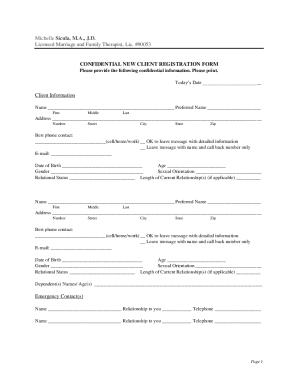

CA RE 207 2013 free printable template

Show details

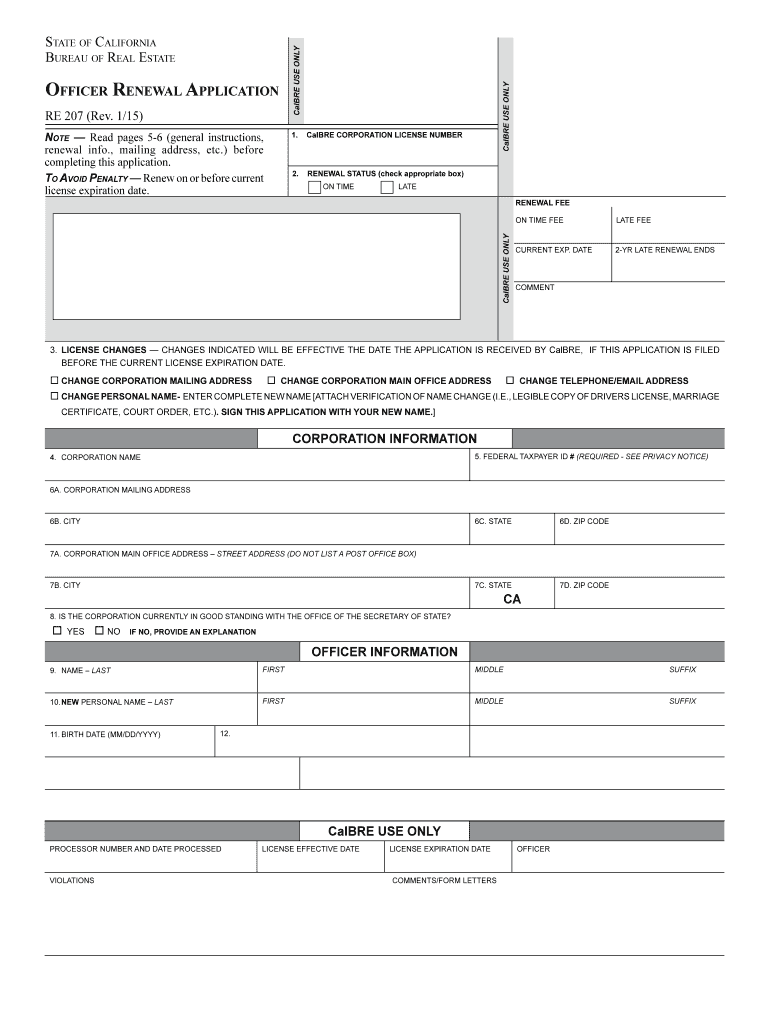

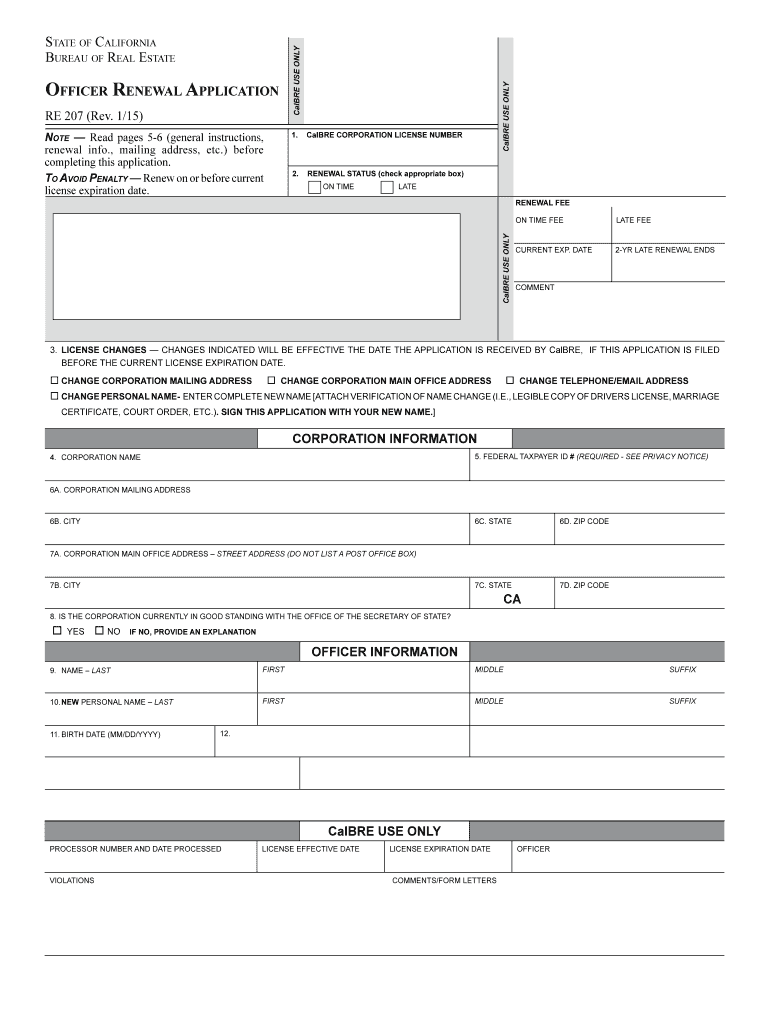

RE 207 (Rev. 1/16). 1. Cal BRE CORPORATION LICENSE NUMBER. 2. ... IF NO, A CONSENT TO SERVICE OF PROCESS (RE 234) MUST BE ON FILE WITH Cal BRE. ..... or authority of this state or an agency of the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA RE 207

Edit your CA RE 207 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA RE 207 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA RE 207 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA RE 207. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA RE 207 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA RE 207

How to fill out CA RE 207

01

Obtain the CA RE 207 form from the California Department of Real Estate website or your local office.

02

Enter your personal information in the designated sections, including your name, contact information, and license number.

03

Provide details regarding your current employment status and history in the real estate field.

04

Complete the sections related to any disciplinary actions or legal issues, if applicable.

05

Review the form for accuracy and completeness before submission.

06

Sign and date the form where indicated.

07

Submit the form to the specified address or online, as guided.

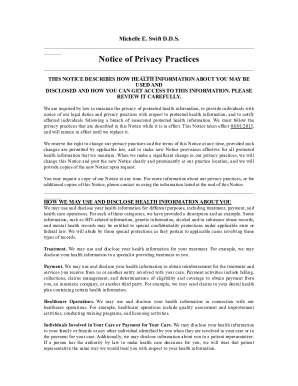

Who needs CA RE 207?

01

Anyone applying for or renewing a real estate license in California.

02

Individuals seeking to report a change in their licensing status.

03

Real estate professionals involved in disciplinary actions or needing to clarify their background.

Fill

form

: Try Risk Free

People Also Ask about

How much does it cost to annual renewal real estate license in California?

Renewal Fees SalespersonBrokerOn Time Renewal$245$300Late Renewal (within 2 years after license expiration date)$367$450

What is the grace period for the renewal of a salesperson's or broker's license?

If you miss renewing your real estate license your expiration date, there is a grace period. In California, you can renew your real estate license at any time up to two years after the expiration.

How much does it cost to renew a real estate license in California?

Renewal Fees SalespersonBrokerOn Time Renewal$245$300Late Renewal (within 2 years after license expiration date)$367$450

How do I renew my expired CA real estate license?

