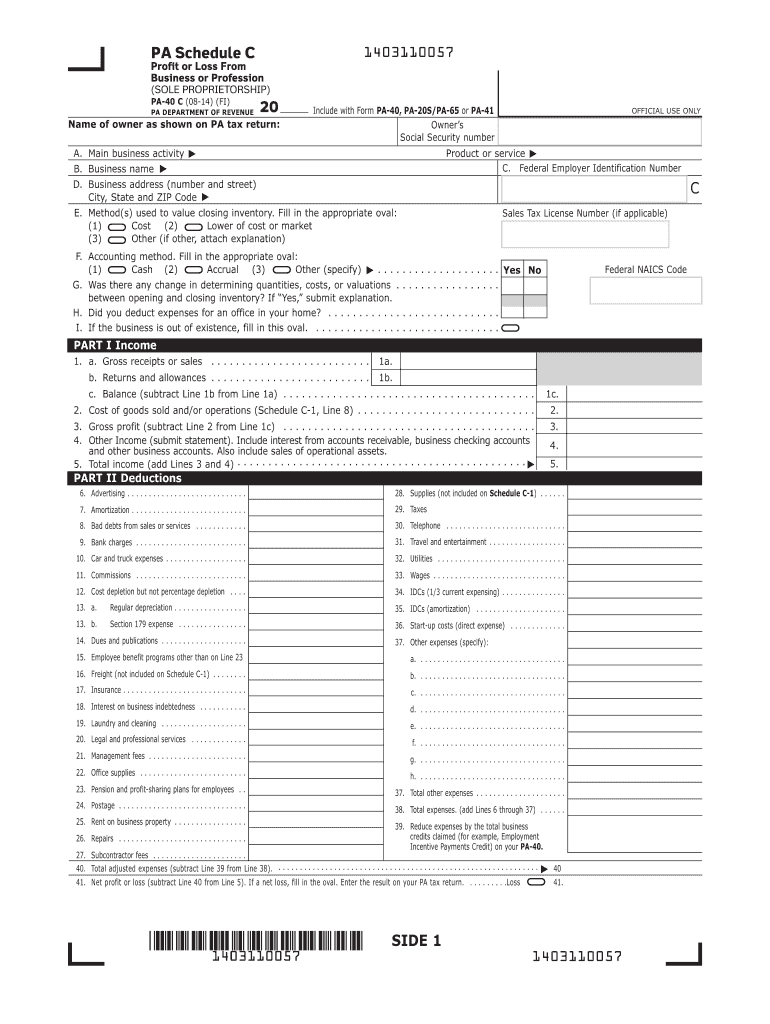

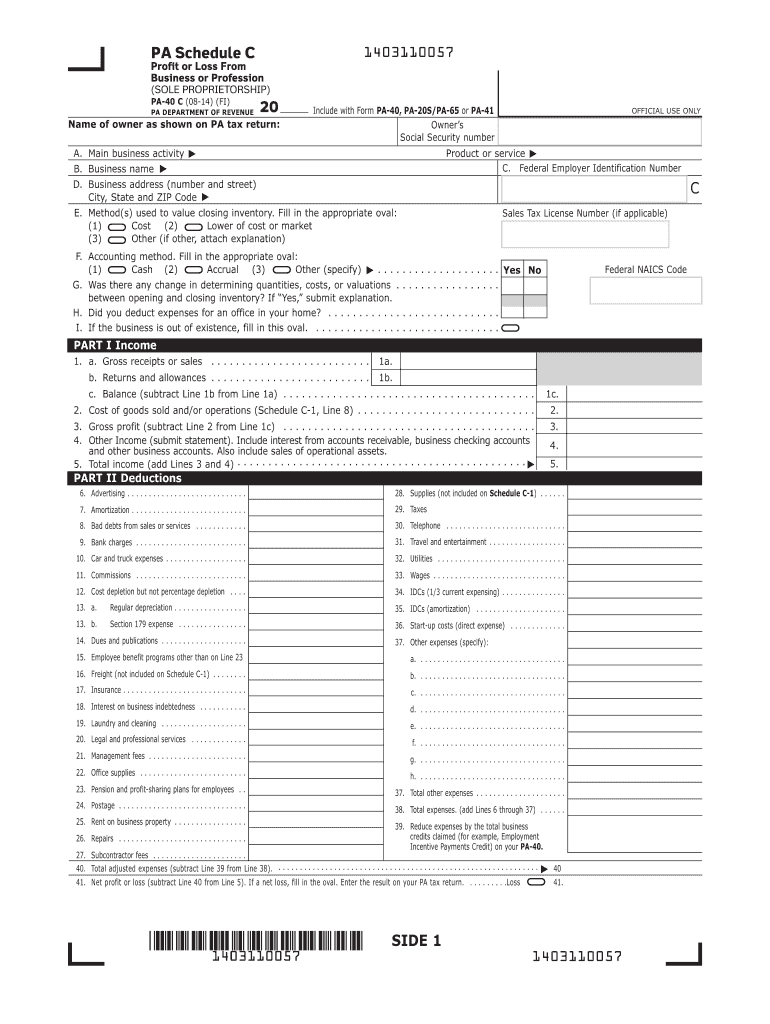

Get the free Federal NAICS Code

Show details

PA-40IN -- 2015 Pennsylvania Personal Income Tax Return Instructions PA-40 A -- 2015 PA Schedule A Interest ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal naics code

Edit your federal naics code form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal naics code form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit federal naics code online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit federal naics code. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal naics code

How to fill out federal naics code:

01

Start by researching the industry in which your business operates. The North American Industry Classification System (NAICS) provides a standardized way to classify businesses into specific industry sectors. Familiarize yourself with the different codes and descriptions to identify the most appropriate one for your business.

02

Once you have identified the correct code, visit the official website of the U.S. Census Bureau, which manages the NAICS system. Search for the NAICS code search tool or database, typically found in the "Economic Programs" or "Business" section of their website.

03

Enter relevant keywords or a brief description of your business activities into the search tool. It will generate a list of potential NAICS codes that match your business.

04

Carefully review the list and select the code that most accurately represents your primary business activities. Consider factors such as the goods or services you provide, your target market, and the nature of your operations.

05

Once you have determined the appropriate NAICS code for your business, you can start using it on various documents, such as tax returns, applications for government contracts, and surveys. Ensure that you consistently use the same NAICS code on all relevant forms and paperwork.

Who needs federal NAICS code?

01

Small and large businesses alike may need a federal NAICS code. It is especially important for government agencies, statistical agencies, and organizations involved in data analysis and economic research. They rely on NAICS codes to classify and analyze businesses within specific industries.

