Get the free basis in stock of the corporation

Show details

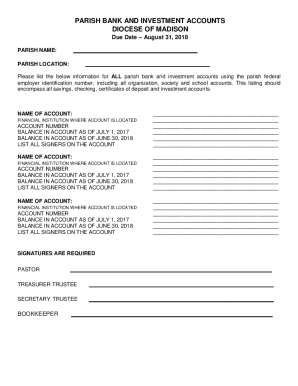

STATE OF HAWAII DEPARTMENT OF TAXATION. 2012. Shareholders#39’s Instructions for Schedule K-1 (Form N-35). Shareholders#39’s Share of Income, Credits, ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign basis in stock of

Edit your basis in stock of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your basis in stock of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit basis in stock of online

Follow the steps below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit basis in stock of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out basis in stock of

Point by point instructions on how to fill out basis in stock of:

01

Gather all necessary information: Before filling out the basis in stock form, gather all relevant information such as the ticker symbol or name of the stock, the date of acquisition, the purchase price, any commissions or fees associated with the purchase, and any adjustments or events that may have occurred during the ownership of the stock.

02

Determine the method of calculation: There are multiple methods to calculate the basis in stock, such as the FIFO (First-In-First-Out), LIFO (Last-In-First-Out), specific identification, or average cost method. Choose the method that is most suitable for your situation and ensure you understand the implications of each method.

03

Complete the necessary sections: Fill out the basis in stock form by accurately entering the required information in the corresponding sections. This may include providing details on the stock, acquisition date, purchase price, adjustments, and any transactions related to the stock.

04

Calculate and report any adjustments: If there have been any adjustments to the basis in stock such as stock splits, dividends, or return of capital, make sure to accurately calculate and report these adjustments in the designated sections of the form.

05

Keep supporting documentation: It is essential to keep all supporting documentation related to the basis in stock calculation, such as purchase receipts, brokerage statements, and any other relevant records. These documents may be required for future reference or during audits.

Who needs basis in stock of?

01

Individual investors: Individual investors who own stocks or other investment securities may need to calculate and report their basis in stock for various purposes such as tax filings, determining gains or losses on stock sales, or for tracking their investment performance.

02

Traders and portfolio managers: Traders and portfolio managers who actively buy and sell stocks on behalf of themselves or their clients also need to maintain accurate records of the basis in stock. This information helps in tracking the performance of trades, assessing investment strategies, and calculating taxable gains or losses.

03

Tax professionals and accountants: Tax professionals and accountants play a crucial role in assisting individuals and businesses with tax preparations and filings. They may need to understand and calculate the basis in stock on behalf of their clients to ensure accurate reporting and compliance with tax regulations.

In summary, understanding how to fill out the basis in stock of involves gathering necessary information, choosing a suitable method of calculation, accurately completing the form, reporting any adjustments, and keeping supporting documentation. This process is important for individual investors, traders, portfolio managers, and tax professionals who deal with stocks and other investment securities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is basis in stock of?

Basis in stock refers to the original cost of a stock for tax purposes.

Who is required to file basis in stock of?

Individuals who have bought or sold stock during the tax year are required to file basis in stock.

How to fill out basis in stock of?

Basis in stock can be filled out by providing the original cost of the stock, any adjustments, and the final basis value.

What is the purpose of basis in stock of?

The purpose of basis in stock is to calculate the capital gains tax that an individual owes when selling stock.

What information must be reported on basis in stock of?

The information that must be reported on basis in stock includes original cost, adjustments, and the final basis value.

How can I get basis in stock of?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific basis in stock of and other forms. Find the template you need and change it using powerful tools.

How do I edit basis in stock of online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your basis in stock of and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I sign the basis in stock of electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your basis in stock of in seconds.

Fill out your basis in stock of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Basis In Stock Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.