Here's How to Renew Your Real Estate License in California Complete the required real estate continuing education at any accredited real estate school, like CA Realty Training. Go to eLicensing on the Department of Real Estate website and enter your course completion numbers. Pay the real estate license renewal fee.

How long do you have to renew your real estate license in California?

Licenses are issued for a four-year period and should be renewed prior to the expiration date listed on the license. As a reminder, the DRE mails a renewal reminder letter to the licensee's mailing address of record approximately 60 days prior to the license expiration date.

How much does a real estate license cost in California?

California state fees to become a real estate salesperson include a $60 exam fee and $245 licensing fee. Other costs include Pre-Licensing course tuition, which can range anywhere from $125 up to $700 depending on the package and the provider.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the CA RE 207 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your CA RE 207 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I edit CA RE 207 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing CA RE 207.

Can I edit CA RE 207 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like CA RE 207. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

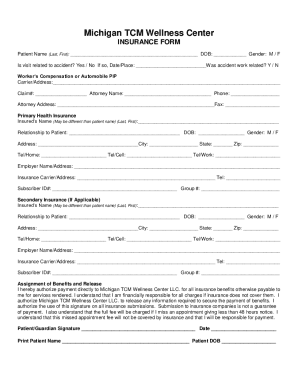

What is CA RE 207?

CA RE 207 is a form used in California for the reporting of real estate withheld tax credits for nonresident individuals and entities.

Who is required to file CA RE 207?

Nonresident individuals and entities that sell California real estate or receive proceeds from a sale that is subject to withholding are required to file CA RE 207.

How to fill out CA RE 207?

To fill out CA RE 207, provide identifying information, details of the transaction, amounts withheld, and any applicable credits or exemptions.

What is the purpose of CA RE 207?

The purpose of CA RE 207 is to report the capital gains withholding for nonresidents, ensuring compliance with California tax laws regarding real estate transactions.

What information must be reported on CA RE 207?

Information required on CA RE 207 includes the seller's and buyer's details, the property address, sale date, amount realized, withholding amounts, and any additional deductions or credits.

Fill out your CA RE 207 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA RE 207 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.