02

Startups and entrepreneurs may also need a federal NAICS code when starting their business or applying for loans, grants, or licenses. It helps government agencies and lenders understand the nature of the business and its industry.

03

Additionally, businesses seeking to participate in government contracts or apply for government certifications may be required to provide their NAICS code. It helps government agencies identify appropriate vendors and evaluate their qualifications.

Overall, understanding how to fill out federal NAICS codes and who needs them is crucial for accurate business classification, market research, access to government resources, and compliance with various reporting requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the federal naics code in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your federal naics code and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I edit federal naics code on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing federal naics code.

Can I edit federal naics code on an iOS device?

Create, modify, and share federal naics code using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is federal naics code?

Federal NAICS code is a classification system used by federal agencies to categorize businesses based on their primary type of economic activity.

Who is required to file federal naics code?

All businesses operating in the United States are required to file a federal NAICS code.

How to fill out federal naics code?

You can find your NAICS code by searching for your industry on the NAICS official website and then include it on relevant forms or documents when requested.

What is the purpose of federal naics code?

The purpose of federal NAICS code is to standardize and classify businesses based on their economic activities, which helps with data collection, analysis, and reporting.

What information must be reported on federal naics code?

Businesses must report their primary type of economic activity, such as manufacturing, retail, or services, using the designated NAICS code.

Fill out your federal naics code online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Naics Code is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.