NE DHHS FSP 1040 Supplement 2008-2025 free printable template

Show details

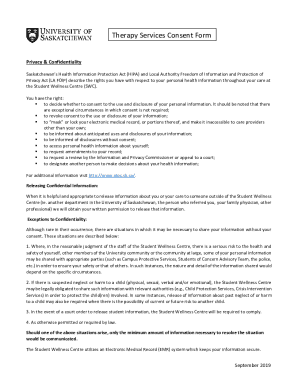

MC Name: MC# FSP 1040 Supplement (Used with the 1040 tax return and all schedules filed with IRS.) Tax Year Complete this document listing payments on the principal of the purchase price of income

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NE DHHS FSP 1040 Supplement

Edit your NE DHHS FSP 1040 Supplement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NE DHHS FSP 1040 Supplement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NE DHHS FSP 1040 Supplement online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NE DHHS FSP 1040 Supplement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out NE DHHS FSP 1040 Supplement

How to fill out NE DHHS FSP 1040 Supplement

01

Obtain the NE DHHS FSP 1040 Supplement form from the Nebraska Department of Health and Human Services website or your local office.

02

Read the instructions carefully to understand the requirements and eligibility criteria.

03

Fill in your personal information at the top of the form, including your name, address, and contact information.

04

Specify your household composition by listing the names and relationship of all household members.

05

Provide details regarding your income sources, including wages, benefits, and other earnings.

06

Document any expenses you have, such as rent/mortgage, utilities, childcare, and medical costs.

07

Double-check all the information for accuracy and completeness before submitting the form.

08

Submit the completed form to the appropriate NE DHHS office by mail or in-person.

Who needs NE DHHS FSP 1040 Supplement?

01

Individuals and families seeking assistance from the Nebraska Department of Health and Human Services (DHHS) programs, particularly those related to food assistance or other financial help.

Fill

form

: Try Risk Free

People Also Ask about

How do you fill out profit or loss from a business?

How to Write a Profit and Loss Statement Step 1 – Track Your Revenue. Step 2 – Determine the Cost of Sales. Step 3 – Figure Out Your Gross Profit. Step 4 – Add Up Your Overhead. Step 5 – Calculate Your Operating Income. Step 6 – Adjust for Other Income and/or Expenses. Step 7 – Net Profit: The Bottom Line.

What is a Schedule C for profit loss from a business?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit. You are involved in the activity with continuity and regularity.

How to calculate line 11 on 1040?

This is your total income. On line 10, fill in your total adjustments to income from line 26 of Schedule 1 (if applicable). On line 11 of your 1040, subtract line 10, your total adjustments to income, from line 9, your total income. This is your AGI.

What goes in line 16 on 1040?

The next section is all about your refund. If the number on Line 19 (your total payments) is greater than the number on Line 16 (your total tax) then you have overpaid the government and are due a refund. Subtract Line 16 from Line 19 to get the amount by which you overpaid and enter it on Line 20.

How do I fill out my 1040 form?

0:46 11:47 How to Fill Out Form 1040 for 2022 | Taxes 2023 | Money Instructor YouTube Start of suggested clip End of suggested clip Finally you will determine your tax bill or refund. This will tell you whether you have already paidMoreFinally you will determine your tax bill or refund. This will tell you whether you have already paid any or all of your tax bill and whether you are eligible for a refund if you have overpaid.

How do I fill out a Schedule C profit or loss from a business?

Steps To Completing Schedule C Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. If You Have a Business Loss.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NE DHHS FSP 1040 Supplement directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your NE DHHS FSP 1040 Supplement and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete NE DHHS FSP 1040 Supplement online?

Easy online NE DHHS FSP 1040 Supplement completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I edit NE DHHS FSP 1040 Supplement on an iOS device?

Use the pdfFiller mobile app to create, edit, and share NE DHHS FSP 1040 Supplement from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is NE DHHS FSP 1040 Supplement?

The NE DHHS FSP 1040 Supplement is a form used in Nebraska to report additional financial information for individuals or families applying for or receiving Supplemental Nutrition Assistance Program (SNAP) benefits.

Who is required to file NE DHHS FSP 1040 Supplement?

Individuals or families who are applying for or currently receiving SNAP benefits in Nebraska are required to file the NE DHHS FSP 1040 Supplement to provide the necessary financial details.

How to fill out NE DHHS FSP 1040 Supplement?

To fill out the NE DHHS FSP 1040 Supplement, applicants must provide accurate information regarding their income, expenses, household composition, and other relevant financial details as specified on the form.

What is the purpose of NE DHHS FSP 1040 Supplement?

The purpose of the NE DHHS FSP 1040 Supplement is to collect detailed financial information to determine eligibility and benefit levels for SNAP assistance.

What information must be reported on NE DHHS FSP 1040 Supplement?

The NE DHHS FSP 1040 Supplement requires reporting on income sources, monthly expenses, household members, and any other financial details that impact eligibility for SNAP benefits.

Fill out your NE DHHS FSP 1040 Supplement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NE DHHS FSP 1040 Supplement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.