weeks for which you are claiming benefits by marking the appropriate boxes.

05

Review your information for accuracy and completeness.

06

Sign and date the form at the bottom before submitting.

07

Submit the completed form online, by mail, or in person as per the instructions provided.

Who needs CA DE 926C?

01

Individuals who are unemployed or underemployed and seeking unemployment benefits in California.

02

Workers who have lost their job due to circumstances beyond their control, such as layoffs or company closures.

03

Self-employed individuals who qualify for unemployment benefits under specific conditions.

Fill

form

: Try Risk Free

People Also Ask about

What is a financial statement for a business?

Financial statements are a set of documents that show your company's financial status at a specific point in time. They include key data on what your company owns and owes and how much money it has made and spent.

What are the four financial statements usually prepared for a business?

For-profit businesses use four primary types of financial statement: the balance sheet, the income statement, the statement of cash flow, and the statement of retained earnings.

What are the 5 components of the financial statements?

The elements of the financial statements will be assets, liabilities, net assets/equity, revenues and expenses. It is noted in Study 1 that moving along the spectrum from cash to accrual accounting does not mean a loss of the cash based information which can still be generated from an accrual accounting system.

How do you fill out a business financial statement?

Lay out your income statement. Put the net sales on one line. Underneath that, put the cost of sales. Put the operating costs in general categories underneath the gross profit. Next, have a line each for the interest and the taxes. The final line should be the net income.

How do I get a business financial statement?

Financial information can be found on the company's web page in Investor Relations where Securities and Exchange Commission (SEC) and other company reports are often kept. The SEC has financial filings electronically available beginning in 1993/1994 free on their website.

What is a financial statement for a business form?

A Business Financial Statement Form is a document that provides an outline of the financial activities of a company over a given or specific period of time. Financial analysts use data in a Business Financial Statement to assess where the company is going in terms of its stock price.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the CA DE 926C in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your CA DE 926C in seconds.

How do I fill out CA DE 926C using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign CA DE 926C and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete CA DE 926C on an Android device?

Use the pdfFiller mobile app to complete your CA DE 926C on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is CA DE 926C?

CA DE 926C is a form used in California for reporting employee wages and withholding tax information to the state.

Who is required to file CA DE 926C?

Employers who have employees working in California and are required to report wages and withholding tax must file CA DE 926C.

How to fill out CA DE 926C?

To fill out CA DE 926C, employers must enter specific employee information, including names, Social Security numbers, wages, and the amounts of taxes withheld for the reporting period.

What is the purpose of CA DE 926C?

The purpose of CA DE 926C is to provide the California Employment Development Department (EDD) with accurate records of employee wages and taxes withheld, ensuring compliance with state tax laws.

What information must be reported on CA DE 926C?

The information that must be reported on CA DE 926C includes the employer's identification details, employee names, Social Security numbers, total wages paid, and the amounts of California state income tax withheld.

Fill out your CA DE 926C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA DE 926c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.