Get the free Modifications to Benefit-Specific Annual Dollar Limits Policy Endorsement

Show details

This document outlines modifications to annual dollar limits in health insurance policies in compliance with the Patient Protection and Affordable Care Act (PPACA), specifically regarding essential

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign modifications to benefit-specific annual

Edit your modifications to benefit-specific annual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your modifications to benefit-specific annual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing modifications to benefit-specific annual online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit modifications to benefit-specific annual. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out modifications to benefit-specific annual

How to fill out Modifications to Benefit-Specific Annual Dollar Limits Policy Endorsement

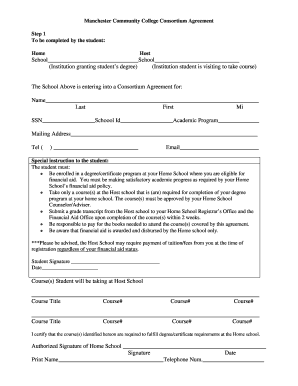

01

Start by accessing the Modifications to Benefit-Specific Annual Dollar Limits Policy Endorsement form.

02

Fill in the policyholder's information at the top of the form, including name, address, and contact details.

03

Identify the specific benefit categories that require modifications by checking the relevant boxes.

04

Indicate the current dollar limits for each benefit category listed on the form.

05

Provide the proposed new dollar limits for each of the benefit categories that are being modified.

06

Justify the requested modifications by providing any necessary details or documentation, if needed.

07

Review the completed form for any errors or missing information.

08

Sign and date the form to certify that all information is true and accurate.

09

Submit the form to the insurance provider according to their submission guidelines.

Who needs Modifications to Benefit-Specific Annual Dollar Limits Policy Endorsement?

01

Individuals or entities with existing insurance policies that have specific annual dollar limits for certain benefits who wish to adjust those limits.

02

Policyholders who anticipate changes in their healthcare needs that may require increased financial coverage.

03

Insurance agents or brokers assisting clients with specific policy modifications related to annual dollar limits.

Fill

form

: Try Risk Free

People Also Ask about

What is a good annual maximum on dental insurance?

A dental annual maximum is the total amount your dental plan will pay toward your care in a 12-month period (also known as the benefit period). Annual maximums typically range between $1,000 and $2,000 – and most people never reach this amount in their benefit period.

What does annual limit mean with insurance?

Annual maximum benefit: The yearly maximum amount that the insurance company will pay for the benefits for which you are covered.

What does insurance limit mean?

Also known as your coverage amount, your insurance limit is the maximum amount your insurer may pay out for a claim, as stated in your policy.

What is the difference between annual limit and lifetime limit?

Annual limit means there is a cap on the benefits that your insurance company will pay in a year. Once you have reached that limit, you have to bear the rest of the costs for that year. Lifetime limit means the cap on the benefits you will receive during the entire period that you're attached in a medical plan.

What are the final rules of Stldi?

Insurance companies can't set a dollar limit on what they spend on essential health benefits for your care during the entire time you're enrolled in that plan.

What is annual cover limit?

An annual limit is the maximum amount we can help with the bills for your services and items included on your cover within a financial year (1 July to 30 June).

What is annual maximum benefit health insurance?

In the final rule, the departments revised the definition of STLDI to limit the length of the initial contract term to no more than three months and the maximum coverage period to no more than four months, taking into account any renewals or extensions.

How do annual limits work?

Annual limits are the total benefits an insurance company will pay in a year while an individual is enrolled in a particular health insurance plan. Starting in 2014, the Affordable Care Act bans annual dollar limits.

What is the annual maximum limit?

The term annual limit is used in several ways when talking about health insurance. An annual limit can refer to the maximum amount that a person will have to pay in out-of-pocket costs when they need medical care.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

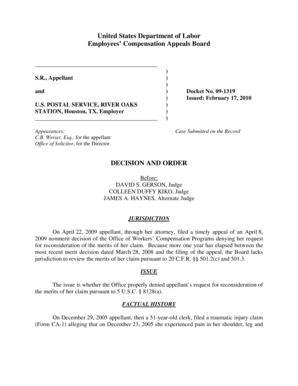

What is Modifications to Benefit-Specific Annual Dollar Limits Policy Endorsement?

The Modifications to Benefit-Specific Annual Dollar Limits Policy Endorsement is an amendment to an insurance policy that allows the insured to change or update the dollar limits associated with specific benefits covered under the policy. It addresses regulatory changes or updates in the coverage needed by the insured.

Who is required to file Modifications to Benefit-Specific Annual Dollar Limits Policy Endorsement?

Insurance providers and policyholders who wish to adjust the benefit-specific dollar limits in their insurance contracts are required to file the Modifications to Benefit-Specific Annual Dollar Limits Policy Endorsement.

How to fill out Modifications to Benefit-Specific Annual Dollar Limits Policy Endorsement?

To fill out the Modifications to Benefit-Specific Annual Dollar Limits Policy Endorsement, the policyholder must provide their policy number, specify the benefit categories for which the limits are being modified, state the new dollar amounts, and sign the endorsement form.

What is the purpose of Modifications to Benefit-Specific Annual Dollar Limits Policy Endorsement?

The purpose of the Modifications to Benefit-Specific Annual Dollar Limits Policy Endorsement is to ensure that insurance policies remain compliant with regulatory standards and meet the changing needs of policyholders regarding coverage limits.

What information must be reported on Modifications to Benefit-Specific Annual Dollar Limits Policy Endorsement?

The information that must be reported includes the policyholder's name, policy number, details of the benefits being modified, the old and new dollar limits, and the effective date of the modifications.

Fill out your modifications to benefit-specific annual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Modifications To Benefit-Specific Annual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.